600 Corporation Tax Return Department of Revenue 2019

Understanding the 600 Corporation Tax Return

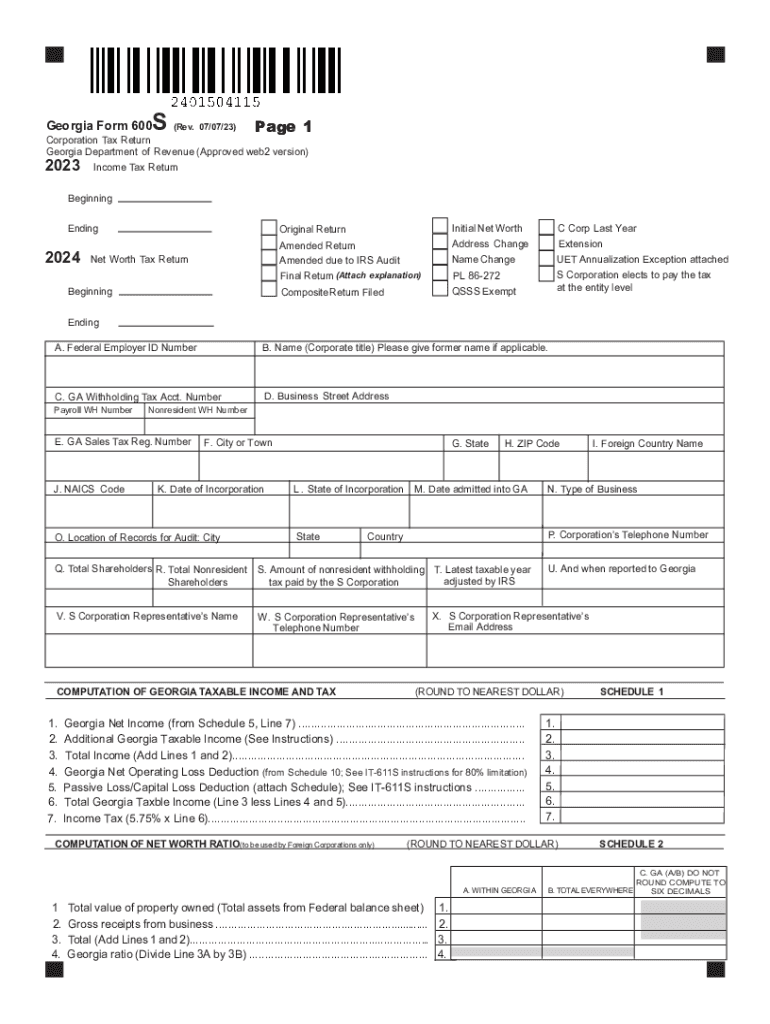

The 600 Corporation Tax Return is a crucial document required by the Georgia Department of Revenue for corporations operating within the state. This form is specifically designed for C corporations, which are taxed separately from their owners. It allows businesses to report their income, deductions, and credits, ultimately determining their tax liability. Understanding the purpose and requirements of this form is essential for compliance and effective tax planning.

Steps to Complete the 600 Corporation Tax Return

Completing the 600 Corporation Tax Return involves several key steps:

- Gather Financial Information: Collect all necessary financial documents, including income statements, balance sheets, and expense reports.

- Complete the Form: Fill out the 600 form accurately, ensuring all income, deductions, and credits are reported.

- Review for Accuracy: Double-check all entries for accuracy and completeness to avoid errors that could lead to penalties.

- Submit the Form: File the completed form by the specified deadline, either online or by mail.

Filing Deadlines and Important Dates

Timely filing of the 600 Corporation Tax Return is essential to avoid penalties. The standard deadline for submitting this form is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day.

Required Documents for Filing

When preparing to file the 600 Corporation Tax Return, certain documents are essential:

- Income Statements: Detailed records of all income earned during the tax year.

- Expense Reports: Documentation of all business expenses, including operating costs and deductions.

- Previous Tax Returns: Copies of prior year returns may be helpful for reference.

- Supporting Documentation: Any additional documents that support claims for deductions or credits.

Penalties for Non-Compliance

Failure to file the 600 Corporation Tax Return on time or inaccuracies in reporting can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential audits. It is important for corporations to stay informed about their filing obligations and ensure compliance to avoid these consequences.

Form Submission Methods

The 600 Corporation Tax Return can be submitted through various methods, providing flexibility for corporations. Options include:

- Online Filing: Many businesses opt to file electronically through the Georgia Department of Revenue's online portal, which is efficient and secure.

- Mail: Corporations may also choose to print the completed form and mail it to the appropriate address provided by the Department of Revenue.

- In-Person Submission: Some businesses may prefer to deliver their forms in person at local Department of Revenue offices.

Quick guide on how to complete 600 corporation tax return department of revenue

Complete 600 Corporation Tax Return Department Of Revenue effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 600 Corporation Tax Return Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to alter and eSign 600 Corporation Tax Return Department Of Revenue seamlessly

- Find 600 Corporation Tax Return Department Of Revenue and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant parts of the documents or hide sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and eSign 600 Corporation Tax Return Department Of Revenue and ensure excellent communication throughout every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 600 corporation tax return department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 600 corporation tax return department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 600s tax and how does it apply to my business?

The 600s tax refers to specific tax reporting requirements for businesses that file Form 1099-MISC. Understanding the 600s tax is crucial for compliance, as failing to report may lead to penalties. airSlate SignNow can assist in organizing and eSigning documents to simplify your reporting process.

-

How can airSlate SignNow help with 600s tax documentation?

airSlate SignNow streamlines the process of preparing and signing documents required for 600s tax compliance. Our platform allows you to easily create, send, and eSign all necessary tax forms, ensuring that your documentation is accurate and timely. This signNowly reduces the burden of tax season for your business.

-

What are the pricing options for airSlate SignNow when managing 600s tax documents?

airSlate SignNow offers competitive pricing plans that cater to different business needs, making it an affordable solution for managing 600s tax documents. Our plans include features designed to enhance productivity and compliance at every level. You can choose a plan that best fits your business size and document management requirements.

-

Are there any integrations available with airSlate SignNow for tax-related software?

Yes, airSlate SignNow seamlessly integrates with various tax-related software solutions to enhance your 600s tax management. Whether you use accounting software or other tax preparation tools, our integrations help streamline your workflows. This will ultimately save you time and reduce the likelihood of errors.

-

What features does airSlate SignNow provide to facilitate the 600s tax filing process?

airSlate SignNow offers features such as templates for 600s tax forms, automatic reminders, and secure eSigning options. These features ensure that you can efficiently prepare and send necessary documents ahead of deadlines. Our platform is designed to empower businesses with the tools needed for smooth tax filing.

-

How does airSlate SignNow ensure the security of sensitive 600s tax information?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive 600s tax information. Our platform utilizes advanced encryption and secure access protocols to protect your data. You can trust that your documents are safe, allowing you to focus on completing your tax filings with confidence.

-

Can I track the status of my 600s tax documents sent through airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents you send, including 600s tax forms. You can easily monitor when documents are viewed, signed, and completed. This transparency helps ensure that your tax filings are on track.

Get more for 600 Corporation Tax Return Department Of Revenue

Find out other 600 Corporation Tax Return Department Of Revenue

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement