Form 8822 Rev December Change of Address Irs

What is the Form 8822 Rev December Change Of Address IRS

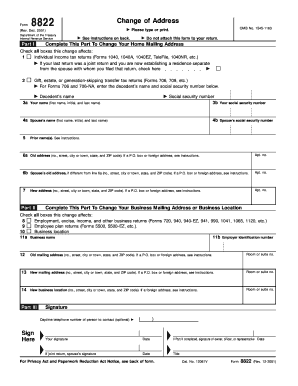

The Form 8822 Rev December, also known as the Change of Address form, is an official document used by taxpayers in the United States to notify the Internal Revenue Service (IRS) of a change in their mailing address. This form is essential for ensuring that the IRS has the correct contact information for taxpayers, which is crucial for receiving important tax documents and correspondence. It is important to note that this form is specifically designed for individuals and not for businesses or entities.

How to use the Form 8822 Rev December Change Of Address IRS

To use the Form 8822 Rev December, taxpayers must first obtain the form from the IRS website or other authorized sources. Once the form is in hand, individuals should fill in their old address, new address, and other required information. After completing the form, it should be signed and dated before submission. This ensures that the IRS processes the change of address efficiently and accurately.

Steps to complete the Form 8822 Rev December Change Of Address IRS

Completing the Form 8822 Rev December involves several straightforward steps:

- Download the form from the IRS website or request a physical copy.

- Provide your personal information, including your name and Social Security number.

- Fill in your previous address and your new address.

- If applicable, include your spouse's information if you are filing jointly.

- Sign and date the form to confirm the accuracy of the information provided.

- Submit the completed form to the IRS either by mail or electronically, if applicable.

Legal use of the Form 8822 Rev December Change Of Address IRS

The legal use of the Form 8822 Rev December is to ensure that the IRS has up-to-date contact information for taxpayers. This is important for maintaining compliance with tax laws and regulations. Failure to update your address could result in missed communications regarding tax liabilities, refunds, or other important notices from the IRS. Therefore, using this form correctly is a legal obligation for taxpayers who change their mailing address.

Filing Deadlines / Important Dates

While there are no specific deadlines for submitting the Form 8822 Rev December, it is advisable to file it as soon as you change your address. Timely submission helps to ensure that the IRS updates your records promptly, allowing for uninterrupted communication regarding your tax matters. Additionally, if you are expecting a tax refund, updating your address before filing your tax return can prevent delays in receiving your refund.

Required Documents

When completing the Form 8822 Rev December, no additional documents are required to be submitted along with the form itself. However, it is beneficial to have your previous tax returns or any IRS correspondence on hand to ensure that the information you provide is accurate. Keeping a copy of the completed form for your records is also advisable.

Quick guide on how to complete form 8822 rev december change of address irs

Complete Form 8822 Rev December Change Of Address Irs with ease on any device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without hassle. Work on Form 8822 Rev December Change Of Address Irs from any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest way to modify and eSign Form 8822 Rev December Change Of Address Irs effortlessly

- Obtain Form 8822 Rev December Change Of Address Irs and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or conceal sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds equivalent legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 8822 Rev December Change Of Address Irs to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8822 rev december change of address irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8822 Rev December Change Of Address IRS?

The Form 8822 Rev December Change Of Address IRS is a form used by taxpayers to notify the IRS of a change in their mailing address. Completing this form ensures that you receive all tax-related documents at your new address. It's important to keep your address updated to avoid missing crucial communication from the IRS.

-

How do I fill out the Form 8822 Rev December Change Of Address IRS?

To fill out the Form 8822 Rev December Change Of Address IRS, you need to provide your old address, new address, and some identifying information such as your name and Social Security number. Follow the instructions carefully to ensure that the form is properly completed. For convenience, consider using e-signature solutions like airSlate SignNow to fill out and send this form securely.

-

What are the benefits of using airSlate SignNow for Form 8822 Rev December Change Of Address IRS?

Using airSlate SignNow to manage your Form 8822 Rev December Change Of Address IRS offers many benefits, including ease of use and enhanced security. The platform allows you to fill out, eSign, and send documents from anywhere, reducing paper waste and ensuring timely submission to the IRS. You also gain access to templates and integrations that streamline your workflow.

-

Is there a fee to use airSlate SignNow for the Form 8822 Rev December Change Of Address IRS?

Yes, airSlate SignNow does have pricing plans that cater to both individuals and businesses. While there may be a fee associated with using the platform, the cost is competitive and provides value with features such as document tracking and secure eSigning. Explore the pricing options to find the best plan suited for your needs.

-

Can I integrate airSlate SignNow with other software for my Form 8822 Rev December Change Of Address IRS?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, including CRMs and cloud storage platforms. This means that you can easily manage your Form 8822 Rev December Change Of Address IRS alongside other essential tools, enhancing overall efficiency in your workflow.

-

What features does airSlate SignNow offer for managing IRS forms like Form 8822 Rev December Change Of Address?

airSlate SignNow offers a range of features including easy document creation, electronic signatures, and real-time collaboration. These features make it simple to prepare and process your Form 8822 Rev December Change Of Address IRS with minimal hassle. Additionally, you'll have access to secure storage and compliance measures that protect your information.

-

How long does it take for the IRS to process the Form 8822 Rev December Change Of Address?

The processing time for the Form 8822 Rev December Change Of Address IRS can vary, but it typically takes 4 to 6 weeks to be updated in their system. By using airSlate SignNow to ensure accurate and timely submission, you can help minimize any delays. It's a good practice to follow up with the IRS if you haven't received confirmation after the processing timeframe.

Get more for Form 8822 Rev December Change Of Address Irs

- Fillable online therefore do not enter fax email print pdffiller form

- Tenancy summons and return of service form pdffiller

- In the district court of county state of oklahoma form

- Oklahoma claim for exemption and request for hearing form

- State of south carolina civil case number plaintiffs form

- Rule to vacate or show cause form

- Civil case number state of south carolina county of arrest form

- South carolina affidavit and itemization of accounts form

Find out other Form 8822 Rev December Change Of Address Irs

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal