General Real Property Rendition of Taxable 2023-2026

Understanding the General Real Property Rendition of Taxable

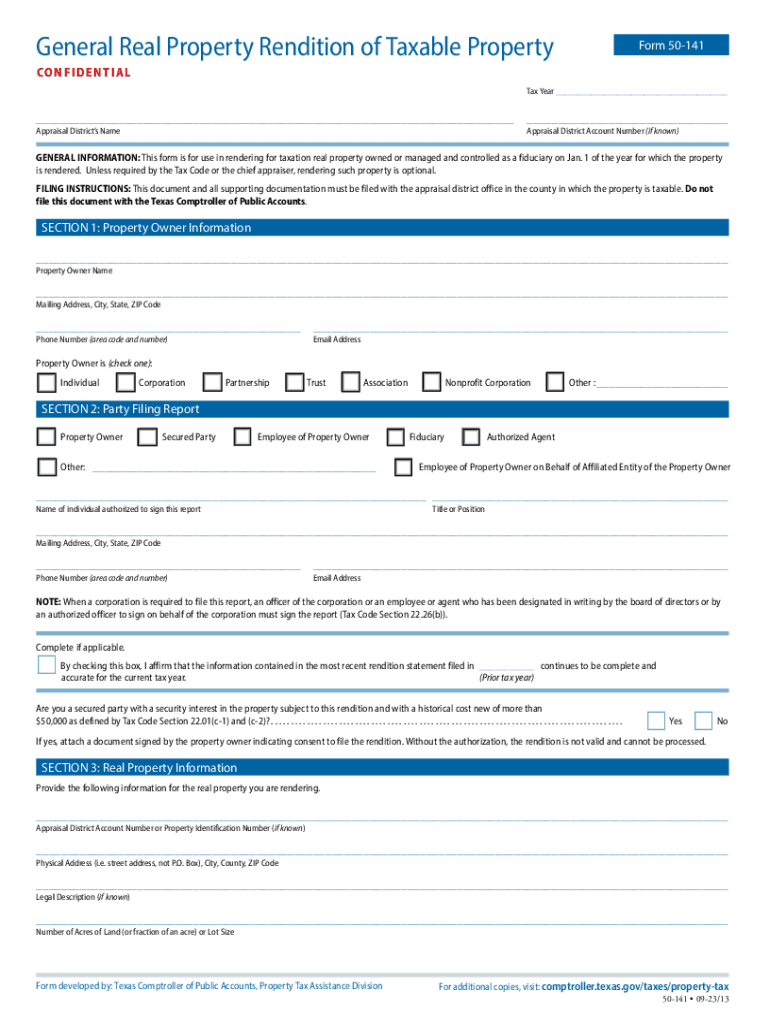

The General Real Property Rendition of Taxable is a crucial form used by property owners in Texas to report property values to the local appraisal district. This form is essential for ensuring that properties are assessed accurately for tax purposes. By providing detailed information about the property, including its location, type, and estimated value, property owners help local authorities determine the appropriate level of taxation. The form is primarily utilized by individuals and businesses that own real estate, ensuring compliance with Texas property tax laws.

Steps to Complete the General Real Property Rendition of Taxable

Completing the General Real Property Rendition of Taxable involves several key steps:

- Gather necessary information about the property, including its legal description, location, and current market value.

- Fill out the rendition form accurately, ensuring all sections are completed, including property details and ownership information.

- Attach any required documentation, such as previous tax statements or appraisal reports, to support the reported value.

- Review the completed form for accuracy before submission to avoid potential penalties.

Filing Deadlines and Important Dates

Timely submission of the General Real Property Rendition of Taxable is vital to avoid penalties. In Texas, the deadline for filing this form is typically April 15 of each year. However, if the property is acquired after January 1, the filing deadline may be extended to 30 days after the acquisition date. Property owners should mark their calendars and ensure that all necessary documents are submitted on time to maintain compliance with state regulations.

Required Documents for Submission

When submitting the General Real Property Rendition of Taxable, property owners should include several key documents:

- The completed rendition form with all required information.

- Supporting documentation that validates the reported property value, such as recent appraisals or sales data.

- Any previous tax statements that may provide context for the current assessment.

Penalties for Non-Compliance

Failure to file the General Real Property Rendition of Taxable by the deadline can result in significant penalties. Texas law stipulates that property owners who do not submit the form on time may face a penalty of up to ten percent of the property’s assessed value. Additionally, late filings may lead to increased scrutiny from appraisal districts, potentially resulting in higher tax assessments in subsequent years. It is essential for property owners to adhere to filing deadlines to avoid these consequences.

Form Submission Methods

The General Real Property Rendition of Taxable can be submitted through various methods, providing flexibility for property owners. The available submission options include:

- Online submission through the local appraisal district's website, where applicable.

- Mailing a hard copy of the completed form and supporting documents to the appraisal district office.

- In-person submission at the local appraisal district office, allowing for immediate confirmation of receipt.

Quick guide on how to complete general real property rendition of taxable

Fill out General Real Property Rendition Of Taxable effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage General Real Property Rendition Of Taxable on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign General Real Property Rendition Of Taxable with ease

- Find General Real Property Rendition Of Taxable and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from your chosen device. Modify and electronically sign General Real Property Rendition Of Taxable and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct general real property rendition of taxable

Create this form in 5 minutes!

How to create an eSignature for the general real property rendition of taxable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas taxable form, and why is it important?

A Texas taxable form is a document required by the state of Texas for reporting and calculating taxes. Understanding this form is essential for compliance, as it ensures that businesses accurately report their taxable income and avoid penalties. Using airSlate SignNow can simplify the process of filling out and submitting your Texas taxable form.

-

How can airSlate SignNow assist with completing Texas taxable forms?

airSlate SignNow offers features that allow users to easily fill out, sign, and send Texas taxable forms electronically. The platform streamlines the process, reduces paperwork, and ensures that forms are completed correctly. By using airSlate SignNow, businesses can save time and minimize errors in their Texas taxable form submissions.

-

Is airSlate SignNow suitable for small businesses handling Texas taxable forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small enterprises. Its user-friendly interface and affordable pricing plans make it easy for small businesses to manage their Texas taxable forms without breaking the bank. The platform empowers small business owners to handle their tax documents efficiently.

-

What features does airSlate SignNow provide for Texas taxable forms?

airSlate SignNow includes features like customizable templates, in-app signing, and document tracking, which are valuable for managing Texas taxable forms. These features help users create efficient workflows around their tax documents and ensure that all necessary information is captured accurately. The platform also provides robust security measures to protect sensitive data.

-

Can I integrate airSlate SignNow with my existing accounting software for Texas taxable forms?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting software tools, enabling effortless handling of Texas taxable forms. This integration allows for smoother data transfer and ensures that all tax related information is consistent and easily accessible. It enhances productivity by minimizing repetitive data entry tasks.

-

What are the benefits of using airSlate SignNow for Texas taxable forms?

Using airSlate SignNow for Texas taxable forms offers numerous benefits including faster processing times, reduced paperwork, and improved accuracy. Businesses can quickly get their forms eSigned, submitted, and stored securely. The convenience of electronic signatures eliminates the need for printing, scanning, or mailing documents.

-

How does eSignature work for Texas taxable forms with airSlate SignNow?

eSignature with airSlate SignNow allows users to electronically sign Texas taxable forms in a legally compliant way. Simply upload your document, add signers, and send it out for signatures, all within a few clicks. This process is not only quick but also provides a detailed audit trail, ensuring all transactions are traceable and secure.

Get more for General Real Property Rendition Of Taxable

- 3 state the full name and current residence address of each person not form

- Limited liability company operating agreement of epl of form

- Motion and order to suspend form

- You are hereby notified that a check numbered issued by you on form

- Can married men who are legally separated date without form

- Ex 24 2 panzecahtm general power of attorney form

- Th judicial district court form

- Motion and order to appoint attorney form

Find out other General Real Property Rendition Of Taxable

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter