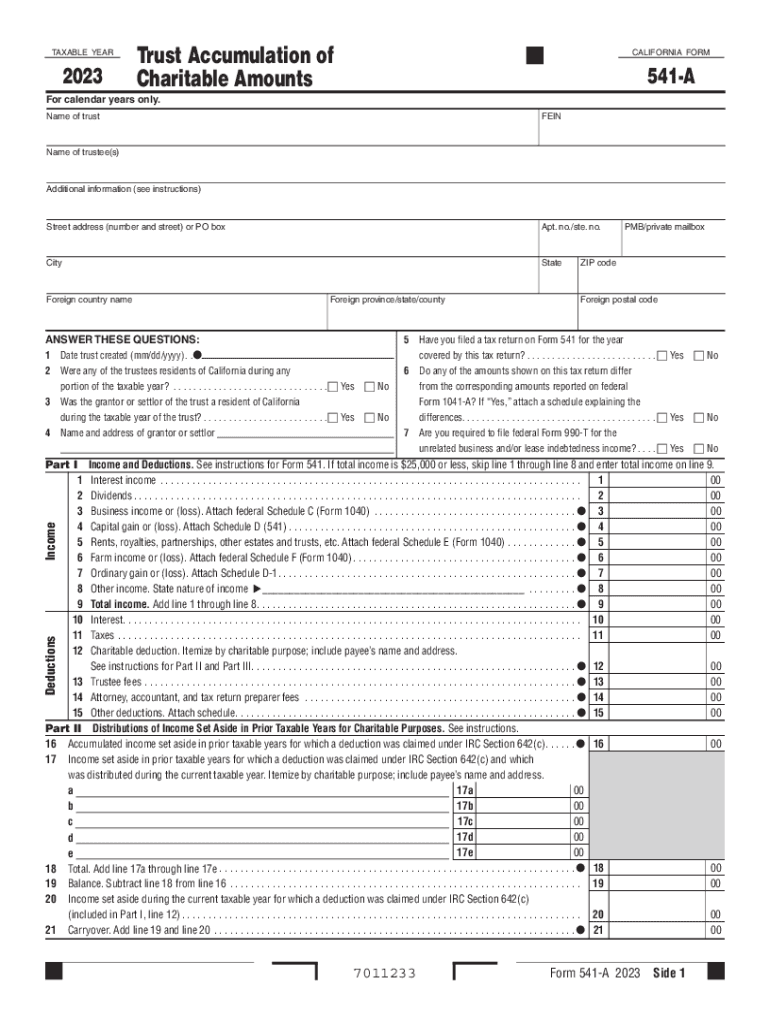

CA State Charitable Trust Form PDF

What is the California Franchise Tax Board Form?

The California Franchise Tax Board (FTB) is responsible for administering California's personal income tax and corporate income tax laws. The forms issued by the FTB, such as the California Franchise Tax Board Form 1131, are essential for individuals and businesses to report their income and calculate taxes owed. These forms are crucial for compliance with state tax regulations and help ensure that taxpayers meet their obligations accurately.

How to Obtain the California Franchise Tax Board Form

To obtain the California Franchise Tax Board Form, individuals can visit the official FTB website. The site offers downloadable PDFs of various forms, including the California Franchise Tax Board Form 1131. Additionally, forms can be requested by contacting the FTB directly through their customer service channels. It is important to ensure that the most current version of the form is used to avoid any compliance issues.

Steps to Complete the California Franchise Tax Board Form

Completing the California Franchise Tax Board Form involves several key steps:

- Gather necessary documents, including income statements and previous tax returns.

- Download the appropriate form from the FTB website.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, either electronically or by mail.

Form Submission Methods

The California Franchise Tax Board Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many forms can be filed electronically through the FTB's secure online portal.

- Mail: Completed forms can be printed and mailed to the appropriate FTB address.

- In-Person: Taxpayers may also visit FTB offices to submit forms directly.

Penalties for Non-Compliance

Failure to submit the California Franchise Tax Board Form on time or inaccuracies in reporting can result in penalties. These penalties may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential legal action for continued non-compliance.

It is crucial for taxpayers to adhere to deadlines and ensure accuracy to avoid these consequences.

Eligibility Criteria for Filing

Eligibility to file the California Franchise Tax Board Form varies based on individual circumstances. Generally, taxpayers must meet the following criteria:

- Be a resident of California or have income sourced from California.

- Meet the income thresholds set by the FTB for the relevant tax year.

- Have the necessary documentation to support claims made on the form.

Reviewing these criteria before filing can help ensure compliance and avoid issues with the FTB.

Quick guide on how to complete ca state charitable trust form pdf

Prepare CA State Charitable Trust Form pdf seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to design, alter, and eSign your documents swiftly without any hold-ups. Handle CA State Charitable Trust Form pdf on any device with airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to modify and eSign CA State Charitable Trust Form pdf effortlessly

- Locate CA State Charitable Trust Form pdf and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and maintains the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign CA State Charitable Trust Form pdf and guarantee excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca state charitable trust form pdf

Create this form in 5 minutes!

How to create an eSignature for the ca state charitable trust form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the California Franchise Tax Board in handling business taxes?

The California Franchise Tax Board oversees the administration of personal and corporate income taxes in California. They manage tax collection and ensure compliance, which is vital for businesses operating in the state. Understanding how the California Franchise Tax Board functions can help businesses stay compliant and avoid penalties.

-

How can airSlate SignNow assist in managing documents related to the California Franchise Tax Board?

airSlate SignNow simplifies the document management process essential for tax filings with the California Franchise Tax Board. Users can easily create, send, and eSign tax-related documents, ensuring that submissions are timely and compliant. This efficient process helps mitigate the risk of errors or delays in tax reporting.

-

What pricing plans does airSlate SignNow offer for businesses concerned about the California Franchise Tax Board?

airSlate SignNow offers flexible pricing plans designed to cater to businesses of all sizes, from startups to established enterprises. These plans provide essential features needed for document management and eSigning, making it cost-effective for those needing to interact with the California Franchise Tax Board. Detailed pricing information can be found on our website.

-

What features make airSlate SignNow a valuable tool for businesses dealing with the California Franchise Tax Board?

Key features of airSlate SignNow include customizable templates, secure eSigning, and seamless document tracking. These functionalities streamline the process of preparing documents for the California Franchise Tax Board, helping businesses save time and ensure accuracy. The platform also offers integrations that enhance its capabilities.

-

How does airSlate SignNow ensure security when handling documents for the California Franchise Tax Board?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect sensitive documents related to the California Franchise Tax Board. This commitment to security reassures businesses that their tax-related information is safe and secure.

-

Can airSlate SignNow integrate with other tools for managing California Franchise Tax Board documents?

Yes, airSlate SignNow offers integrations with various tools and platforms, enhancing document management services. These integrations facilitate smoother workflows for businesses that need to handle documents for the California Franchise Tax Board alongside their other operational needs. Connecting with tools like cloud storage and CRM systems saves time and improves productivity.

-

What benefits does airSlate SignNow provide for businesses interacting with the California Franchise Tax Board?

Businesses using airSlate SignNow benefit from increased efficiency, reduced paperwork, and improved compliance. The ability to eSign and manage documents electronically streamlines interactions with the California Franchise Tax Board. This convenience enables businesses to focus more on their core operations rather than administrative burdens.

Get more for CA State Charitable Trust Form pdf

- Community service hours log sheet 2017 2018 form

- New student admission new student admission application form

- Special checklist form

- Mcps forms 336 20 rev 501 montgomery county public schools mcps k12 md

- New student information form montgomery county public

- Temporary employee evaluation form

- Nc distribution form

- Physical form for sports

Find out other CA State Charitable Trust Form pdf

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed