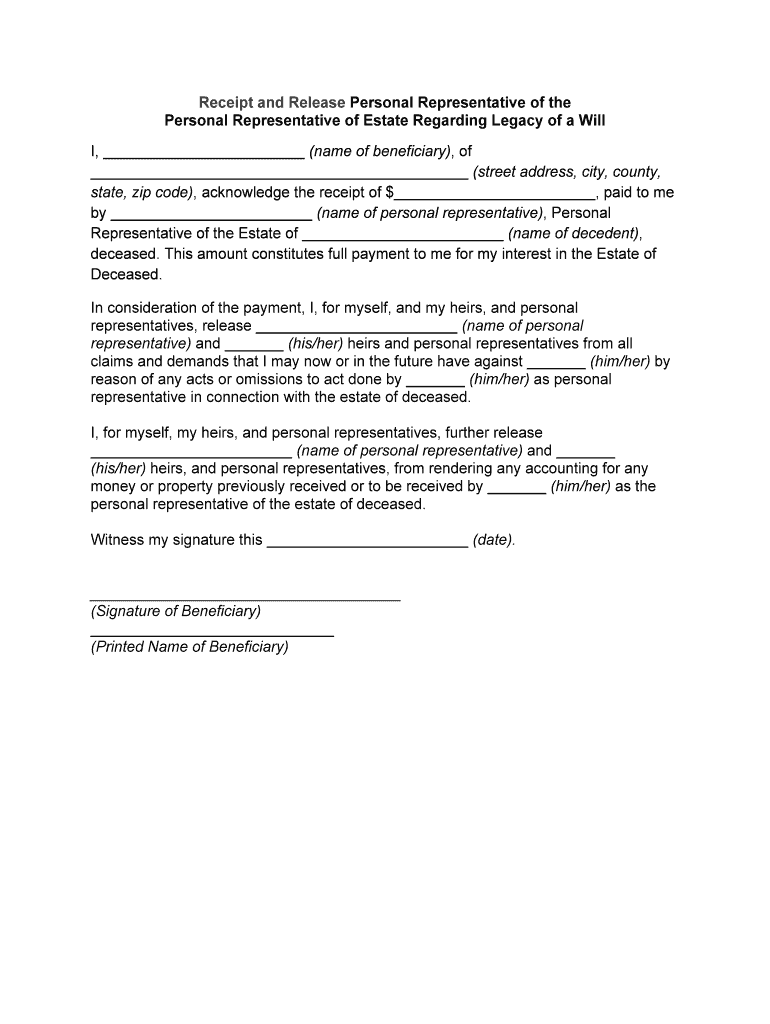

Receipt Form

What is the Receipt

A receipt is a document that serves as proof of a transaction between a buyer and a seller. It typically includes details such as the date of purchase, items or services purchased, the price, and the method of payment. Receipts can be issued for various transactions, including retail purchases, services rendered, and online transactions. They are essential for record-keeping and can be required for returns, exchanges, or warranty claims.

How to Use the Receipt

Receipts can be used for multiple purposes, including tracking expenses, managing budgets, and filing taxes. For businesses, receipts are crucial for accounting and tax reporting. Individuals can use receipts to keep track of personal spending or to claim deductions during tax season. It is advisable to store receipts in an organized manner, whether digitally or physically, to ensure easy access when needed.

Key Elements of the Receipt

A well-structured receipt contains several key elements that enhance its utility. These include:

- Date: The date when the transaction occurred.

- Vendor Information: Name and contact details of the seller.

- Itemized List: Description of items or services purchased, including quantities and prices.

- Total Amount: The total cost of the transaction, including taxes and fees.

- Payment Method: How the payment was made, such as cash, credit card, or digital payment.

Steps to Complete the Receipt

Completing a receipt involves several steps to ensure accuracy and compliance. Follow these steps:

- Gather all necessary information, including transaction details and buyer information.

- Clearly itemize each product or service, including prices and quantities.

- Calculate the total amount, ensuring all taxes and fees are included.

- Choose a format for the receipt, either digital or paper, and ensure it is easy to read.

- Provide a copy to the buyer and retain a copy for your records.

Legal Use of the Receipt

Receipts hold legal significance as they serve as proof of a transaction. They may be required for warranty claims, returns, or disputes. In a legal context, receipts can be used to substantiate claims in court or during audits. It is essential to ensure that receipts are accurate and contain all necessary information to be considered valid.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines on how receipts should be maintained for tax purposes. Taxpayers are encouraged to keep receipts for all deductible expenses, as these documents serve as proof during audits. The IRS recommends retaining receipts for at least three years from the date of filing the tax return. Proper documentation can help avoid penalties and ensure compliance with tax laws.

Quick guide on how to complete receipt 495568264

Effortlessly Prepare Receipt on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly option to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any delays. Manage Receipt across any platform with airSlate SignNow applications for Android or iOS and streamline your document-driven processes today.

Efficiently Modify and Electronically Sign Receipt with Ease

- Locate Receipt and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow attends to all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Receipt and ensure seamless communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the receipt 495568264

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What types of receipts can I create with airSlate SignNow?

With airSlate SignNow, you can create various types of receipts, including sales receipts, payment receipts, and service receipts. Our platform allows you to customize these receipts to fit your specific needs, ensuring they are professional and meet your business requirements.

-

How much does airSlate SignNow cost for generating receipts?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. For generating receipts, the cost is included in our subscription plans, which provide access to all document management features, making it a cost-effective solution for your business.

-

Can I automate receipt generation using airSlate SignNow?

Yes, airSlate SignNow allows you to automate the generation of receipts to streamline your processes. By setting up templates, you can quickly create and send receipts with just a few clicks, saving time and reducing the effort involved in document management.

-

Is it easy to eSign a receipt using airSlate SignNow?

Absolutely! airSlate SignNow makes it easy to eSign receipts through our intuitive interface. Once you create a receipt, you can simply send it to the recipient for their electronic signature, ensuring a swift and secure signing process.

-

Does airSlate SignNow integrate with accounting software for receipt management?

Yes, airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage receipts and financial documents efficiently. These integrations help keep your financial records organized and ensure all receipts are easily accessible in one place.

-

What are the benefits of using airSlate SignNow for receipt generation?

Using airSlate SignNow for receipt generation offers numerous benefits, including improved accuracy, faster processing times, and a reduction in paper usage. Additionally, our platform enhances collaboration and tracking capabilities, making receipt management effortless for your team.

-

Can I customize my receipts in airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your receipts, so they reflect your brand identity. You can add your logo, change colors, and modify the layout to ensure your receipts meet your specific business needs.

Get more for Receipt

- Arkansas probate forms state specificus legal forms

- Declaration under probate code section 13101 state form

- Official probate form 7probate code sec

- Administrative order number 12 official probate forms

- This form has been officially prescribed by the supreme court of arkansas for use under the probate code act 140 of the 1949

- Probate administration and foreign grants act supreme court form

- This form has been officially prescribed by the supreme court of arkansas for use under the probate cede act 140 of the 1949

- Court forms free legal forms us federal ampampamp state court

Find out other Receipt

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation