712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number &amp Dor Ms 2012

What is the 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms

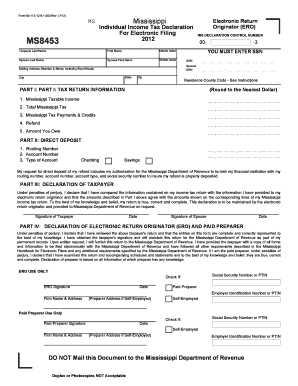

The 712 MS MS8453 is a specific tax form used in the United States, primarily for reporting information related to taxpayers and their spouses. This form captures essential details such as the taxpayer's last name, the spouse's last name, and the mailing address. The inclusion of the number and designation "Dor Ms" may refer to specific instructions or sections within the form that pertain to the documentation process. Understanding this form is crucial for accurate tax filing and compliance with IRS regulations.

How to use the 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms

Using the 712 MS MS8453 involves filling out the required information accurately. Taxpayers must enter their last name, their spouse's last name, and the complete mailing address. It is important to ensure that all details are correct to avoid delays in processing. The form may also require additional information related to income or deductions, depending on the specific tax situation of the taxpayer. Familiarizing oneself with the instructions provided with the form can help streamline the process.

Steps to complete the 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms

Completing the 712 MS MS8453 involves several key steps:

- Gather necessary personal information, including both taxpayers' last names and mailing address.

- Carefully read the instructions accompanying the form to understand any specific requirements.

- Fill out the form, ensuring all details are accurate and complete.

- Review the form for any errors before submission.

- Submit the form according to the guidelines provided, either electronically or by mail.

Legal use of the 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms

The 712 MS MS8453 must be used in compliance with IRS regulations. This form serves as a legal document that provides the IRS with necessary information regarding taxpayers and their spouses. Failing to complete the form correctly or submit it on time can lead to penalties or delays in processing tax returns. It is essential for taxpayers to understand their legal obligations when using this form to ensure compliance with federal tax laws.

Key elements of the 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms

Key elements of the 712 MS MS8453 include:

- Taxpayer's last name

- Spouse's last name

- Complete mailing address

- Any additional required information, such as income details or deductions

Each of these elements is crucial for the accurate processing of tax information by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 712 MS MS8453 typically align with standard tax filing periods established by the IRS. Taxpayers should be aware of these dates to ensure timely submission. Missing a deadline can result in penalties or interest on unpaid taxes. It is advisable to check the IRS website or consult a tax professional for the most current deadlines relevant to this form.

Quick guide on how to complete 712 ms ms8453 taxpayer last name spouse last name mailing address number ampamp dor ms

Effortlessly Prepare 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms on Any Device

Online document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, edit, and electronically sign your documents swiftly and without any hold-ups. Manage 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

The Easiest Way to Edit and Electronically Sign 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms with Ease

- Find 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes just moments and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the concerns of misplaced or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and electronically sign 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 712 ms ms8453 taxpayer last name spouse last name mailing address number ampamp dor ms

Create this form in 5 minutes!

How to create an eSignature for the 712 ms ms8453 taxpayer last name spouse last name mailing address number ampamp dor ms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms. form?

The 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms. form is an essential document used for tax purposes. It helps in accurately reporting taxpayer information, ensuring compliance, and simplifying the tax filing process. Using airSlate SignNow, you can easily complete and eSign this form electronically.

-

How can airSlate SignNow help with the 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms. form?

airSlate SignNow streamlines the process of preparing and signing the 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms. form. Our platform allows users to fill out the form electronically, collect signatures, and store documents securely. This enhances efficiency and accuracy when managing important tax documents.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to fit different business needs, allowing you to select the best option for handling forms such as the 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms. form. Our competitive pricing ensures that you have access to powerful tools without breaking your budget. You can find more details on our pricing page.

-

Is my data secure while using airSlate SignNow to eSign forms?

Yes, using airSlate SignNow ensures that your data, including information related to the 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms. form, is protected. Our platform employs industry-standard encryption protocols and security measures to safeguard your personal and confidential information. Trust us to keep your data safe while you eSign documents.

-

Can I integrate airSlate SignNow with other software systems?

Absolutely! airSlate SignNow provides seamless integration with various software applications, making it easy to manage the 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms. form alongside your existing systems. Our integrations enhance workflow efficiency and allow you to automate processes effortlessly, connecting with tools you already use.

-

What features does airSlate SignNow offer for sending tax forms?

airSlate SignNow offers a range of features tailored for sending tax forms, including customizable templates, bulk sending, tracking options, and eSigning capabilities. These features facilitate the efficient handling of documents like the 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms. form. With user-friendly tools, you can ensure your forms are sent and signed promptly.

-

How can airSlate SignNow improve the efficiency of tax filing?

Utilizing airSlate SignNow signNowly improves the efficiency of tax filing processes, especially when dealing with forms such as the 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number & Dor Ms. form. By enabling electronic document preparation and signatures, the software reduces turnaround time and minimizes errors, allowing for a smoother filing experience.

Get more for 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number &amp Dor Ms

- To download the adult waiver amp release of liability snyder form

- Henrico county division of fire firefighter form

- Va physical form

- School allies applicationdocx form

- Loudoun adu 486144693 form

- Awana registration form template

- New chain of custody 03 09 17 copper state analytical lab form

- Arkansas diamond deferred compensation plan form

Find out other 712 MS MS8453 Taxpayer Last Name Spouse Last Name Mailing Address Number &amp Dor Ms

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online