600S Print 8 26 21 2021

Understanding the Georgia 600S Tax Return

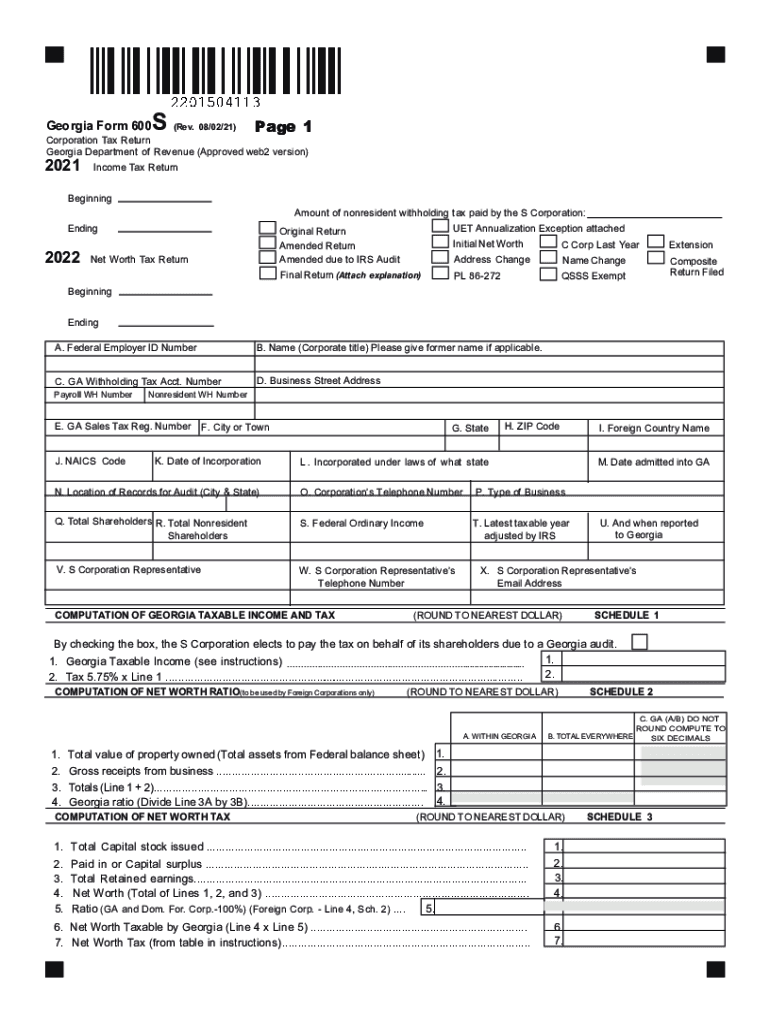

The Georgia 600S tax return is specifically designed for S corporations operating within the state of Georgia. This form is essential for reporting the income, deductions, and credits of S corporations, which pass their income directly to shareholders for tax purposes. Understanding the structure and requirements of the Georgia 600S is crucial for compliance and accurate tax reporting.

Steps to Complete the Georgia 600S Tax Return

Filling out the Georgia 600S tax return involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Complete the Georgia 600S form, ensuring all income and deductions are accurately reported.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline, either electronically or via mail.

Filing Deadlines for the Georgia 600S Tax Return

Timely filing of the Georgia 600S tax return is essential to avoid penalties. The typical deadline for filing is the 15th day of the third month following the end of the corporation’s tax year. For most corporations operating on a calendar year, this means the deadline is March 15. Extensions may be available, but they must be requested prior to the original deadline.

Required Documents for the Georgia 600S Tax Return

To accurately complete the Georgia 600S tax return, certain documents are required:

- Financial statements, including profit and loss statements.

- Documentation of all income sources.

- Records of deductions and credits claimed.

- Shareholder information, including ownership percentages.

Form Submission Methods for the Georgia 600S Tax Return

The Georgia 600S tax return can be submitted through various methods:

- Online: Many taxpayers choose to file electronically using approved e-filing software.

- By Mail: The completed form can be mailed to the Georgia Department of Revenue.

- In-Person: Taxpayers may also choose to deliver their forms directly to local tax offices.

Penalties for Non-Compliance with the Georgia 600S Tax Return

Failure to file the Georgia 600S tax return on time or inaccuracies in reporting can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential audits from the Georgia Department of Revenue.

Quick guide on how to complete 600s print 82621

Complete 600S Print 8 26 21 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as a superb eco-friendly alternative to traditional printed and signed papers, enabling you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage 600S Print 8 26 21 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign 600S Print 8 26 21 effortlessly

- Find 600S Print 8 26 21 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that task.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Verify the details and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign 600S Print 8 26 21 while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 600s print 82621

Create this form in 5 minutes!

People also ask

-

What is a Georgia 600S tax return?

The Georgia 600S tax return is a tax form specifically designed for S corporations doing business in Georgia. It reports the S corporation's income, deductions, and credits, ensuring compliance with state tax laws. Filing the Georgia 600S tax return accurately is crucial for minimizing tax liability.

-

How do I file my Georgia 600S tax return electronically?

You can file your Georgia 600S tax return electronically using approved e-filing software. Many online platforms, including airSlate SignNow, offer features that simplify the e-filing process. Ensure you follow all prompts carefully to submit your Georgia 600S tax return successfully.

-

What are the deadlines for filing Georgia 600S tax returns?

Typically, the deadline for filing your Georgia 600S tax return is the 15th day of the third month following the end of your tax year. For corporations on a calendar year, this means the deadline is March 15. It's important to adhere to this timeline to avoid penalties on your Georgia 600S tax return.

-

What are the benefits of using airSlate SignNow for my Georgia 600S tax return?

Using airSlate SignNow for your Georgia 600S tax return offers numerous benefits, including easy document sharing and e-signature capabilities. This platform streamlines collaboration among partners and accountants, reducing the time spent on filing. Additionally, airSlate SignNow is a cost-effective option that ensures compliance with necessary tax filings.

-

Can I save my Georgia 600S tax return progress with airSlate SignNow?

Yes, airSlate SignNow allows you to save your Georgia 600S tax return progress as you work. This feature enables you to complete your filing at your convenience without worrying about data loss. You can return to your saved documents anytime before final submission.

-

Are there any integrations available for filing the Georgia 600S tax return?

AirSlate SignNow offers several integrations that can simplify the process of filing your Georgia 600S tax return. These integrations can connect with accounting software to pull necessary data directly, thus enhancing accuracy and saving time. Check the integration options available in the airSlate SignNow platform for optimized filing.

-

What type of customer support is available for Georgia 600S tax return queries?

AirSlate SignNow provides robust customer support for any queries related to your Georgia 600S tax return. You can access FAQs, live chat, or email support to receive timely assistance. Our support team is well-trained to handle all your tax return-related questions.

Get more for 600S Print 8 26 21

- Guaranty or guarantee of payment of rent north carolina form

- Letter from landlord to tenant as notice of default on commercial lease north carolina form

- Residential or rental lease extension agreement north carolina form

- Commercial rental lease application questionnaire north carolina form

- Apartment lease rental application questionnaire north carolina form

- Nc rental lease form

- Salary verification form for potential lease north carolina

- North carolina agreement form

Find out other 600S Print 8 26 21

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF