Maine Minimum Tax Credit and Carryforward to 2022

What is the Maine Minimum Tax Credit and Carryforward To

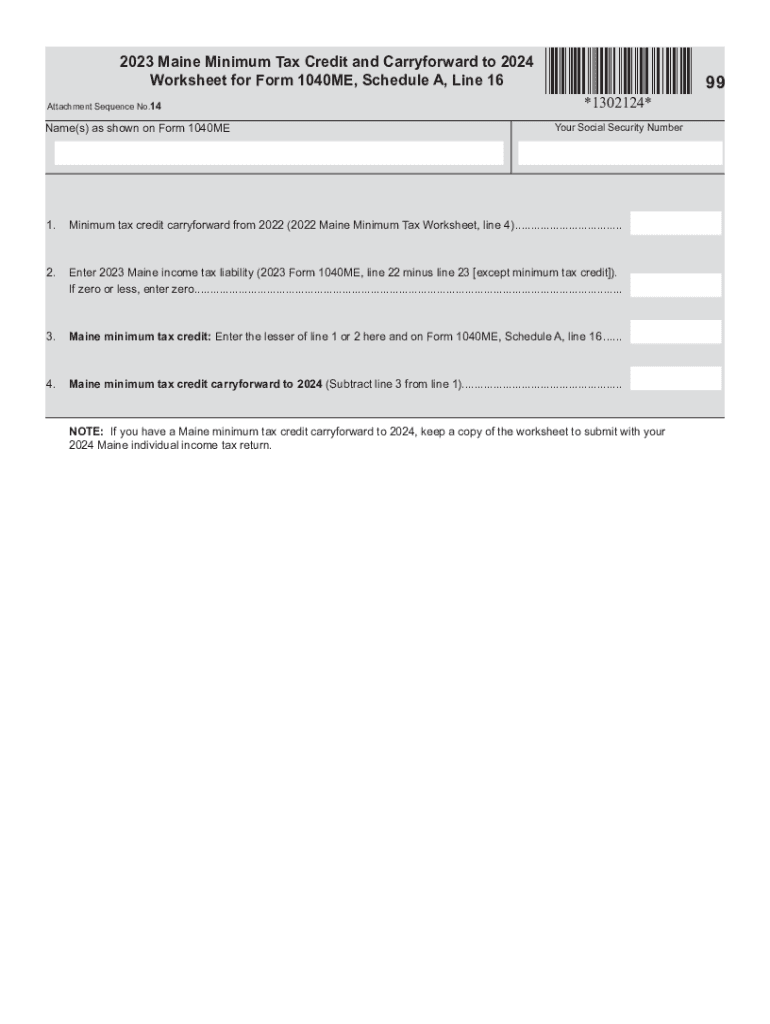

The Maine Minimum Tax Credit is a tax benefit designed to assist individuals and businesses in offsetting their tax liabilities. This credit is particularly relevant for those whose tax obligations fall below a certain threshold. The carryforward provision allows taxpayers to apply any unused portion of the credit to future tax years, ensuring that they can benefit from the credit even if they do not fully utilize it in the year it is claimed. Understanding this credit is crucial for effective tax planning and compliance.

How to use the Maine Minimum Tax Credit and Carryforward To

To utilize the Maine Minimum Tax Credit, taxpayers must first determine their eligibility based on income and tax liability. Once eligibility is established, the credit can be claimed on the appropriate tax return form. If the credit exceeds the current year's tax liability, the remaining amount can be carried forward to subsequent years. Taxpayers should keep detailed records of their tax filings and any credits claimed to ensure accurate reporting in future years.

Eligibility Criteria

Eligibility for the Maine Minimum Tax Credit is primarily based on income levels and tax filing status. Individuals and businesses must meet specific income thresholds to qualify. Additionally, certain types of income may affect eligibility, so it is essential to review the criteria carefully. Taxpayers should consult the latest guidelines from the Maine Revenue Services to confirm their eligibility before applying for the credit.

Steps to complete the Maine Minimum Tax Credit and Carryforward To

Completing the Maine Minimum Tax Credit involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Determine your eligibility based on the current income thresholds set by the state.

- Complete the relevant tax forms, ensuring to include the Maine Minimum Tax Credit section.

- Calculate the amount of credit you are eligible for and apply it to your tax liability.

- If applicable, document any unused credit for carryforward to future tax years.

Required Documents

To successfully claim the Maine Minimum Tax Credit, taxpayers need to provide specific documents, including:

- Proof of income, such as W-2 forms or 1099 statements.

- Previous tax returns to establish prior tax liability.

- Any additional documentation that supports the claim for the credit, such as schedules or worksheets.

Filing Deadlines / Important Dates

Filing deadlines for the Maine Minimum Tax Credit align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth, while extensions may be available. It is crucial to stay informed about any changes to deadlines, as state regulations may vary. Taxpayers should mark their calendars to ensure timely filing and avoid penalties.

Who Issues the Form

The Maine Revenue Services is responsible for issuing the forms related to the Maine Minimum Tax Credit. This agency provides the necessary documentation and guidelines for taxpayers to accurately claim their credits. It is advisable to refer to their official resources for the most current forms and instructions to ensure compliance with state tax laws.

Quick guide on how to complete maine minimum tax credit and carryforward to

Complete Maine Minimum Tax Credit And Carryforward To effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed forms, allowing you to easily find the necessary document and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly and without hurdles. Manage Maine Minimum Tax Credit And Carryforward To on any platform using airSlate SignNow's Android or iOS applications and streamline your document process today.

How to edit and electronically sign Maine Minimum Tax Credit And Carryforward To with ease

- Find Maine Minimum Tax Credit And Carryforward To and click Get Form to begin.

- Make use of the tools we provide to finalize your form.

- Select important sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to store your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, boring form navigation, or errors that necessitate printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Maine Minimum Tax Credit And Carryforward To to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maine minimum tax credit and carryforward to

Create this form in 5 minutes!

How to create an eSignature for the maine minimum tax credit and carryforward to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine Minimum Tax Credit and Carryforward To?

The Maine Minimum Tax Credit and Carryforward To is a tax incentive designed to assist businesses by allowing them to apply unused credits to future tax liabilities. It helps ease the financial burden on companies while ensuring they can maximize their tax savings over time. Understanding how to leverage this credit is crucial for effective tax planning.

-

How can the Maine Minimum Tax Credit and Carryforward To benefit my business?

Utilizing the Maine Minimum Tax Credit and Carryforward To can signNowly reduce your taxable income, thereby lowering your overall tax liability. This credit can be particularly beneficial for startups and small businesses struggling with initial expenses. Properly planning the use of this credit can lead to substantial savings in the long run.

-

Are there any eligibility requirements for the Maine Minimum Tax Credit and Carryforward To?

Yes, businesses must meet specific criteria to qualify for the Maine Minimum Tax Credit and Carryforward To. These may include being a registered entity in the state of Maine and potentially meeting certain income thresholds. It’s important to review the guidelines or consult a tax professional to ensure eligibility.

-

How do I apply for the Maine Minimum Tax Credit and Carryforward To?

To apply for the Maine Minimum Tax Credit and Carryforward To, businesses typically need to fill out the appropriate tax forms during their annual tax filing. Ensure that you have all necessary documentation to substantiate your eligibility. Consulting with a tax advisor can streamline this process and help maximize your benefits.

-

Can I integrate the Maine Minimum Tax Credit and Carryforward To with airSlate SignNow?

Yes, airSlate SignNow can be integrated into your tax documentation processes, making it easier to manage paperwork related to the Maine Minimum Tax Credit and Carryforward To. By using airSlate SignNow, you can easily eSign and send documents required for applying or validating the credit. This streamlines your workflow and saves valuable time.

-

What features should I look for when using airSlate SignNow for tax-related documents?

When utilizing airSlate SignNow for tax-related documents, look for features such as secure eSigning, document templates, and streamlined workflows. These tools can facilitate the management of paperwork associated with the Maine Minimum Tax Credit and Carryforward To, ensuring compliance and accuracy. Additionally, the ability to track document status can enhance efficiency.

-

Is there a cost associated with using airSlate SignNow for the Maine Minimum Tax Credit and Carryforward To?

Yes, there is a pricing structure for using airSlate SignNow, which offers various plans designed to fit different business needs. Investing in airSlate SignNow can ultimately save you money by improving the efficiency of your document management processes, including those required for the Maine Minimum Tax Credit and Carryforward To. Review the pricing options to find the best fit for your budget.

Get more for Maine Minimum Tax Credit And Carryforward To

- Hereinafter referred to as grantor does hereby convey release form

- Joint tenants with form

- Accordance with the applicable laws of the state of idaho and form

- Small claim form sc1 2 3rd judicial district idaho

- Completion of this contract form

- Control number id 020 77 form

- In th supreme c th state of id idaho supreme court form

- Affidavit of competence form

Find out other Maine Minimum Tax Credit And Carryforward To

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple