Form it 249Claim for Long Term Care Insurance Credit 2023

What is the Form IT-249 Claim For Long Term Care Insurance Credit

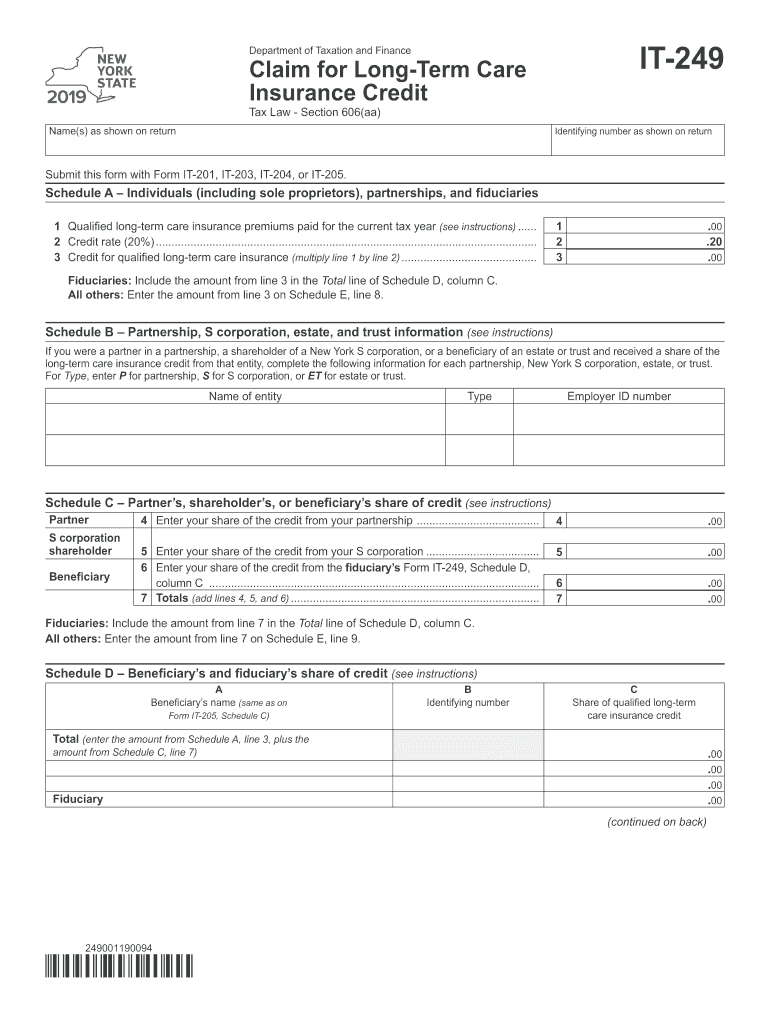

The Form IT-249 is a tax form used by residents of New York State to claim a credit for long-term care insurance premiums. This credit is designed to provide financial relief for individuals who have purchased long-term care insurance policies. The form allows taxpayers to report the amount of premiums paid during the tax year and calculate the credit based on those amounts. It is essential for taxpayers to understand the purpose of this form to ensure they can maximize their tax benefits related to long-term care expenses.

Steps to Complete the Form IT-249 Claim For Long Term Care Insurance Credit

Completing the Form IT-249 involves several key steps:

- Gather necessary documentation, including proof of premium payments for long-term care insurance.

- Fill out your personal information at the top of the form, ensuring accuracy in your name, address, and Social Security number.

- Report the total amount of premiums paid in the designated section of the form.

- Calculate the credit by applying the appropriate percentage to the total premiums reported.

- Review the completed form for any errors before submission.

Following these steps can help ensure that the form is filled out correctly and submitted on time.

How to Obtain the Form IT-249 Claim For Long Term Care Insurance Credit

The Form IT-249 can be obtained through various channels. Taxpayers can download the form directly from the New York State Department of Taxation and Finance website. Additionally, physical copies may be available at local tax offices or public libraries. It is advisable to ensure that you have the most current version of the form to avoid any issues during the filing process.

Eligibility Criteria for the Form IT-249 Claim For Long Term Care Insurance Credit

To qualify for the credit claimed on the Form IT-249, taxpayers must meet certain eligibility criteria:

- The taxpayer must be a resident of New York State.

- The long-term care insurance policy must be in force for the entire tax year.

- Premiums must be paid for qualified long-term care insurance coverage.

Understanding these criteria is crucial for taxpayers to determine their eligibility for the credit.

Filing Deadlines / Important Dates

Taxpayers should be aware of the important deadlines related to the Form IT-249. Typically, the form must be filed by the same deadline as the New York State personal income tax return. For most taxpayers, this is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about specific dates to ensure timely filing and avoid penalties.

Required Documents for the Form IT-249 Claim For Long Term Care Insurance Credit

When filing the Form IT-249, taxpayers need to provide certain documents to support their claim:

- Proof of premium payments, such as receipts or statements from the insurance provider.

- A copy of the long-term care insurance policy, which may be requested for verification purposes.

Having these documents ready can facilitate a smoother filing process and help substantiate the claim for the credit.

Quick guide on how to complete form it 249claim for long term care insurance credit

Complete Form IT 249Claim For Long Term Care Insurance Credit effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Handle Form IT 249Claim For Long Term Care Insurance Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Form IT 249Claim For Long Term Care Insurance Credit with ease

- Obtain Form IT 249Claim For Long Term Care Insurance Credit and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form IT 249Claim For Long Term Care Insurance Credit and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 249claim for long term care insurance credit

Create this form in 5 minutes!

How to create an eSignature for the form it 249claim for long term care insurance credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 249Claim For Long Term Care Insurance Credit?

Form IT 249Claim For Long Term Care Insurance Credit is a tax form used to claim a credit for long-term care insurance premiums. This form helps taxpayers reduce their tax liability by providing a credit for eligible long-term care insurance expenses. Understanding how to properly fill out this form can maximize your tax benefits.

-

How can airSlate SignNow help with Form IT 249Claim For Long Term Care Insurance Credit?

airSlate SignNow simplifies the process of completing and submitting Form IT 249Claim For Long Term Care Insurance Credit by allowing users to eSign and send documents securely. Our platform ensures that all necessary information is captured accurately, reducing the risk of errors. This streamlines your tax filing process and saves you time.

-

What are the pricing options for using airSlate SignNow for Form IT 249Claim For Long Term Care Insurance Credit?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for managing Form IT 249Claim For Long Term Care Insurance Credit. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required. This ensures you only pay for what you need.

-

What features does airSlate SignNow provide for managing Form IT 249Claim For Long Term Care Insurance Credit?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for Form IT 249Claim For Long Term Care Insurance Credit. These tools enhance efficiency and ensure compliance with tax regulations. Additionally, our platform allows for easy collaboration among team members.

-

Are there any benefits to using airSlate SignNow for Form IT 249Claim For Long Term Care Insurance Credit?

Using airSlate SignNow for Form IT 249Claim For Long Term Care Insurance Credit offers numerous benefits, including increased efficiency and reduced paperwork. The platform's user-friendly interface makes it easy to navigate and complete forms quickly. Furthermore, the secure eSigning feature ensures that your documents are protected.

-

Can I integrate airSlate SignNow with other software for Form IT 249Claim For Long Term Care Insurance Credit?

Yes, airSlate SignNow can be integrated with various software applications to enhance your workflow for Form IT 249Claim For Long Term Care Insurance Credit. This includes popular accounting and tax software, allowing for seamless data transfer and improved efficiency. Integrations help streamline your document management process.

-

Is airSlate SignNow secure for handling Form IT 249Claim For Long Term Care Insurance Credit?

Absolutely, airSlate SignNow prioritizes security when handling Form IT 249Claim For Long Term Care Insurance Credit. Our platform employs advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe and compliant with industry standards.

Get more for Form IT 249Claim For Long Term Care Insurance Credit

Find out other Form IT 249Claim For Long Term Care Insurance Credit

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form