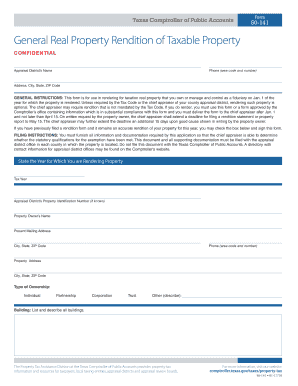

Form 50 141 General Real Property Rendition of Taxable Property General Real Property Rendition of Taxable Property 2017

What is the Form 50-141 General Real Property Rendition of Taxable Property?

The Form 50-141 General Real Property Rendition of Taxable Property is a document used in the United States for reporting property that is subject to taxation. This form is typically required by local appraisal districts to ensure that property values are accurately assessed for tax purposes. It provides a standardized method for property owners to declare the characteristics and value of their real property, which can include land, buildings, and improvements. By submitting this form, property owners help local authorities determine the appropriate tax rates and ensure compliance with state tax laws.

Steps to Complete the Form 50-141 General Real Property Rendition of Taxable Property

Completing the Form 50-141 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the property, including its location, size, and any improvements made. Next, accurately fill out each section of the form, providing details such as the property’s market value and any exemptions that may apply. It is essential to review the completed form for any errors or omissions before submission. Finally, submit the form to the appropriate local appraisal district by the specified deadline to avoid penalties.

Legal Use of the Form 50-141 General Real Property Rendition of Taxable Property

The legal use of the Form 50-141 is crucial for property owners to understand. This form serves as an official declaration of property value, and its accuracy is essential for fair taxation. Submitting a completed form is a legal requirement in many jurisdictions, and failure to do so can result in penalties or increased assessments. Additionally, the information provided on the form is used by local governments to allocate resources and plan for community services, making its legal implications significant for both taxpayers and local authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 50-141 can vary by state and local jurisdiction, but it is typically required to be submitted annually. Property owners should be aware of the specific deadlines set by their local appraisal district to avoid late fees or penalties. It is advisable to check with the local authorities for the exact date, as missing the deadline can impact the assessment of property taxes for the year.

Form Submission Methods (Online / Mail / In-Person)

The Form 50-141 can be submitted through various methods, depending on the local appraisal district's policies. Many jurisdictions now offer online submission options, allowing property owners to fill out and submit the form digitally. Alternatively, the form can often be mailed to the appropriate office or delivered in person. It is important to verify the preferred submission method with the local appraisal district to ensure compliance and timely processing.

Key Elements of the Form 50-141 General Real Property Rendition of Taxable Property

The key elements of the Form 50-141 include sections for property identification, owner information, and property valuation. Property owners must provide detailed descriptions of the property, including its physical characteristics and any improvements. Additionally, the form requires the owner to declare the estimated market value of the property and any applicable exemptions. These elements are critical for ensuring that the property is assessed accurately for taxation purposes.

Examples of Using the Form 50-141 General Real Property Rendition of Taxable Property

Examples of using the Form 50-141 include situations where property owners need to report new acquisitions, renovations, or changes in property use. For instance, if a homeowner adds a new structure or significantly improves their property, they must report these changes on the form. Similarly, businesses that expand their facilities or change their operational status must also file this form to reflect the updated property value accurately. By providing these updates, property owners help ensure that their tax assessments are fair and reflect the current state of their property.

Quick guide on how to complete form 50 141 general real property rendition of taxable property general real property rendition of taxable property

Your assistance manual on how to prepare your Form 50 141 General Real Property Rendition Of Taxable Property General Real Property Rendition Of Taxable Property

If you’re wondering how to create and submit your Form 50 141 General Real Property Rendition Of Taxable Property General Real Property Rendition Of Taxable Property, here are a few concise instructions on making tax declaration easier.

To begin, you merely need to register your airSlate SignNow account to change how you manage documents online. airSlate SignNow is a highly intuitive and powerful document solution that enables you to edit, draft, and finalize your income tax papers effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revert to modify information as necessary. Optimize your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your Form 50 141 General Real Property Rendition Of Taxable Property General Real Property Rendition Of Taxable Property in minutes:

- Create your account and start handling PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to open your Form 50 141 General Real Property Rendition Of Taxable Property General Real Property Rendition Of Taxable Property in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save modifications, print your copy, submit it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please remember that filing on paper can lead to return errors and postpone reimbursements. Naturally, before e-filing your taxes, verify the IRS website for submission rules specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form 50 141 general real property rendition of taxable property general real property rendition of taxable property

FAQs

-

Is there a taxable event when you distribute a real estate property to the owners of an S corp after you close that S corp?

If the company is closed, it has no assets, so the company is not closed.By "distributed" it sounds like you mean.... given for free... there is a difference... depending on how many owners of the s Corp there is.It is taxable, yes, in complacated ways depending on the details, the entity will make a profit or loss depending on what the transaction would look like, and perhaps the receiver will have to pay taxes... or maybe both. I think you need to put more info here or assumptions here so you can get a better answer.

-

What are the smallest types of properties you can buy to sell for profit in real estate or business in general (i.e. cheap cars are property, etc)?

One of the smallest types of properties in real estate are mobile homes. They are fairly inexpensive to get into compared to other real estate property types (i.e., single-family homes, apartment buildings, etc). What's great about mobile homes are that they are mobile. They can be attached to land and treated as real property. Or, they can be unattached to land and treated as personal property, just like a car. The taxes on mobile homes are much lower than your traditional single-family homes (as well as the insurance), which reduces costs.

-

Real Estate: How do I best structure a rental property if the bank refuses to title it to an LLC but I still want to operate it out of an LLC?

The bank doesn’t have anything to do with the title to the property.The bank makes loans.What you seem to be saying is that you are buying the property with a partner and you want the bank to loan money to an LLC.Why would the bank do that?The bank needs a first lien on the property to secure the loan. Only the owner of the property can give the bank a first lien. That is you and your partner.If you are saying that you want to create a Limited Liability Company (LLC) with you and your partner as the sole owners, and then have the LLC purchase the property, and you want the bank to loan the money to the LLC to purchase the property, then the answer is simple.The bank is the one who makes the decision about loaning money.If the bank is not comfortable loaning money to a company that, by its very nature and name, has no liability for paying it back, beyond foreclosure on the property, then the bank will not loan the money.The bank would prefer that you and your partner borrow the money.That way, if you do not pay it back, the bank will foreclose on the property and sell it at auction and apply the net proceeds to satisfy your loan.And then, the bank will sue you for the remaining balance and get a deficiency judgment against you for the unpaid part of the loan.And that’s why banks will not loan to an LLC, but will loan to the owner of the LLC.Plus, and I don’t want to scare you with this, if you try to pull some stunt to get around this, you are operating in the area that is called “fraud” and you really don’t want to go there.Accept the decision of the bank, and look for a commercial loan, or to private “hard money lenders” to provide the funds.I hope this helps.Good Luck.Michael Lantrip, Author “How To Do A Section 1031 Like Kind Exchange.”

-

How can I get out of a real estate contract when I priced the property too low and really feel it is a mistake to sell it?

Number one thing is to step back and think objectively talking to your listing agent. Hopefully, you did use an experienced Realtor to help you set the price. If a home is priced correctly, you should expect to have interest and offers early. You may have to wait a while before you get another similar offer. When a home first goes on the market, you get both the people who’ve been looking for possibly weeks or more plus new buyers just starting.If you truly want to get out of the contract talk to a real estate attorney. As a seller contracts really don’t give you much out unless a buyer defaults. If this your homesteaded home, you may be able to avoid being forced to sell but could be held liable for buyers costs and possibly damages. Your home may even be held up from being sold to someone else. If you have a listing agreement, you may be responsible for commissions.Think carefully, then talk to an attorney.

-

In the greater Silicon Valley area, with all of it's high property values, why does the El Camino Real corridor generally feel so old, outdated, and rundown from South San Francisco all the way to Santa Clara?

It seems simple, but it's not. It's the old Problem of the Commons. For five years the Grand Boulevard Initiative (Check out the NEW Grand Boulevard Initiative Message Platform!) has been trying to develop a common visions and coordinated municipal policies for recreating The El Camino as an appealing, pedestrian-oriented, New Urban thoroughfare. But El Camino connects 19 cities (and 19 City Councils), each of which makes its own development decisions. One example of the difficulties involved is the Bus Rapid Transit Program (BRT) proposal -- another ambitious initiative that's been percolating for the better part of a decade. Rapid transit sounds great, but the downside is that it will take two lanes away from cars. These dedicated BRT lanes would come at the cost of some left and right turn lanes, crossings and intersections, and street parking. Businesses worry that a two-year construction project will drive away shoppers and limited stops will make it inconvenient to shop at businesses between stops. Each city gets to make its own decision about the dedicated lanes. So no city wants to make a decision until its neighbors do, because nobody wants to bear all the burden with little benefit; which is what would happen without the approval of all 19 cities. Then there's the fact that all the property is privately-owned, and those owners have owned many of those properties a long time and are making money the way things are today, so why spend more money? What kind of return will they get on that investment if they're still surrounded by mid-century shabbiness? And can the businesses leasing on El Camino afford higher rents resulting from higher owner investment? The area can only support a certain number of Santana Rows. Empty storefronts is worse for everyone than shabby storefronts. Putting pressure on owners to improve their property gets into the murky area of infringing on property rights. Tax incentives for improving properties reduce the money available for providing public services -- needs will increase if the improvements are successful in attracting more people and businesses to the area. Add to all this the fact that as soon as a developer brings a proposal for one of those appealing, pedestrian-oriented, New Urban developments, people complain about traffic, multi-story buildings, population growth, urbanization -- "losing our small town character," although no Silicon Valley city has been a small town since 1950. The bottom line is that, yes, inexorably El Camino will improve because there is no place left to go. But don't hold your breath.

