Reset Form Form 80 115 13 8 1 000 Rev 2013

Key elements of the Mississippi individual income tax declaration

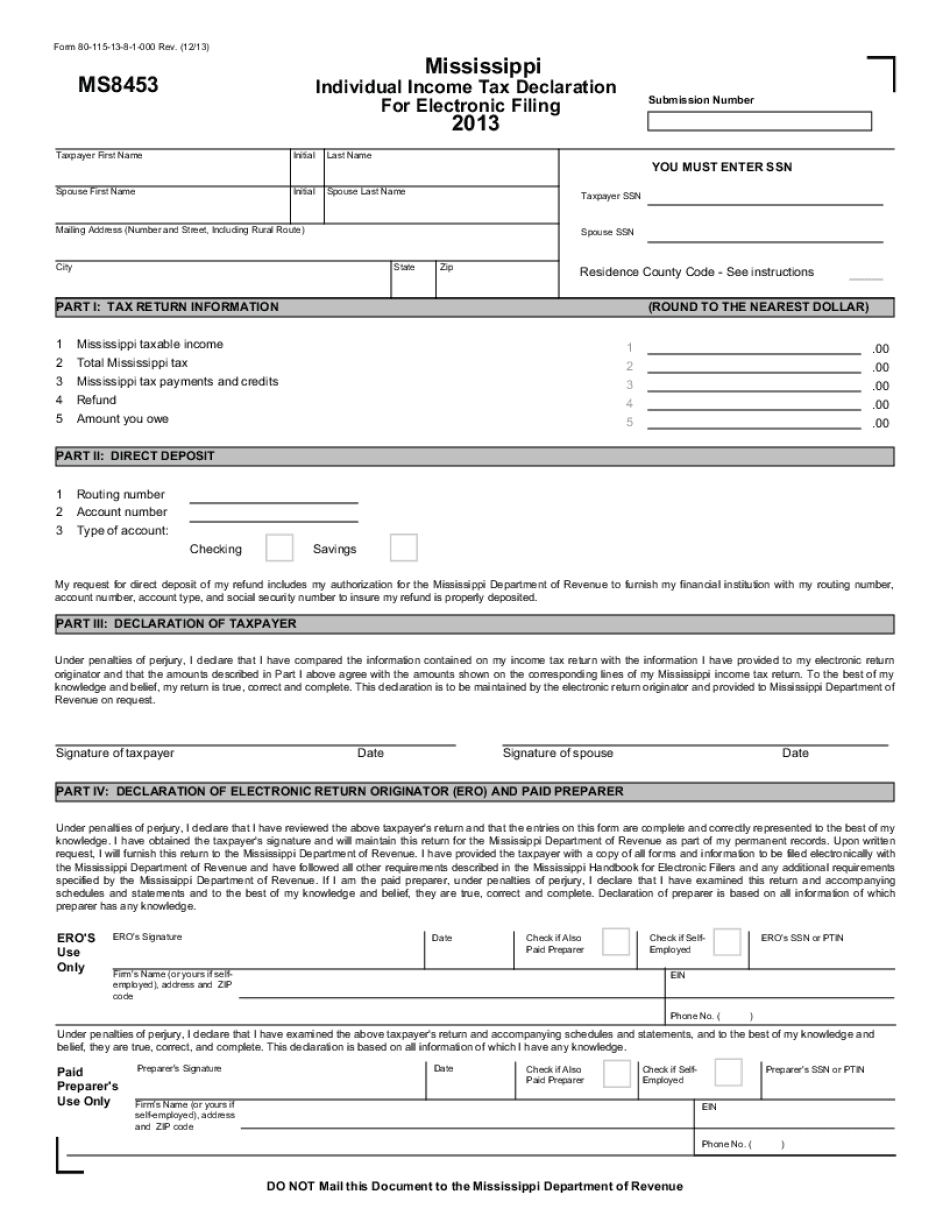

The Mississippi individual income tax declaration is essential for residents and those earning income in the state. This form requires specific information to ensure accurate tax reporting. Key elements include:

- Personal Information: This includes your name, Social Security number, and address.

- Filing Status: You must indicate whether you are filing as single, married filing jointly, married filing separately, or head of household.

- Income Details: Report all sources of income, including wages, salaries, and any other taxable income.

- Deductions and Credits: Include any allowable deductions or credits that can reduce your taxable income.

- Signature: The declaration must be signed and dated, confirming the accuracy of the information provided.

Steps to complete the Mississippi individual income tax declaration

Completing the Mississippi individual income tax declaration involves several clear steps to ensure accuracy and compliance. Follow these steps for a successful filing:

- Gather all necessary documentation, including W-2 forms, 1099s, and records of other income.

- Choose the appropriate filing status based on your personal situation.

- Fill out the personal information section accurately, ensuring all names and identification numbers are correct.

- Report your total income, including wages, interest, and dividends.

- Calculate any deductions or credits you are eligible for to reduce your taxable income.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Sign and date the form before submission.

Filing deadlines and important dates for the Mississippi individual income tax declaration

Understanding the filing deadlines for the Mississippi individual income tax declaration is crucial to avoid penalties. Key dates include:

- April 15: This is the standard deadline for filing individual income tax returns.

- October 15: If you file for an extension, this is the deadline for submitting your return.

It is important to be aware of these dates to ensure timely filing and payment of any taxes owed.

Form submission methods for the Mississippi individual income tax declaration

There are several methods available for submitting your Mississippi individual income tax declaration. Each method offers different advantages:

- Online Filing: Many taxpayers choose to file electronically through approved tax preparation software, which can streamline the process.

- Mail: You can print your completed form and mail it to the appropriate state tax office. Ensure you use the correct address based on your location.

- In-Person: Some individuals prefer to submit their forms in person at local tax offices, allowing for immediate confirmation of receipt.

Eligibility criteria for the Mississippi individual income tax declaration

To file the Mississippi individual income tax declaration, you must meet certain eligibility criteria. These include:

- Being a resident of Mississippi or earning income from Mississippi sources.

- Meeting the minimum income thresholds set by the state for filing.

- Having a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

Understanding these criteria ensures that you are eligible to file and can avoid complications during the process.

Quick guide on how to complete reset form form 80 115 13 8 1 000 rev

Complete Reset Form Form 80 115 13 8 1 000 Rev effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmental-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage Reset Form Form 80 115 13 8 1 000 Rev on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Reset Form Form 80 115 13 8 1 000 Rev with minimal effort

- Obtain Reset Form Form 80 115 13 8 1 000 Rev and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Reset Form Form 80 115 13 8 1 000 Rev and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reset form form 80 115 13 8 1 000 rev

Create this form in 5 minutes!

How to create an eSignature for the reset form form 80 115 13 8 1 000 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing a Mississippi individual income tax declaration?

The process for filing a Mississippi individual income tax declaration begins with gathering necessary financial documents and accessing the Mississippi Department of Revenue's website. You can use software like airSlate SignNow to eSign and submit your declaration securely. It’s important to ensure all information is accurate to avoid delays in processing.

-

How can airSlate SignNow help with my Mississippi individual income tax declaration?

airSlate SignNow simplifies the eSigning process for your Mississippi individual income tax declaration, allowing you to quickly gather signatures and submit documents. The platform provides templates tailored to tax declarations, ensuring a streamlined workflow. Plus, it leaves you with a secure digital record for your reference.

-

Are there any integration options available for eSigning my Mississippi individual income tax declaration?

Yes, airSlate SignNow offers seamless integrations with various accounting software and business tools, making it easy to incorporate eSigning into your workflow. This enables you to manage your Mississippi individual income tax declaration alongside your financial documentation effortlessly, enhancing overall efficiency.

-

What features does airSlate SignNow offer for managing tax declarations?

airSlate SignNow provides features such as customizable templates, bulk sending, and advanced tracking for your Mississippi individual income tax declaration. These tools help you manage the signing process more effectively and ensure all parties stay updated every step of the way.

-

Is airSlate SignNow cost-effective for small businesses filing Mississippi individual income tax declaration?

Absolutely! airSlate SignNow is designed to be a budget-friendly solution for businesses of all sizes, including small businesses managing their Mississippi individual income tax declaration. Its pricing plans cater to various needs, allowing you to choose the one that best fits your budget without sacrificing quality or functionality.

-

Can I track the status of my Mississippi individual income tax declaration after sending it?

Yes, airSlate SignNow provides real-time tracking of your Mississippi individual income tax declaration. You’ll receive notifications when your document is opened and signed, ensuring you are always aware of its status and can follow up promptly if needed.

-

What are the benefits of eSigning my Mississippi individual income tax declaration?

ESigning your Mississippi individual income tax declaration with airSlate SignNow enhances the efficiency and security of the signing process. It saves time by eliminating paper trails and enables quick submissions, while also ensuring compliance with legal standards for eSignatures, increasing the overall reliability of your filing.

Get more for Reset Form Form 80 115 13 8 1 000 Rev

Find out other Reset Form Form 80 115 13 8 1 000 Rev

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple