Dor Georgia GovdocumentdocumentGeorgia Form 500 Rev 062020 Georgia Department of Revenue 2020

Understanding Georgia Tax Form 600

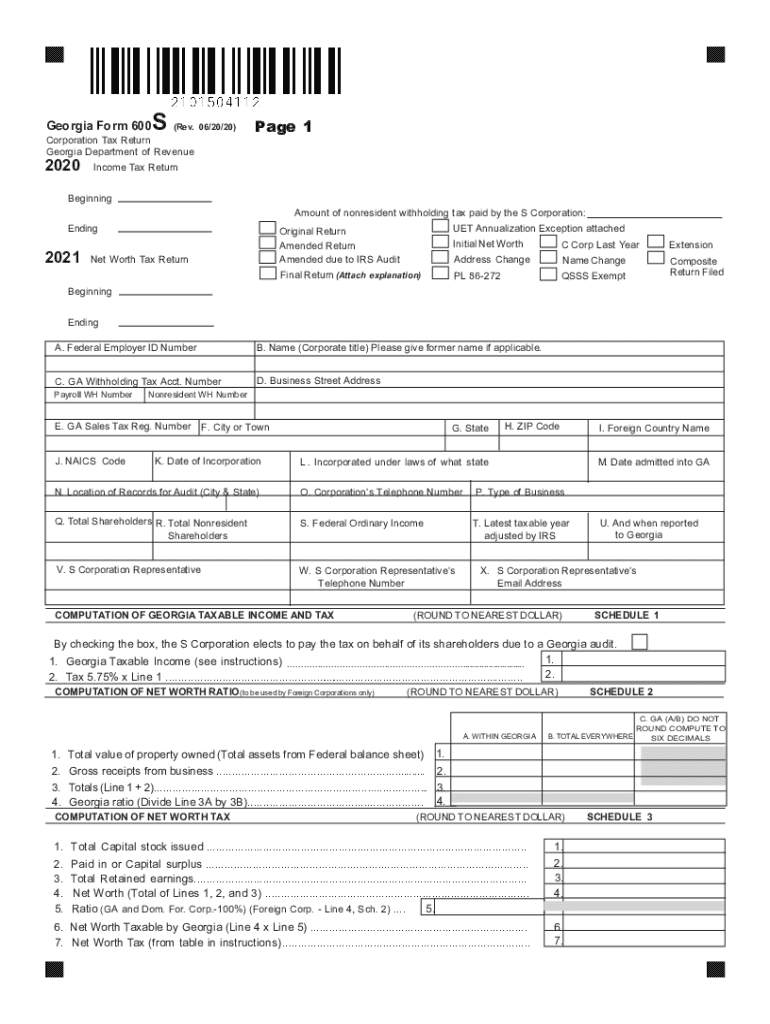

The Georgia Tax Form 600 is a crucial document for corporations operating within the state. This form is specifically designed for the reporting of corporate income tax. It is essential for businesses to accurately complete this form to ensure compliance with state tax regulations. The form captures various financial details, including income, deductions, and credits, which ultimately determine the corporation's tax liability. Understanding the specific requirements and instructions for Form 600 is vital for successful filing.

Steps to Complete Georgia Tax Form 600

Completing the Georgia Tax Form 600 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and expense records. Next, follow these steps:

- Fill out the basic information section, including the corporation's name, address, and federal employer identification number (FEIN).

- Report total income, which includes all revenue generated during the tax year.

- Detail allowable deductions, such as business expenses and losses, to calculate taxable income.

- Apply any available tax credits, which can reduce the overall tax liability.

- Review the completed form for accuracy before submitting it to the Georgia Department of Revenue.

Filing Deadlines for Georgia Tax Form 600

Timely filing of the Georgia Tax Form 600 is essential to avoid penalties. The standard deadline for submitting this form is typically the fifteenth day of the fourth month following the close of the corporation’s fiscal year. For corporations operating on a calendar year, this means the due date is April 15. It is important to stay informed about any changes in deadlines, as extensions may be available under certain circumstances.

Required Documents for Filing Form 600

When preparing to file the Georgia Tax Form 600, several documents are required to support the information reported on the form. These documents include:

- Financial statements, including balance sheets and income statements.

- Records of all income received during the tax year.

- Documentation of business expenses and deductions claimed.

- Any relevant tax credit documentation.

Having these documents organized and readily available can streamline the filing process and help ensure accuracy.

Submission Methods for Georgia Tax Form 600

Corporations have multiple options for submitting the Georgia Tax Form 600. The form can be filed electronically through the Georgia Department of Revenue's online portal, which is a convenient option that allows for quicker processing times. Alternatively, businesses can choose to submit the form via traditional mail. When mailing, it is advisable to send the form using a trackable service to confirm delivery.

Penalties for Non-Compliance with Form 600

Failure to file the Georgia Tax Form 600 on time can result in significant penalties. The Georgia Department of Revenue imposes fines for late filings, which can accumulate daily until the form is submitted. Additionally, interest may be charged on any unpaid tax amounts. It is crucial for corporations to adhere to filing deadlines and ensure compliance to avoid these financial repercussions.

Quick guide on how to complete dorgeorgiagovdocumentdocumentgeorgia form 500 rev 062020 georgia department of revenue

Complete Dor georgia govdocumentdocumentGeorgia Form 500 Rev 062020 Georgia Department Of Revenue easily on any device

Managing documents online has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any delays. Handle Dor georgia govdocumentdocumentGeorgia Form 500 Rev 062020 Georgia Department Of Revenue on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Dor georgia govdocumentdocumentGeorgia Form 500 Rev 062020 Georgia Department Of Revenue effortlessly

- Locate Dor georgia govdocumentdocumentGeorgia Form 500 Rev 062020 Georgia Department Of Revenue and click Get Form to commence.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Dor georgia govdocumentdocumentGeorgia Form 500 Rev 062020 Georgia Department Of Revenue and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dorgeorgiagovdocumentdocumentgeorgia form 500 rev 062020 georgia department of revenue

Create this form in 5 minutes!

How to create an eSignature for the dorgeorgiagovdocumentdocumentgeorgia form 500 rev 062020 georgia department of revenue

The way to create an e-signature for a PDF file in the online mode

The way to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an e-signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the Georgia tax form 600?

The Georgia tax form 600 is a corporate income tax return form that businesses use to report their income, deductions, and tax liability in the state of Georgia. It is essential for corporations operating in Georgia to properly complete and file this form to comply with state tax regulations.

-

How can airSlate SignNow help with the Georgia tax form 600?

airSlate SignNow provides an easy-to-use platform for digitally signing and sending your Georgia tax form 600. This streamlines the process, reduces paperwork, and ensures that your forms are filed on time, keeping your business compliant with Georgia tax laws.

-

What are the pricing options for using airSlate SignNow for the Georgia tax form 600?

airSlate SignNow offers various pricing plans that cater to different business needs, whether you are a small business or a larger corporation. Pricing is competitive and designed to provide an affordable solution for managing and eSigning essential documents like the Georgia tax form 600.

-

Are there any features specifically beneficial for filing the Georgia tax form 600?

Yes, airSlate SignNow includes features like document templates, automated workflows, and secure eSigning, all of which are beneficial for filing the Georgia tax form 600. These features help ensure accuracy and efficiency, giving users peace of mind when dealing with important tax submissions.

-

What benefits does airSlate SignNow offer for businesses filing the Georgia tax form 600?

Using airSlate SignNow for your Georgia tax form 600 offers numerous benefits, including time savings, cost-effectiveness, and improved organization. With its user-friendly interface, businesses can easily manage their tax forms and ensure compliance with minimal hassle.

-

Can airSlate SignNow integrate with accounting software for the Georgia tax form 600?

Yes, airSlate SignNow integrates seamlessly with various accounting software options. This integration can simplify the process of preparing the Georgia tax form 600 by allowing users to import necessary data directly into their signed documents.

-

Is there customer support available for users of the Georgia tax form 600 on airSlate SignNow?

Absolutely, airSlate SignNow offers robust customer support that can assist users with any questions related to the Georgia tax form 600. Whether you need help with eSigning, document management, or integrations, their support team is available to guide you through the process.

Get more for Dor georgia govdocumentdocumentGeorgia Form 500 Rev 062020 Georgia Department Of Revenue

Find out other Dor georgia govdocumentdocumentGeorgia Form 500 Rev 062020 Georgia Department Of Revenue

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself