This Agreement Describes the Terms of the FICA Account that We, Form

What is the This Agreement Describes The Terms Of The FICA Account That We

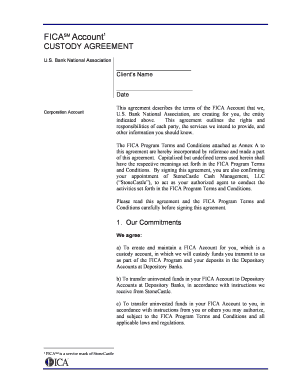

The document titled "This Agreement Describes The Terms Of The FICA Account That We" outlines the specific terms and conditions related to the FICA account. FICA, which stands for the Federal Insurance Contributions Act, governs the collection of payroll taxes for Social Security and Medicare. This agreement serves as a formal understanding between parties regarding their obligations, rights, and responsibilities in managing the FICA account. It is essential for ensuring compliance with federal regulations and for maintaining accurate records of contributions.

Key elements of the This Agreement Describes The Terms Of The FICA Account That We

Several key elements are included in the agreement, which are crucial for both parties involved. These elements typically encompass:

- Definitions: Clarification of terms used within the agreement to ensure mutual understanding.

- Obligations: Responsibilities of each party in relation to contributions and record-keeping.

- Compliance: Requirements to adhere to federal laws and regulations regarding FICA contributions.

- Dispute Resolution: Procedures for addressing any disagreements that may arise from the agreement.

- Amendments: Guidelines for making changes to the agreement as needed.

How to use the This Agreement Describes The Terms Of The FICA Account That We

Using the agreement effectively involves understanding its structure and content. The following steps can guide users in utilizing this document:

- Review: Carefully read through the entire agreement to grasp all terms and conditions.

- Consult: Seek legal or financial advice if any terms are unclear or require further explanation.

- Complete: Fill in any required information accurately, ensuring that all parties are identified correctly.

- Sign: Ensure that all parties sign the agreement, indicating their acceptance of the terms.

- Store: Keep a copy of the signed agreement in a secure location for future reference.

Legal use of the This Agreement Describes The Terms Of The FICA Account That We

This agreement is legally binding once signed by all parties involved. It is designed to ensure compliance with federal laws governing FICA contributions. Proper use of this document protects the rights of both parties and provides a framework for accountability. It is advisable to maintain updated records and ensure that all contributions are made as stipulated in the agreement to avoid potential legal issues.

Steps to complete the This Agreement Describes The Terms Of The FICA Account That We

Completing the agreement involves several important steps to ensure accuracy and compliance:

- Gather Information: Collect all necessary details about the parties involved, including names, addresses, and tax identification numbers.

- Fill Out the Agreement: Input the required information into the agreement, following the specified format.

- Review for Accuracy: Double-check all entries for correctness before proceeding to signatures.

- Sign the Document: Have all parties sign the agreement, ensuring that signatures are dated.

- Distribute Copies: Provide copies of the signed agreement to all parties for their records.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding FICA contributions and the associated agreements. It is important to adhere to these guidelines to ensure compliance and avoid penalties. Users should familiarize themselves with the IRS rules related to FICA, including contribution rates, reporting requirements, and deadlines for submission. Regularly checking for updates from the IRS can help maintain compliance and ensure that all obligations are met.

Quick guide on how to complete this agreement describes the terms of the fica account that we

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly favored by businesses and individuals. It serves as a superb eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and eSign your documents without delays. Handle [SKS] across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize key sections of your documents or obscure sensitive details using the features that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal stature as a standard wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure outstanding communication throughout every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to This Agreement Describes The Terms Of The FICA Account That We,

Create this form in 5 minutes!

How to create an eSignature for the this agreement describes the terms of the fica account that we

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'This Agreement Describes The Terms Of The FICA Account That We,' entail?

This Agreement Describes The Terms Of The FICA Account That We, provides clarity on the responsibilities and services associated with managing a FICA account. It's designed to ensure that users understand the conditions of their account usage, associated fees, and compliance requirements.

-

How does airSlate SignNow simplify signing documents related to FICA accounts?

With airSlate SignNow, signing documents related to FICA accounts becomes a seamless process. This Agreement Describes The Terms Of The FICA Account That We, enables users to electronically sign their documents securely, ensuring efficiency while maintaining compliance with regulations.

-

What are the pricing options for airSlate SignNow for FICA account management?

AirSlate SignNow offers flexible pricing plans tailored to different business needs. Users can explore plans that specifically support functions described in This Agreement Describes The Terms Of The FICA Account That We, allowing businesses to choose a package that aligns with their financial goals.

-

What features does airSlate SignNow provide for managing FICA accounts?

AirSlate SignNow includes several features beneficial for handling FICA accounts, such as secure electronic signatures, document tracking, and integration capabilities. These features, as outlined in This Agreement Describes The Terms Of The FICA Account That We,, provide holistic support for your account management.

-

Are there any benefits to using airSlate SignNow for FICA accounts?

Utilizing airSlate SignNow for FICA accounts offers numerous benefits, including time savings, reduced paperwork, and enhanced security. This Agreement Describes The Terms Of The FICA Account That We, also ensures that users are compliant while optimizing their document handling processes.

-

Can airSlate SignNow integrate with other software for FICA account management?

Absolutely! airSlate SignNow can seamlessly integrate with various software applications, enhancing the efficiency of your FICA account management. This Agreement Describes The Terms Of The FICA Account That We, acknowledges these integrations as a means to streamline workflows.

-

How secure is airSlate SignNow for managing FICA account documents?

AirSlate SignNow offers top-tier security measures, including encryption and secure storage, to protect your FICA account documents. This Agreement Describes The Terms Of The FICA Account That We, highlights our commitment to safeguarding sensitive information against unauthorized access.

Get more for This Agreement Describes The Terms Of The FICA Account That We,

Find out other This Agreement Describes The Terms Of The FICA Account That We,

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document