Florida May Stop Businesses from Going Cashless 2024

Filing Deadlines and Important Dates

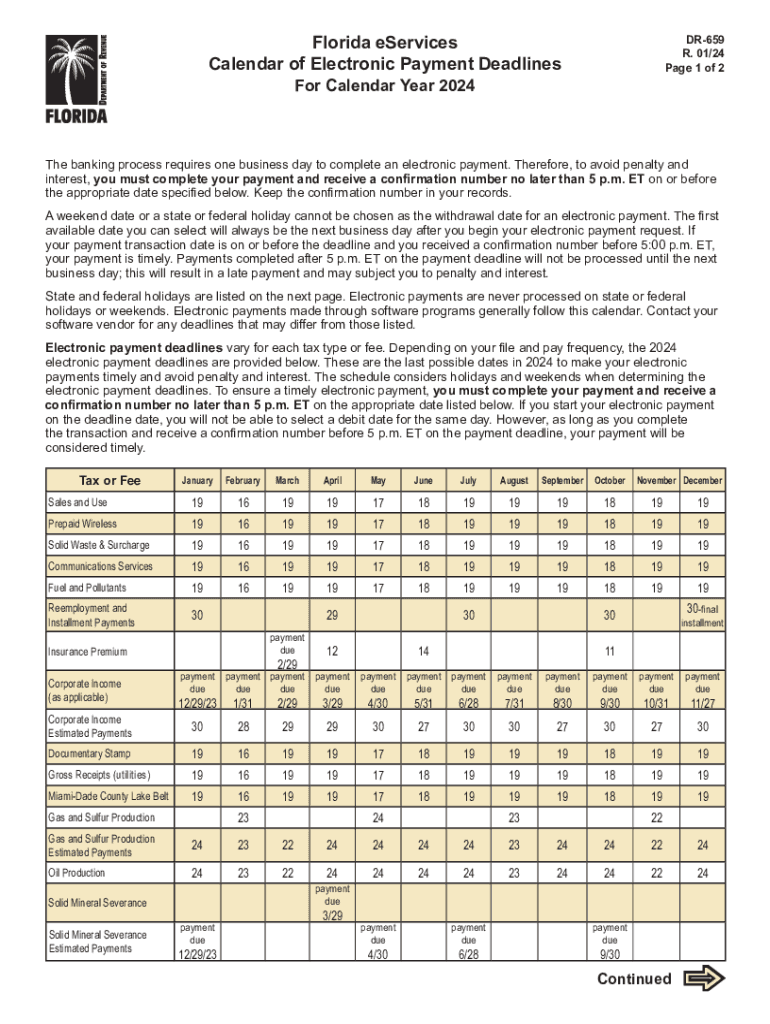

Understanding the filing deadlines and important dates associated with the 2020 calendar is crucial for businesses and individuals alike. In the United States, various tax obligations and compliance requirements are tied to specific dates throughout the year. For instance, the deadline for filing individual income tax returns for 2020 was April 15, 2021. Businesses also have their own set of deadlines, such as the due dates for payroll taxes and estimated tax payments.

It is essential to keep track of these dates to avoid penalties and ensure compliance with federal and state regulations. Marking these dates on your calendar can help you stay organized and prepared for any necessary filings.

Required Documents

When preparing to meet the filing requirements for the 2020 calendar year, having the right documents is vital. Commonly required documents include W-2 forms for employees, 1099 forms for independent contractors, and various receipts for deductible expenses. Additionally, businesses may need to gather financial statements and previous tax returns for accurate reporting.

For specific forms such as the W-9 or the DR-659 in Florida, ensure you have the correct versions and understand the information required. This preparation can streamline the filing process and reduce the likelihood of errors.

Form Submission Methods

Submitting forms accurately and on time is essential for compliance. For the 2020 calendar year, forms can typically be submitted through various methods, including online, by mail, or in person. Online submissions are often the fastest and most efficient way to file, especially for tax forms, as they can reduce processing times.

When submitting by mail, it is important to send forms to the correct address and consider using certified mail for tracking purposes. In-person submissions may be necessary for certain documents or in specific situations, such as when dealing with local government offices.

IRS Guidelines

The Internal Revenue Service (IRS) provides comprehensive guidelines for filing taxes and other forms related to the 2020 calendar year. These guidelines cover everything from eligibility criteria to specific instructions for various forms. Familiarizing yourself with these guidelines can help ensure that you are compliant with federal tax laws.

For instance, understanding the differences between various filing statuses can affect your tax liability. The IRS website offers resources and tools to assist taxpayers in navigating these requirements effectively.

Penalties for Non-Compliance

Failing to comply with filing deadlines and requirements can result in significant penalties. The IRS imposes fines for late filings, underpayment of taxes, and inaccuracies in submitted forms. For example, the penalty for filing a late tax return can be a percentage of the unpaid taxes for each month the return is late.

Additionally, state regulations, such as those in Florida, may impose their own penalties for non-compliance with local tax laws. Being aware of these potential penalties can motivate timely and accurate submissions.

Eligibility Criteria

Eligibility criteria for various tax forms and filings can vary based on factors such as income level, business structure, and residency status. For example, certain deductions and credits may only be available to taxpayers who meet specific income thresholds.

Understanding these criteria is essential for maximizing potential tax benefits and ensuring compliance with federal and state regulations. Consulting IRS guidelines or a tax professional can provide clarity on eligibility for various forms and benefits.

Quick guide on how to complete florida may stop businesses from going cashless

Complete Florida May Stop Businesses From Going Cashless seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Florida May Stop Businesses From Going Cashless on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Florida May Stop Businesses From Going Cashless effortlessly

- Find Florida May Stop Businesses From Going Cashless and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or mask confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your updates.

- Select how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Florida May Stop Businesses From Going Cashless and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida may stop businesses from going cashless

Create this form in 5 minutes!

How to create an eSignature for the florida may stop businesses from going cashless

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to 2020 calendar dates?

airSlate SignNow offers robust features to manage your documents efficiently, including eSigning capabilities, templates, and reminders based on 2020 calendar dates. These features allow you to streamline your workflow and ensure timely document handling, which is essential for meetings and deadlines set on your 2020 calendar.

-

How can I integrate airSlate SignNow with other tools while using 2020 calendar dates?

airSlate SignNow seamlessly integrates with various applications, ensuring you can access and share your 2020 calendar dates efficiently. Whether through Google Calendar or other scheduling tools, this integration helps enhance collaboration and keeps your document timelines aligned with important 2020 dates.

-

Is there a free trial available for testing the 2020 calendar dates functionality?

Yes, airSlate SignNow offers a free trial that allows users to explore its features, including those related to 2020 calendar dates. During the trial, you can evaluate how effectively the platform manages your document workflows tied to your 2020 schedule without any commitment.

-

What pricing options does airSlate SignNow offer for managing documents linked to 2020 calendar dates?

airSlate SignNow provides flexible pricing plans that cater to various business needs for managing documents around 2020 calendar dates. You can choose from individual, team, or enterprise plans, each designed to ensure cost-effectiveness while delivering valuable features.

-

How does airSlate SignNow improve efficiency in dealing with 2020 calendar dates?

airSlate SignNow improves efficiency by automating document workflows, allowing users to focus on important 2020 calendar dates. By reducing manual handling and providing quick access to eSignatures, businesses can save time and ensure documents are always aligned with key deadlines.

-

Can airSlate SignNow support document signing activities scheduled around 2020 calendar dates?

Absolutely! airSlate SignNow is designed to accommodate document signing activities scheduled around your 2020 calendar dates. With its user-friendly interface, signers can quickly access documents, ensuring that important events are never delayed.

-

What are the benefits of using airSlate SignNow for managing documents related to 2020 calendar dates?

The primary benefits of using airSlate SignNow for managing documents associated with your 2020 calendar dates include increased productivity, reduced turnaround time, and enhanced accuracy. These advantages help businesses maintain compliance and stay organized throughout the year.

Get more for Florida May Stop Businesses From Going Cashless

- County hereinafter referred to as grantor and a duly organized form

- Agreement between contractor and owner for construction 09 form

- Free independent contractor agreement template word form

- Medical history of horse form

- Company existing under and by virtue of the laws of the state of and having form

- County hereinafter referred to as grantor and a limited liability form

- Deems reasonably necessary for my minor child andor children form

- Car totaled but title in friends name us insurance agents form

Find out other Florida May Stop Businesses From Going Cashless

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe