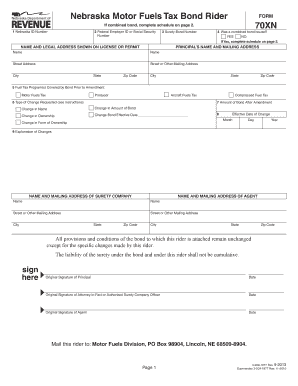

Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne Form

What is the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne

The Nebraska Motor Fuels Tax Bond Rider 70XN is a legal document that serves as a financial guarantee for businesses involved in the sale or distribution of motor fuels in Nebraska. This bond rider is specifically designed to ensure compliance with state tax regulations related to motor fuels. It provides a mechanism for the Nebraska Department of Revenue to collect any unpaid taxes owed by fuel distributors, thereby protecting the state’s revenue interests.

This bond rider is an essential component for businesses that wish to operate legally within the motor fuels industry in Nebraska. By obtaining this bond, companies demonstrate their commitment to adhering to state laws and fulfilling their tax obligations.

How to obtain the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne

To obtain the Nebraska Motor Fuels Tax Bond Rider 70XN, businesses must first contact a licensed surety bond provider. These providers specialize in issuing bonds and can guide applicants through the process. The following steps outline the typical procedure:

- Identify a licensed surety bond company that operates in Nebraska.

- Complete an application form, which may require information about the business, its owners, and financial history.

- Provide any necessary documentation that supports the application, such as financial statements or business licenses.

- Pay the required premium, which is typically a percentage of the total bond amount.

- Receive the bond rider once approved, ensuring it meets the state’s requirements.

Steps to complete the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne

Completing the Nebraska Motor Fuels Tax Bond Rider 70XN involves several key steps to ensure accuracy and compliance. Here is a simplified process:

- Gather all necessary information about the business, including its legal name, address, and tax identification number.

- Consult with a surety bond provider to understand specific requirements for the bond rider.

- Fill out the bond rider form accurately, ensuring all details are correct and complete.

- Review the completed form with a legal or tax professional to avoid errors.

- Submit the form along with any required documentation to the appropriate state authority.

Key elements of the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne

The Nebraska Motor Fuels Tax Bond Rider 70XN includes several critical elements that must be understood by applicants. These elements ensure that the bond rider is compliant with state regulations:

- Principal: The business or individual responsible for fulfilling the bond obligations.

- Obligee: The Nebraska Department of Revenue, which requires the bond for compliance.

- Bond Amount: The financial guarantee amount, which varies based on the volume of fuel sold or distributed.

- Effective Date: The date when the bond rider becomes effective and is enforceable.

- Conditions of the Bond: Specific conditions under which the bond may be forfeited, such as failure to pay taxes.

Legal use of the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne

The legal use of the Nebraska Motor Fuels Tax Bond Rider 70XN is essential for businesses engaged in the motor fuels industry. This bond rider serves as a legal instrument that ensures compliance with state tax laws. It protects the state’s revenue by providing a financial mechanism to recover unpaid taxes from fuel distributors. Failure to maintain a valid bond can lead to legal penalties, including fines and the suspension of business operations.

Businesses must ensure that the bond rider is kept up to date and renewed as required to avoid any legal complications. Regular communication with the surety provider can help ensure compliance with all legal obligations.

State-specific rules for the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne

Each state has specific rules governing the Nebraska Motor Fuels Tax Bond Rider 70XN. In Nebraska, businesses must adhere to the following state-specific regulations:

- All motor fuel distributors must obtain a bond rider before commencing operations.

- The bond amount is determined based on the estimated annual tax liability of the business.

- Businesses must notify the Nebraska Department of Revenue of any changes to their operations that may affect the bond.

- Failure to comply with bond requirements can result in penalties, including fines and revocation of business licenses.

Quick guide on how to complete nebraska motor fuels tax bond rider 70xn revenue ne

Effortlessly prepare [SKS] on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it digitally. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Employ the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as an old-fashioned wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne

Create this form in 5 minutes!

How to create an eSignature for the nebraska motor fuels tax bond rider 70xn revenue ne

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne?

The Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne is a specialized bond designed for businesses involved in the sale of motor fuels in Nebraska. This bond ensures compliance with state regulations, covering any taxes owed to the state. It serves as a financial guarantee against unlawful practices in the fuel industry.

-

How much does the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne cost?

The pricing for the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne varies based on several factors, including the business’s credit score and the amount of bond coverage needed. Typically, premiums range from 1% to 15% of the total bond amount. It's essential to get a quote from a reliable bonding provider to determine the exact cost.

-

What are the main benefits of obtaining the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne?

Obtaining the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne allows your business to comply with state regulations while reducing the risk of financial penalties. It also enhances your business's credibility with state authorities and customers, demonstrating a commitment to lawful practices. Additionally, having this bond can facilitate smoother operational processes.

-

How can I apply for the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne?

You can apply for the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne through a licensed surety bond provider or agency. The process generally involves filling out an application, providing financial documentation, and undergoing a credit check. Once approved, the bond can be issued quickly, allowing you to meet regulatory requirements without delay.

-

Is the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne refundable?

The Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne is generally not refundable once purchased, as it acts as a guarantee for the state. However, if you no longer need the bond due to a change in business operations or licensing, you may be able to request a cancellation. Be sure to check with your bonding company for specific terms and conditions.

-

What happens if I need to make a claim against the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne?

If a claim needs to be made against the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne, it typically involves notifying the bond issuer and providing evidence supporting the claim. The bonding company will then investigate the issue. Valid claims can result in compensation up to the bond amount, and it’s crucial to resolve any claims promptly to avoid future difficulties.

-

What documents do I need to provide for the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne?

To secure the Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne, you usually need to provide financial statements, proof of business identity, and information about your business operations. Some providers may also require additional documentation based on your creditworthiness. It's best to consult with your bonding professional for a comprehensive list of requirements.

Get more for Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne

- Digital signature certificate subscription form sify safescrypt

- Patient authorization form generali

- Kfc forms karnataka

- Nys courts diy forms

- Teacher application form fort vermilion school division

- Superheat and subcooling troubleshooting pdf form

- Epicrisis report sample form

- School bus driver otological form

Find out other Nebraska Motor Fuels Tax Bond Rider 70XN Revenue Ne

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document