-

If the biggest loss you can take out on a rental property is about $25,000, how are people claiming to pay almost 0 dollars in taxes even though they receive over 1 million of dollars of taxable income annually?

First you’re probably talking about a $25k max ANNUAL loss deduction. The rest carries forward. And that’s for LOSSES. You only have to break even to not pay taxes in a current year. Loss carry forwards and backs offset taxes in FUTURE years.Second, depreciation is the real tax gold mine. Tax reduction without actual expenditure.On top of that, there’s accelerated depreciation.And, many property owners are wealthy from other endeavors which carry their own tax advantages:‘depletion’ for petroleum.depreciation of IP (patents, trademarks and copyrights) for corporations.The tax codes were designed for the very rich who get advantages by being involved in businesses that the average person is not involved in.Consider the ‘value’ of the name Coca Cola, or Facebook. (These ‘values’ are HUGE, in the billions). That value exists because the name is associated with a ‘going concern’ that has its own extraordinary value. But you don’t have to spend any money to derive that value.Nonetheless, it’s depreciable.This is the real value of ‘Branding’. If your name ever hits it big, its depreciability is a gold mine.

-

Should F-1 students from Russia pay taxes on cryptocurrency gains to the US? The tax treaty says capital gains on assets other than real property would be taxable only in the country of residence of the person deriving the gain.

One of the reasons cryptocurrencies are as popular as they are and drive a global underground economy, is because they are anonymous, untraceable. Unless you’re dumb enough to convert to any government issued currency there is no trail of profit or loss to declare on any governments taxes.

-

In the event of a foreign invasion which could not be stopped, would US officials order the general public to take up arms and defend themselves, and their property? If so, how would that scenario play out?

“In the event of a foreign invasion which could not be stopped, would US officials order the general public to take up arms and defend themselves, and their property? If so, how would that scenario play out?”To begin with, no other country on Earth, or combination of countries, could invade the USA. They lack the logistical outsignNow. That means, they don’t have the ships, aircraft, and supplies to transport and support an expeditionary force of sufficient size. Anyone wanting to invade the USA would need years of preparation, costing double-digit percentages of their GNP and impossible to hide.Second, our Navy is stronger than every other navy on Earth put together. In a set-piece battle of massed fleets, a few ships of the rest of the world’s navies might survive the first day, but not the first night, because our naval aircraft are the only ones that can fly and fight at night. The transports and supply ships of an invasion fleet would present a target that the invaders would have to defend, thus making a set-piece, winner take all battle inevitable.Thirdly, as Ms. Finn points out, we have nuclear weapons. A conventional invasion that somehow, impossibly, seemed to be working, would be met with nuclear strikes, either on the invasion forces themselves or their source countries. As Miyamoto Musashi said, it is false and demeaning to die with a weapon un-drawn, and we wouldn’t.Finally, if somehow, triply impossibly, an invasion force managed to establish itself, then we would resist any and all possible ways. Full mobilization in areas still under our control, guerrilla warfare in areas under enemy control. Universal conscription of all able-bodied adults, either to fight or to support the fighters. The regular armed forces and national guard would be the nucleus of a much bigger emergency-raised force. In occupied areas, veterans would probably be asked to lead local resistance. We have a lot of experience as occupiers fighting against insurgents. We know how to turn that around. It would be awful, but anyone who thinks we would react passively is even more naive than those Americans who thought that Vietnamese, Iraqis, or Afghans would react passively.And then, of course, comes revenge. After we had exterminated the invasion force, we wouldn’t just make peace status quo ante. The invading countries would be made to suffer disproportionately.

-

How should two people structure a company where Person A is putting in 100% of the capital to purchase rental properties, while Person B is a real estate professional who has found undervalued properties and will act as contractor, rental manager, and general executor?

One way to look at this is to separate out the various functions, assign market rates to them, and split the equity in the entity itself equally.As an example, let's say that the market rate for a real estate professional is $100,000 annually, and the market rate for interest on a loan is 5% (I'm over-simplifying this greatly in order to make a point, so finance pros please don't jump down my throat.) Let's finally assume that we're going to buy a property that costs $900,000.Following this logic, the two partners form NewCo with each putting in $1 for a 50% share. NewCo now borrows $1,055,000 from partner A, secured by all assets of the company. $900,000 of that is used to buy the building, $100,000 is used to hire partner B for a year, $52,500 is used to pay partner A interest on the loan, and the balance for expenses.After one year, the building is sold for $2,055,000, and the original loan is repaid in full. The profit left in NewCo is thus $1,000,000 which is split 50/50 between the partners.Result?Partner A (as a lender) invested cash and got a market return; Partner B (as a real estate professional) invested expertise and time and got a market salary; both partners invested entrepreneurial efforts in creating NewCo and making it viable (something that required both money and expertise) and got a signNow (and equal) equity-based return.

Create this form in 5 minutes!

How to create an eSignature for the form 50 141 general real property rendition of taxable property general real property rendition of taxable property

How to make an eSignature for your Form 50 141 General Real Property Rendition Of Taxable Property General Real Property Rendition Of Taxable Property online

How to generate an eSignature for the Form 50 141 General Real Property Rendition Of Taxable Property General Real Property Rendition Of Taxable Property in Chrome

How to generate an electronic signature for putting it on the Form 50 141 General Real Property Rendition Of Taxable Property General Real Property Rendition Of Taxable Property in Gmail

How to create an eSignature for the Form 50 141 General Real Property Rendition Of Taxable Property General Real Property Rendition Of Taxable Property right from your smart phone

How to generate an electronic signature for the Form 50 141 General Real Property Rendition Of Taxable Property General Real Property Rendition Of Taxable Property on iOS devices

How to create an eSignature for the Form 50 141 General Real Property Rendition Of Taxable Property General Real Property Rendition Of Taxable Property on Android

People also ask

-

What is Form 50 141 General Real Property Rendition Of Taxable Property?

Form 50 141 General Real Property Rendition Of Taxable Property is a crucial document used to report taxable property to the local appraisal district. This form assists property owners in ensuring accurate valuation and taxation of their real estate assets. Properly filing this form can help businesses manage their property taxes effectively.

-

How can airSlate SignNow help with Form 50 141 General Real Property Rendition Of Taxable Property?

airSlate SignNow offers an intuitive platform for electronically signing and submitting the Form 50 141 General Real Property Rendition Of Taxable Property. Our solution simplifies the process, making it easier for businesses to get signatures quickly and ensure that their documents are filed on time. Plus, you can track the status of your submissions effortlessly.

-

What are the pricing options for using airSlate SignNow with Form 50 141 General Real Property Rendition Of Taxable Property?

airSlate SignNow provides flexible pricing plans to accommodate different business needs when filing Form 50 141 General Real Property Rendition Of Taxable Property. You can choose from various subscription models, which are designed to be cost-effective while offering extensive features. Additionally, you can start with a free trial to evaluate our services.

-

What features does airSlate SignNow offer for managing Form 50 141 General Real Property Rendition Of Taxable Property?

Our platform offers features like customizable templates, secure eSignature options, document tracking, and easy sharing for Form 50 141 General Real Property Rendition Of Taxable Property. With these tools, businesses can streamline their workflows and enhance collaboration among teams. This helps save time and increases productivity.

-

Are there integrations available for airSlate SignNow when working with Form 50 141 General Real Property Rendition Of Taxable Property?

Yes, airSlate SignNow seamlessly integrates with various applications and services suitable for handling Form 50 141 General Real Property Rendition Of Taxable Property. This includes integration with popular CRM systems, document storage solutions, and e-mail services. These integrations help facilitate a smoother workflow for your business.

-

What benefits can businesses expect from using airSlate SignNow for Form 50 141 General Real Property Rendition Of Taxable Property?

By using airSlate SignNow for Form 50 141 General Real Property Rendition Of Taxable Property, businesses can signNowly reduce turnaround times for document approvals. Additionally, our secure eSignature capabilities ensure legal compliance and authenticity. Overall, businesses can expect increased efficiency, cost savings, and enhanced accuracy in their property tax management.

-

Can I access airSlate SignNow on mobile devices for filing Form 50 141 General Real Property Rendition Of Taxable Property?

Absolutely! airSlate SignNow is optimized for mobile devices, allowing you to manage Form 50 141 General Real Property Rendition Of Taxable Property from anywhere. Our mobile app enables you to eSign documents and send them for signature on the go, making it a convenient option for busy professionals looking to streamline their processes.

Get more for Form 50 141 General Real Property Rendition Of Taxable Property General Real Property Rendition Of Taxable Property

Find out other Form 50 141 General Real Property Rendition Of Taxable Property General Real Property Rendition Of Taxable Property

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document