Georgia Consol 2005

What is the Georgia Consol

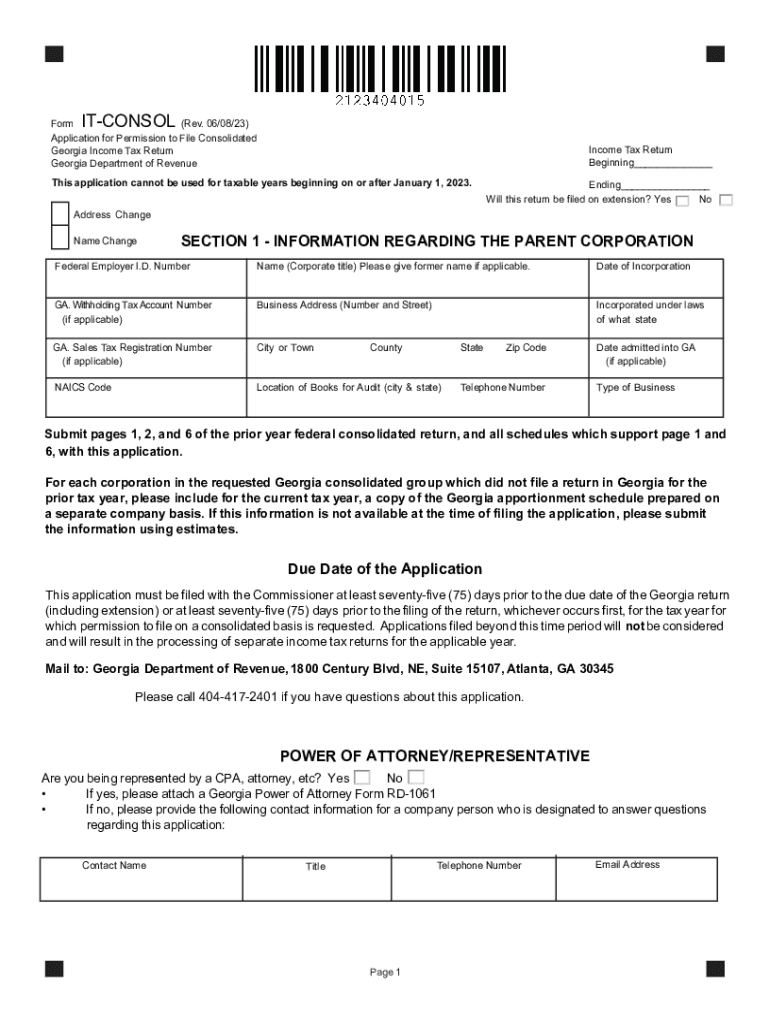

The Georgia Consol, officially known as the Georgia Department of Revenue (DOR) Consolidated Income Tax Return, is a tax form designed for certain business entities in Georgia. This form allows eligible corporations to file a single tax return that consolidates the income of multiple affiliated companies. By using this form, businesses can streamline their tax reporting process, potentially reducing administrative burdens and ensuring compliance with state tax regulations.

How to use the Georgia Consol

To effectively use the Georgia Consol, businesses must first determine their eligibility. Typically, this form is utilized by corporations that are part of a consolidated group. Once eligibility is confirmed, businesses can complete the form by accurately reporting their combined income, deductions, and credits. It is essential to follow the specific guidelines provided by the Georgia DOR to ensure that all necessary information is included and correctly calculated.

Steps to complete the Georgia Consol

Completing the Georgia Consol involves several key steps:

- Gather financial statements for all entities within the consolidated group.

- Calculate the total income, deductions, and credits for the group.

- Fill out the Georgia Consol form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline, either online or via mail.

Required Documents

When preparing to file the Georgia Consol, businesses should have the following documents ready:

- Financial statements for each entity in the consolidated group.

- Previous year’s tax returns for reference.

- Documentation supporting any deductions or credits claimed.

- Any applicable schedules or additional forms required by the Georgia DOR.

Filing Deadlines / Important Dates

Filing deadlines for the Georgia Consol typically align with the federal tax deadlines. Generally, the form must be submitted by the fifteenth day of the fourth month following the end of the tax year. It is crucial for businesses to stay informed about any changes to these deadlines, as well as any extensions that may be available.

Penalties for Non-Compliance

Failure to file the Georgia Consol on time or provide accurate information can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential audits. To avoid these consequences, it is essential for businesses to adhere to all filing requirements and deadlines set forth by the Georgia DOR.

Quick guide on how to complete georgia consol 484360564

Complete Georgia Consol seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any hold-ups. Manage Georgia Consol on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest method to edit and electronically sign Georgia Consol with ease

- Find Georgia Consol and click on Get Form to begin.

- Utilize the features we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Verify all the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document versions. airSlate SignNow takes care of all your document management needs in just a few clicks from a device of your preference. Edit and electronically sign Georgia Consol and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct georgia consol 484360564

Create this form in 5 minutes!

How to create an eSignature for the georgia consol 484360564

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a GA IT tax return printable?

A GA IT tax return printable refers to a form that taxpayers in Georgia can fill out and print to report their income and calculate their taxes. This printable version allows for easy completion and submission, ensuring compliance with Georgia tax laws. Using the airSlate SignNow platform, you can seamlessly eSign and manage these documents for added convenience.

-

How can I obtain a GA IT tax return printable form?

You can obtain a GA IT tax return printable form through the Georgia Department of Revenue's website or directly via the airSlate SignNow platform. By using SignNow, you can fill out the form electronically and print it for submission. This method simplifies the process of getting your GA IT tax return printable and ensures accuracy.

-

Is the GA IT tax return printable compliant with state regulations?

Yes, the GA IT tax return printable provided through the airSlate SignNow platform is fully compliant with Georgia state regulations. It includes all required fields and adheres to the latest tax laws. By using our platform, you can ensure that your printable tax return meets all necessary criteria for submission.

-

Can I eSign my GA IT tax return printable using SignNow?

Absolutely! With airSlate SignNow, you can easily eSign your GA IT tax return printable directly on the platform. This feature allows for quick and secure signing, reducing the time it takes to finalize your tax documents and ensuring they are submitted promptly.

-

What are the benefits of using airSlate SignNow for my GA IT tax return printable?

Using airSlate SignNow for your GA IT tax return printable offers numerous benefits, including streamlined document management, the ability to eSign from anywhere, and enhanced security features. Our platform also allows for easy sharing and storage of essential tax documents. This efficiency helps you focus more on your tax strategy rather than paperwork.

-

How does pricing work for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans that cater to both individual taxpayers and businesses needing GA IT tax return printable solutions. Pricing varies based on the features you choose, but our service is designed to be cost-effective, making it accessible for everyone. Visit our pricing page to find the plan that suits your needs.

-

Can I save and edit my GA IT tax return printable after starting it?

Yes, you can save and edit your GA IT tax return printable anytime using airSlate SignNow. Our platform allows you to pause and resume your work, making it convenient to complete your tax return at your own pace. This feature is especially useful if you need to gather additional information before finalizing your submission.

Get more for Georgia Consol

Find out other Georgia Consol

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure