Form 8862SP Rev December Information to Claim Earned Income Credit After Disallowance Spanish Version 2023

What is the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version

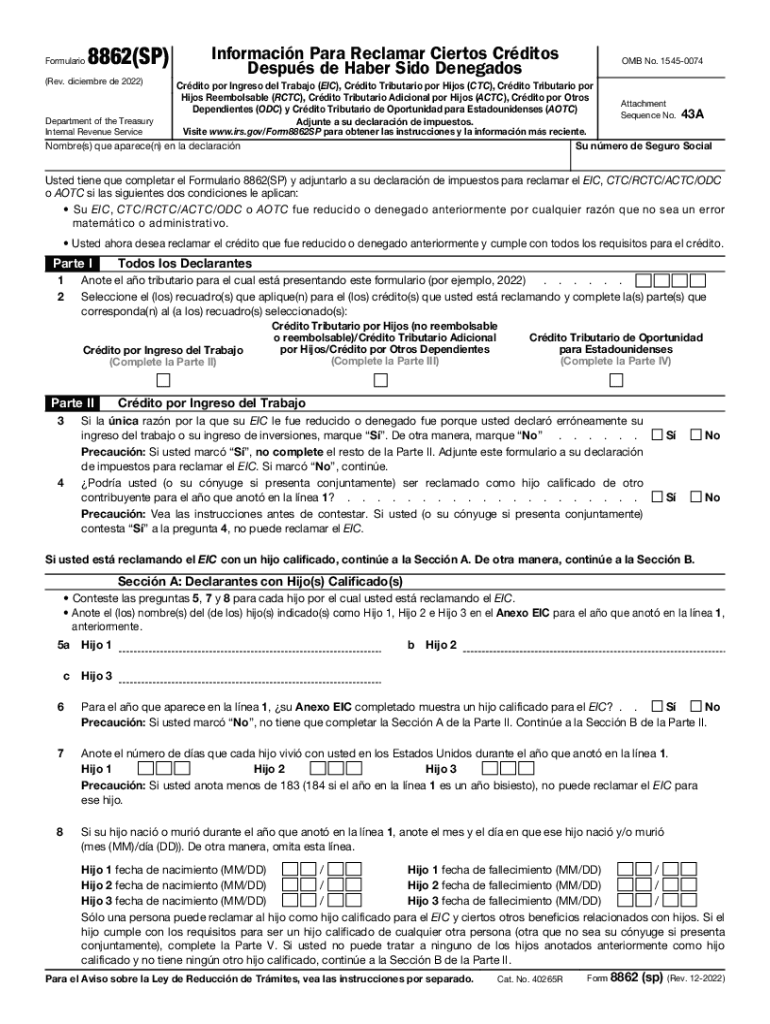

The Form 8862SP Rev December is specifically designed for individuals who wish to claim the Earned Income Credit (EIC) after it has been previously disallowed. This Spanish version of the form provides essential information and instructions for Spanish-speaking taxpayers in the United States. It allows them to formally request the reinstatement of their eligibility for the EIC, which can provide significant financial relief for low- to moderate-income families. Understanding the purpose and requirements of this form is crucial for anyone looking to reclaim their tax benefits.

Steps to complete the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version

Completing the Form 8862SP Rev December involves several key steps:

- Begin by entering your personal information, including your name, Social Security number, and address.

- Indicate the tax year for which you are claiming the EIC.

- Provide details about your qualifying children, if applicable, including their names and Social Security numbers.

- Answer questions regarding your eligibility for the EIC, ensuring that you meet the necessary criteria.

- Review the form for accuracy and completeness before submission.

Following these steps carefully can help ensure that your claim is processed smoothly.

How to obtain the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version

The Form 8862SP Rev December can be obtained through various methods. Taxpayers can download the form directly from the IRS website or request a physical copy by calling the IRS. Additionally, many community organizations and tax assistance programs may provide copies of the form, especially during tax season. Ensuring you have the correct version is important for accurate filing.

Eligibility Criteria for the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version

To be eligible to use the Form 8862SP Rev December, taxpayers must meet specific criteria. These include having previously claimed the Earned Income Credit and having it disallowed in a prior tax year. It is also essential that the taxpayer has taken steps to rectify the issues that led to the disallowance. This form is only applicable for the tax year following the disallowance, and individuals must ensure they meet all eligibility requirements to successfully reclaim the EIC.

IRS Guidelines for the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version

The IRS provides detailed guidelines for completing and submitting the Form 8862SP Rev December. Taxpayers should refer to these guidelines to understand the necessary documentation and evidence required to support their claim for the Earned Income Credit. It is important to follow IRS instructions closely to avoid delays or rejections in processing the form. Familiarizing oneself with these guidelines can greatly enhance the chances of a successful claim.

Form Submission Methods for the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version

Taxpayers can submit the Form 8862SP Rev December through various methods. The form can be filed electronically if using compatible tax software, which often simplifies the process. Alternatively, individuals may choose to print the form and mail it to the appropriate IRS address. It is important to ensure that the form is submitted by the deadline to avoid any penalties or issues with the claim.

Quick guide on how to complete form 8862sp rev december information to claim earned income credit after disallowance spanish version

Easily Prepare Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Handle Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and eSign Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version

- Locate Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version and click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a standard wet ink signature.

- Verify all details and click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8862sp rev december information to claim earned income credit after disallowance spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 8862sp rev december information to claim earned income credit after disallowance spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version?

The Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version is a crucial document for individuals looking to reclaim their Earned Income Credit after it has been disallowed in prior years. This form provides necessary guidelines and informational sections tailored for Spanish-speaking individuals, ensuring a smooth submission process.

-

How can I use airSlate SignNow to complete the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version?

With airSlate SignNow, you can easily upload, complete, and eSign the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version in a user-friendly environment. Our platform simplifies the entire process, making it convenient for users to manage their tax documents efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, ranging from basic to premium options. Our aim is to provide a cost-effective solution suitable for businesses and individuals looking to efficiently handle forms like the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version.

-

What features does airSlate SignNow provide for handling Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version?

airSlate SignNow provides robust features such as document creation, automated workflows, secure eSigning, and storage solutions tailored for the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version. These features enhance document tracking and make the entire process more streamlined.

-

Can airSlate SignNow integrate with other software for the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as CRM systems and cloud storage solutions, facilitating an efficient workflow for managing the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version and other important documents.

-

What are the benefits of using airSlate SignNow for Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version?

Using airSlate SignNow for the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version offers signNow benefits, including time savings, reduced paperwork, and improved accuracy. Our platform enables users to complete documents with ease while ensuring compliance with IRS requirements.

-

How secure is airSlate SignNow when handling the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version?

Security is a top priority at airSlate SignNow. We implement industry-standard encryption protocols to protect sensitive information when you're handling the Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version, ensuring your data remains safe and confidential throughout the process.

Get more for Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version

- And assignor on the day of 20 and is incorporated herein by form

- Form ks 864lt

- Check enclosed number form

- Form ks 988lt

- The initial monthlyweeklydaily circle one charge applicable to form

- Free kansas notarial certificate attestation of a copy form

- Fcl 010 authorization for emergency medical care kansas form

- Cerner enters into agreement to purchase former bannister

Find out other Form 8862SP Rev December Information To Claim Earned Income Credit After Disallowance Spanish Version

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation