MD RESIDENT INCOME TAX RETURN Marylandtaxes Gov 2022

Understanding the Maryland Amended Return

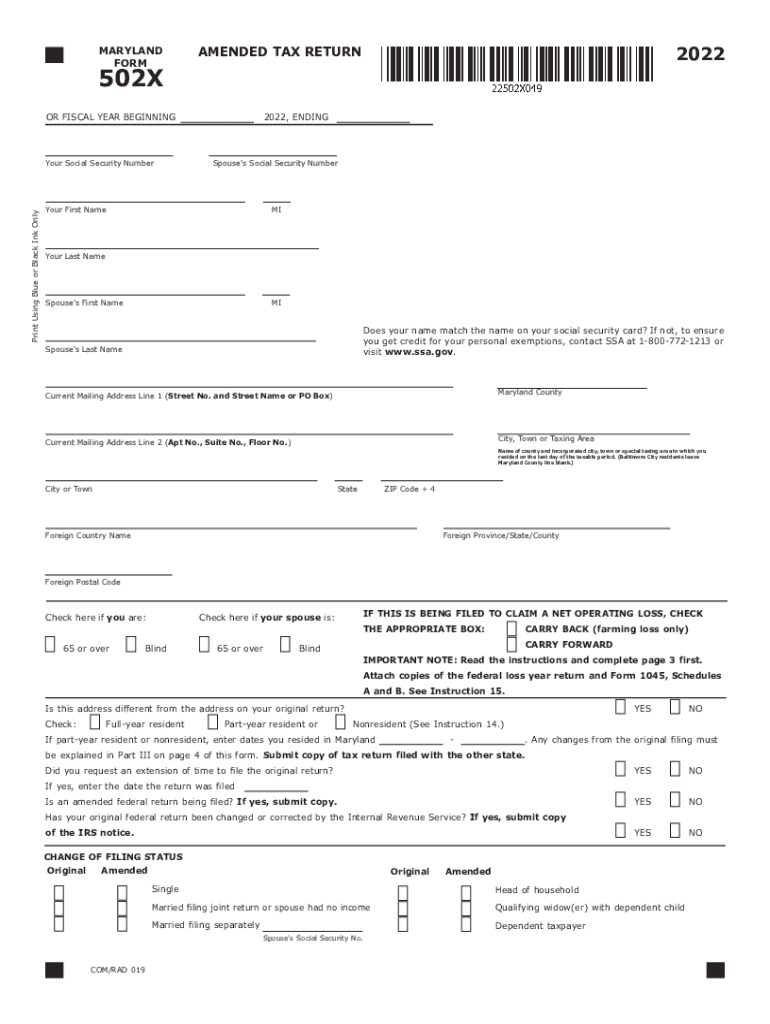

The Maryland amended return, commonly referred to as the MD 502X, is a crucial document for taxpayers who need to correct errors or make changes to their original Maryland state tax return. This form allows individuals to amend their income tax filings for various reasons, such as correcting income, deductions, or credits. It is essential to ensure that the amended return is completed accurately to avoid potential penalties or issues with the Maryland State Comptroller's office.

Steps to Complete the Maryland Amended Return

Filing an amended return involves several key steps to ensure compliance and accuracy. Here’s a streamlined process:

- Gather all necessary documents, including your original tax return and any supporting documentation for the changes being made.

- Obtain the MD 502X form from the Maryland State Comptroller’s website or through authorized tax preparation software.

- Carefully fill out the form, making sure to indicate the changes clearly and accurately.

- Attach any required documents that support your amendments, such as W-2s or 1099s.

- Review the completed form for accuracy before submission.

- Submit the amended return either electronically or by mail, following the specific submission guidelines provided by the Maryland State Comptroller.

Legal Use of the Maryland Amended Return

The Maryland amended return is legally recognized as a valid document for correcting previously filed tax returns. To ensure its legal standing, it must adhere to specific requirements, including proper signatures and submission methods. Utilizing a reliable eSignature solution can enhance the legal validity of the document, particularly when electronic signatures are involved. Compliance with relevant laws, such as the ESIGN Act and UETA, is crucial for the acceptance of eSigned documents.

Filing Deadlines for the Maryland Amended Return

Timely filing of the Maryland amended return is essential to avoid penalties. Generally, taxpayers have up to three years from the original filing deadline to submit an amended return. This period allows individuals to correct any inaccuracies without incurring late fees. It is advisable to check the specific deadlines for the tax year in question and plan accordingly to ensure compliance.

Required Documents for Filing

When preparing to file the Maryland amended return, several documents are typically required. These include:

- Your original Maryland tax return.

- Supporting documents that justify the changes being made, such as revised W-2 forms or additional tax forms.

- Any correspondence received from the Maryland State Comptroller regarding your original return.

Having these documents ready can facilitate a smoother filing process and help ensure that all necessary information is provided.

Common Scenarios for Amending a Maryland Return

Taxpayers may find themselves needing to amend their Maryland return for various reasons. Common scenarios include:

- Incorrect income reported due to missing or misreported W-2s or 1099s.

- Changes in deductions or credits that were initially overlooked.

- Adjustments due to changes in filing status, such as marriage or divorce.

Understanding these scenarios can help taxpayers identify when it is necessary to file an amended return to ensure compliance with state tax laws.

Quick guide on how to complete md resident income tax return marylandtaxesgov

Complete MD RESIDENT INCOME TAX RETURN Marylandtaxes gov effortlessly on any device

Digital document management has become favored by companies and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary format and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Manage MD RESIDENT INCOME TAX RETURN Marylandtaxes gov on any device through airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign MD RESIDENT INCOME TAX RETURN Marylandtaxes gov with ease

- Obtain MD RESIDENT INCOME TAX RETURN Marylandtaxes gov and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark pertinent sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that function.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal value as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign MD RESIDENT INCOME TAX RETURN Marylandtaxes gov and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct md resident income tax return marylandtaxesgov

Create this form in 5 minutes!

How to create an eSignature for the md resident income tax return marylandtaxesgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an MD amended return?

An MD amended return is a revised version of your original tax return filed in Maryland. It allows taxpayers to correct errors or make changes to their previously submitted information. Using an MD amended return ensures that your tax records are accurate and up to date.

-

How can airSlate SignNow help with filing an MD amended return?

AirSlate SignNow simplifies the process of filing an MD amended return by allowing you to electronically sign and send documents quickly. Our platform provides templates and features that help you gather information accurately and efficiently. You can have peace of mind knowing your amended return will be properly documented and submitted.

-

What are the pricing options for using airSlate SignNow for an MD amended return?

AirSlate SignNow offers flexible pricing plans that cater to various business needs, including features for filing an MD amended return. Depending on the plan you choose, you can access additional tools for document management and eSignature capabilities. It's best to consult our pricing page for details on the plans that include these features.

-

What features does airSlate SignNow provide for MD amended returns?

AirSlate SignNow provides features such as customizable templates, cloud storage, and eSignature capabilities specifically designed to streamline the process of submitting an MD amended return. These tools help eliminate errors and save time, ensuring that your documents are completed correctly and efficiently. Additionally, you can track document status in real-time.

-

Are there any benefits to using airSlate SignNow for an MD amended return?

Yes, using airSlate SignNow for your MD amended return offers numerous benefits, including enhanced efficiency and reduced turnaround time. Our platform enables electronic signatures, eliminating the need for printing and mailing, which saves you time and resources. Furthermore, our user-friendly interface ensures that anyone can navigate the document preparation process with ease.

-

Can I integrate airSlate SignNow with other software for MD amended returns?

Absolutely! AirSlate SignNow seamlessly integrates with various software applications, allowing you to manage your MD amended return alongside other business processes. API access and integration options enable you to connect with accounting software, CRM systems, and more, streamlining your workflow and enhancing productivity.

-

What types of documents can I eSign when filing an MD amended return?

When filing an MD amended return, you can eSign a variety of documents including the amended tax forms, supporting documentation, and any additional requirements specified by the Maryland state tax authority. AirSlate SignNow supports multiple document formats to ensure that you can manage all your paperwork in one platform. This versatility simplifies the filing process signNowly.

Get more for MD RESIDENT INCOME TAX RETURN Marylandtaxes gov

- Legal last will and testament form for single person with adult and minor children rhode island

- Legal last will and testament form for single person with adult children rhode island

- Legal last will and testament for married person with minor children from prior marriage rhode island form

- Legal last will and testament form for married person with adult children from prior marriage rhode island

- Legal last will and testament form for divorced person not remarried with adult children rhode island

- Legal last will and testament form for divorced person not remarried with no children rhode island

- Legal last will and testament form for divorced person not remarried with minor children rhode island

- Legal last will and testament form for divorced person not remarried with adult and minor children rhode island

Find out other MD RESIDENT INCOME TAX RETURN Marylandtaxes gov

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast