600S Corporation Tax Return Georgia Department of Revenue 2022-2026

What is the 600S Corporation Tax Return?

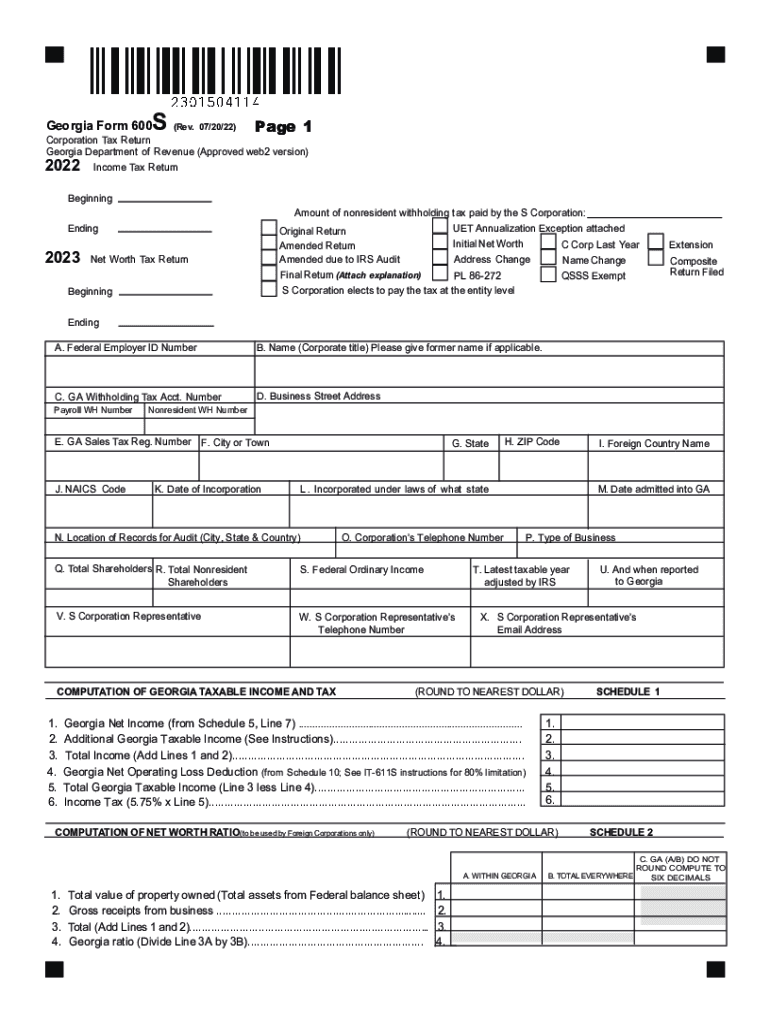

The 600S Corporation Tax Return is a specific tax form used by S corporations in Georgia to report their income, deductions, and credits to the Georgia Department of Revenue. This form is essential for S corporations to fulfill their tax obligations at the state level. Unlike traditional corporations, S corporations pass their income, losses, and deductions through to their shareholders, who then report these amounts on their personal tax returns. Understanding the purpose and requirements of the 600S form is crucial for compliance and accurate reporting.

Steps to complete the 600S Corporation Tax Return

Completing the 600S Corporation Tax Return involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions or credits. Next, accurately fill out the form, ensuring that all income and expenses are reported correctly. Pay special attention to sections that require detailed information about shareholders and their distributions. After completing the form, review it for accuracy before submitting it to the Georgia Department of Revenue. Finally, keep a copy of the completed return for your records.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the 600S Corporation Tax Return. Generally, S corporations must file their tax returns by the fifteenth day of the third month following the end of their tax year. For corporations operating on a calendar year, this means the due date is March 15. If additional time is needed, corporations may file for an extension, which typically allows for an additional six months. However, it is crucial to ensure that any taxes owed are paid by the original due date to avoid penalties and interest.

Legal use of the 600S Corporation Tax Return

The legal use of the 600S Corporation Tax Return is defined by the regulations set forth by the Georgia Department of Revenue. This form serves as an official document for reporting income and ensuring compliance with state tax laws. When completed accurately and submitted on time, the 600S form helps protect the corporation and its shareholders from legal repercussions associated with tax evasion or misreporting. It is essential for S corporations to understand their legal obligations and maintain proper records to support the information reported on this form.

Required Documents

To successfully complete the 600S Corporation Tax Return, several documents are required. These include:

- Financial statements, including income statements and balance sheets

- Records of all income received and expenses incurred during the tax year

- Details of shareholder distributions and ownership percentages

- Any applicable tax credits or deductions that the corporation is eligible for

Having these documents readily available will streamline the process of completing the tax return and ensure accuracy in reporting.

State-specific rules for the 600S Corporation Tax Return

Each state may have specific rules and regulations regarding the filing of the 600S Corporation Tax Return. In Georgia, it is important to be aware of any unique requirements, such as specific deductions or credits available only to Georgia S corporations. Additionally, understanding how state laws interact with federal regulations can help corporations navigate their tax responsibilities effectively. Consulting with a tax professional familiar with Georgia tax law is advisable to ensure compliance and optimize tax outcomes.

Quick guide on how to complete 600s corporation tax return georgia department of revenue

Complete 600S Corporation Tax Return Georgia Department Of Revenue effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right template and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without holdups. Manage 600S Corporation Tax Return Georgia Department Of Revenue on any device with airSlate SignNow’s Android or iOS applications and simplify any document-driven process today.

The easiest way to amend and eSign 600S Corporation Tax Return Georgia Department Of Revenue without hassle

- Locate 600S Corporation Tax Return Georgia Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important parts of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Revise and eSign 600S Corporation Tax Return Georgia Department Of Revenue to ensure excellent communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 600s corporation tax return georgia department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 600s corporation tax return georgia department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the GA Form 600 instructions 2023?

The GA Form 600 instructions 2023 provide detailed guidance on completing the form required for specific tax exemption claims in Georgia. These instructions outline eligibility criteria, necessary documentation, and submission guidelines to ensure compliance with state regulations.

-

How can I access the GA Form 600 instructions 2023 online?

You can easily access the GA Form 600 instructions 2023 on the official Georgia Department of Revenue website. The site offers downloadable PDFs and interactive forms designed to help you navigate through the application process smoothly.

-

What features does airSlate SignNow offer for handling the GA Form 600?

airSlate SignNow provides a user-friendly platform that allows you to eSign and send the GA Form 600 securely and efficiently. With features like document templates, real-time collaboration, and compliance tracking, managing the form becomes effortless.

-

Are there any costs associated with using airSlate SignNow for GA Form 600 instructions 2023?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. They provide a free trial period, allowing you to test the features related to the GA Form 600 instructions 2023 before committing to a subscription.

-

How does airSlate SignNow ensure security when handling GA Form 600 instructions 2023?

airSlate SignNow prioritizes security with advanced encryption protocols and secure cloud storage. These measures ensure that your documents, including the GA Form 600 instructions 2023, are protected against unauthorized access.

-

Can I integrate airSlate SignNow with other applications for GA Form 600?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and more. This functionality can streamline the process of managing your GA Form 600 instructions 2023 alongside other essential business tools.

-

What benefits does airSlate SignNow provide for completing GA Form 600 instructions 2023?

Using airSlate SignNow for your GA Form 600 instructions 2023 simplifies the eSigning process, saving you time and reducing errors. Its automated workflows ensure that all steps are followed, making it easier to stay compliant and organized.

Get more for 600S Corporation Tax Return Georgia Department Of Revenue

- Mutual wills package with last wills and testaments for married couple with adult children rhode island form

- Mutual wills package with last wills and testaments for married couple with no children rhode island form

- Mutual wills package with last wills and testaments for married couple with minor children rhode island form

- Ri legal will 497325451 form

- Legal last will and testament form for a married person with no children rhode island

- Rhode island married get form

- Rhode island form 497325454

- Legal last will and testament form for married person with adult and minor children from prior marriage rhode island

Find out other 600S Corporation Tax Return Georgia Department Of Revenue

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document