Maryland Amended Tax Form 2016

What is the Maryland Amended Tax Form

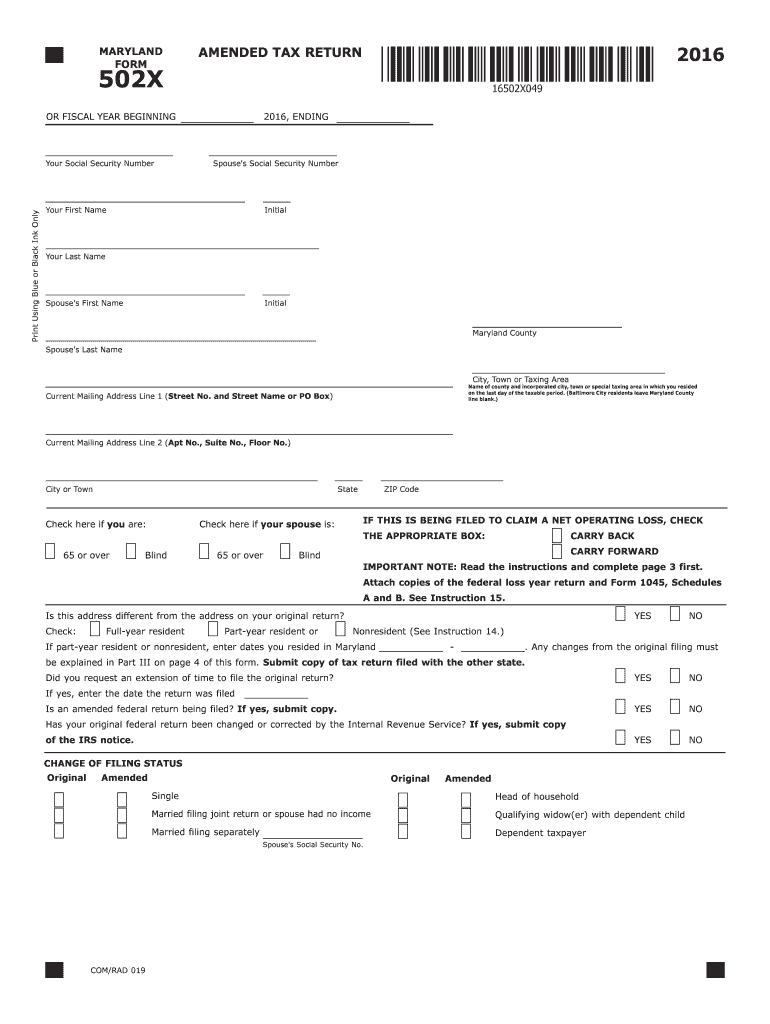

The Maryland Amended Tax Form is a document used by taxpayers in Maryland to correct errors or make changes to their previously filed state tax returns. This form allows individuals and businesses to update their tax information, ensuring accurate reporting of income, deductions, and credits. It is essential for maintaining compliance with state tax regulations and can impact tax liabilities and refunds.

How to use the Maryland Amended Tax Form

To use the Maryland Amended Tax Form effectively, taxpayers should first gather all relevant documentation related to their original tax return. This includes W-2s, 1099s, and any other income statements. After completing the amended form, it is important to clearly indicate the changes made and provide explanations where necessary. Ensure that the amended form is signed and dated before submission to validate the changes.

Steps to complete the Maryland Amended Tax Form

Completing the Maryland Amended Tax Form involves several steps:

- Obtain the correct version of the Maryland Amended Tax Form.

- Fill in personal information, including name, address, and Social Security number.

- Indicate the tax year for which the amendment is being filed.

- Detail the changes being made, including any adjustments to income or deductions.

- Provide an explanation for each change in the designated section.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Maryland Amended Tax Form

The Maryland Amended Tax Form is legally binding when completed and submitted according to state regulations. It must be filed within specific timeframes to ensure compliance with tax laws. Failure to use the form correctly can result in penalties or additional taxes owed. It is crucial to adhere to the guidelines set forth by the Maryland Comptroller's office regarding amendments to tax returns.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Maryland Amended Tax Form. Generally, the form should be filed within three years from the original return's due date or within two years from the date the tax was paid, whichever is later. Staying informed about these deadlines helps avoid penalties and ensures timely processing of amendments.

Form Submission Methods

The Maryland Amended Tax Form can be submitted through various methods:

- Online submission via the Maryland Comptroller's website, where electronic filing is available.

- Mailing the completed form to the appropriate address provided by the Maryland Comptroller.

- In-person submission at designated offices for those who prefer face-to-face assistance.

Quick guide on how to complete maryland amended tax 2016 form

Easily Prepare Maryland Amended Tax Form on Any Device

Managing documents online has gained popularity among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can easily locate the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Maryland Amended Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign Maryland Amended Tax Form

- Locate Maryland Amended Tax Form and click on Get Form to begin.

- Use the tools available to complete your document.

- Highlight essential sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review all the information and click the Done button to save your changes.

- Decide how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Maryland Amended Tax Form and ensure outstanding communication throughout every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland amended tax 2016 form

Create this form in 5 minutes!

How to create an eSignature for the maryland amended tax 2016 form

How to create an electronic signature for the Maryland Amended Tax 2016 Form in the online mode

How to make an electronic signature for your Maryland Amended Tax 2016 Form in Chrome

How to make an electronic signature for putting it on the Maryland Amended Tax 2016 Form in Gmail

How to create an eSignature for the Maryland Amended Tax 2016 Form right from your smart phone

How to generate an electronic signature for the Maryland Amended Tax 2016 Form on iOS devices

How to generate an electronic signature for the Maryland Amended Tax 2016 Form on Android OS

People also ask

-

What is the Maryland Amended Tax Form?

The Maryland Amended Tax Form is used to correct errors on a previously filed Maryland tax return. By completing this form, taxpayers can ensure their tax records are accurate and avoid potential penalties. airSlate SignNow simplifies the eSigning process for this form, making it efficient and straightforward.

-

How can I electronically sign the Maryland Amended Tax Form?

With airSlate SignNow, you can easily eSign the Maryland Amended Tax Form online. Our platform allows you to upload the form, apply your signature, and send it securely. This saves time and ensures that your amended tax return is submitted promptly.

-

What features does airSlate SignNow offer for handling the Maryland Amended Tax Form?

airSlate SignNow provides features such as document templates, real-time collaboration, and legally binding eSignatures. These features make it easy for users to manage their Maryland Amended Tax Form efficiently, ensuring that all necessary changes are made accurately.

-

Is airSlate SignNow a cost-effective solution for filing the Maryland Amended Tax Form?

Yes, airSlate SignNow offers a cost-effective solution for filing the Maryland Amended Tax Form. Our pricing is competitive and designed to accommodate businesses of all sizes, providing access to essential tools for an affordable monthly fee.

-

Can airSlate SignNow integrate with other software for tax preparation?

airSlate SignNow seamlessly integrates with various tax preparation software, streamlining the process for completing the Maryland Amended Tax Form. This integration allows users to easily transfer data and minimize the risk of errors, resulting in a more efficient workflow.

-

What are the benefits of using airSlate SignNow for the Maryland Amended Tax Form?

Using airSlate SignNow to complete your Maryland Amended Tax Form offers numerous benefits, including enhanced convenience and quick turnaround times. You'll also gain access to secure cloud storage for your documents, ensuring that your tax information is safely stored and easily accessible.

-

How does airSlate SignNow ensure the security of my Maryland Amended Tax Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and comply with industry standards to protect your data while you complete and eSign your Maryland Amended Tax Form, ensuring that your personal information remains confidential and secure.

Get more for Maryland Amended Tax Form

- Temporary medical power form

- Arkansas living will and durable power of attorney for health care form

- Rhode island legal last will and testament form for single person with no children

- Promissory note form iowa image

- Florida notice of dishonored check civil keywords bad check bounced check form

- South dakota legal last will and testament form for divorced person not remarried with minor children

- Fill in the blank eoh form

- New jersey residential real estate sales disclosure statement form

Find out other Maryland Amended Tax Form

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online