Oregon Trimet Tax Form

What is the Oregon Trimet Tax Form

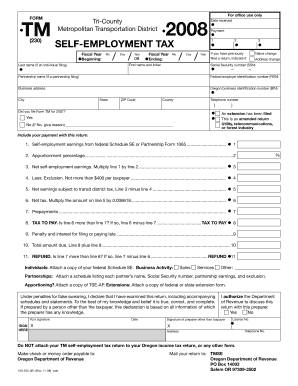

The Oregon Trimet Tax Form is an essential document for individuals and businesses operating within the Tri-County area of Oregon. This form is specifically designed to report and pay the Trimet tax, which supports public transportation services in the region. The tax is applicable to various entities, including self-employed individuals, corporations, and partnerships. Understanding the purpose and requirements of this form is crucial for compliance with local tax regulations.

Steps to complete the Oregon Trimet Tax Form

Completing the Oregon Trimet Tax Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your income details and any deductions applicable to your situation. Follow these steps:

- Obtain the latest version of the Oregon Trimet Tax Form from the official state website or authorized sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income and any applicable deductions, following the instructions provided on the form.

- Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Sign and date the form before submission.

How to obtain the Oregon Trimet Tax Form

The Oregon Trimet Tax Form can be obtained through several methods to ensure accessibility for all taxpayers. You can access the form online via the official Oregon Department of Revenue website. Additionally, physical copies may be available at local tax offices or public libraries. It is advisable to ensure you have the most current version of the form to comply with any recent changes in tax regulations.

Legal use of the Oregon Trimet Tax Form

To ensure the legal use of the Oregon Trimet Tax Form, it is essential to adhere to the guidelines set forth by the Oregon Department of Revenue. This includes accurately reporting income and paying the appropriate tax amount. Failure to comply with these regulations can result in penalties or legal repercussions. Utilizing a reliable eSignature solution, like signNow, can streamline the submission process while ensuring that your form is legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon Trimet Tax Form are crucial to avoid late fees and penalties. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. However, it is important to check for any specific announcements or changes in deadlines that may occur due to special circumstances or legislative updates. Marking these dates on your calendar can help ensure timely compliance.

Penalties for Non-Compliance

Non-compliance with the Oregon Trimet Tax Form requirements can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to understand the consequences of failing to file or pay the required taxes on time. Staying informed about your obligations and utilizing resources for assistance can help mitigate these risks.

Quick guide on how to complete oregon trimet tax form

Complete Oregon Trimet Tax Form seamlessly on any device

Managing documents online has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Oregon Trimet Tax Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to modify and electronically sign Oregon Trimet Tax Form effortlessly

- Find Oregon Trimet Tax Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Oregon Trimet Tax Form and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon trimet tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to orsttw h?

airSlate SignNow is a powerful eSignature tool that directly facilitates orsttw h by enabling businesses to send, sign, and manage documents electronically. This easy-to-use platform streamlines the signing process, making it efficient and cost-effective for all users. With airSlate SignNow, businesses can enhance document workflow while ensuring legal compliance.

-

What features does airSlate SignNow offer that support orsttw h?

airSlate SignNow includes features like custom workflows, templates, and advanced security measures to support orsttw h. These features allow users to automate the signing process and manage document flow seamlessly, all while maintaining high security standards. Additionally, integration capabilities with various software enhance overall productivity.

-

How much does airSlate SignNow cost for implementing orsttw h?

The pricing for airSlate SignNow is designed to be affordable, ensuring that implementing orsttw h fits within your budget. Plans vary based on features, with options for small businesses as well as enterprises. For detailed pricing, it's best to visit our pricing page or contact our sales team for personalized quotes.

-

Can airSlate SignNow integrate with other tools to enhance orsttw h?

Yes, airSlate SignNow offers seamless integrations with a wide array of applications to enhance orsttw h. Whether you use CRM systems, document management software, or productivity tools, our platform can be easily connected. These integrations help streamline your processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for orsttw h?

Using airSlate SignNow for orsttw h presents numerous benefits, including reduced turnaround time for document signing, increased accuracy, and improved document security. It empowers your team to focus on core business activities by simplifying the signing process. Additionally, it enhances customer experience through faster transaction times.

-

Is airSlate SignNow compliant with legal standards for orsttw h?

Absolutely! airSlate SignNow is fully compliant with international legal standards for orsttw h, ensuring that all electronic signatures are valid and secure. Our platform utilizes advanced encryption and security protocols to protect sensitive information. You can trust that your signed documents are legally binding and compliant.

-

How can I get started with airSlate SignNow for orsttw h?

Getting started with airSlate SignNow for orsttw h is simple and user-friendly. Visit our website to sign up for a free trial or explore our pricing options. Once registered, you can access a range of resources, including tutorials and customer support, to help you streamline your document processes quickly.

Get more for Oregon Trimet Tax Form

- Omb100 e form

- Msf 4201 form

- Referral form prime therapeutics

- External social work referral form

- Knox trail council campership application boy scouts of ktc bsa form

- County alarm billing gcso form

- Staff application form camp taum sauk

- Individual professional development plan massachusetts marlborough massteacher form

Find out other Oregon Trimet Tax Form

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal