Installment Agreement 082023Layout 1 2023-2026

Understanding the Rhode Island Power of Attorney Form

The Rhode Island power of attorney form is a legal document that allows an individual, known as the principal, to designate another person, called the agent, to make decisions on their behalf. This form is particularly useful in situations where the principal may be unable to make decisions due to illness, absence, or incapacity. The powers granted can be broad or limited, depending on the principal's wishes. It is essential to ensure that the form complies with Rhode Island state laws to be considered valid.

Key Elements of the Rhode Island Power of Attorney Form

When preparing the Rhode Island power of attorney form, several key elements must be included:

- Principal's Information: Full name and address of the person granting authority.

- Agent's Information: Full name and address of the person receiving authority.

- Powers Granted: A clear description of the specific powers the agent will have, such as handling financial matters, real estate transactions, or medical decisions.

- Effective Date: Indication of when the powers become effective—immediately or upon a specific event, like incapacitation.

- Signature and Notarization: The principal's signature and a notary public's acknowledgment to validate the document.

Steps to Complete the Rhode Island Power of Attorney Form

Completing the Rhode Island power of attorney form involves several straightforward steps:

- Obtain the official form from a reliable source, ensuring it meets Rhode Island requirements.

- Fill in the principal's and agent's details accurately.

- Specify the powers being granted clearly and concisely.

- Decide on the effective date for the powers to commence.

- Sign the document in the presence of a notary public to ensure legal validity.

Legal Use of the Rhode Island Power of Attorney Form

The Rhode Island power of attorney form is legally binding once it is signed and notarized. It is crucial for the agent to act in the best interest of the principal and adhere to the powers granted. Misuse of the authority can lead to legal repercussions. Therefore, both the principal and agent should understand their rights and responsibilities under this agreement.

Eligibility Criteria for the Rhode Island Power of Attorney Form

To create a valid Rhode Island power of attorney, the following eligibility criteria must be met:

- The principal must be at least eighteen years old and of sound mind.

- The agent must also be at least eighteen years old and can be a trusted family member, friend, or professional.

- Both parties should be aware of the powers being granted and the implications of the document.

Form Submission Methods for the Rhode Island Power of Attorney

Once completed, the Rhode Island power of attorney form does not need to be filed with any government agency. However, it is advisable to provide copies to relevant parties, such as the agent, financial institutions, and healthcare providers, to ensure they are aware of the authority granted. Maintaining a copy for personal records is also recommended.

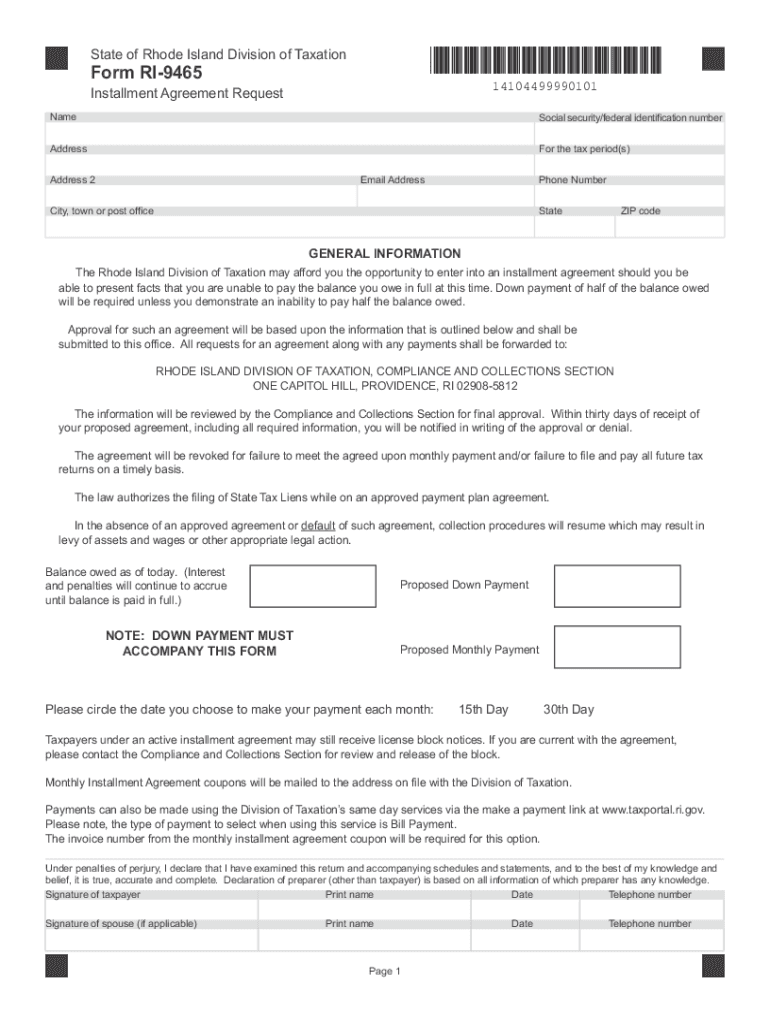

Quick guide on how to complete installment agreement 082023layout 1

Effortlessly prepare Installment Agreement 082023Layout 1 on any device

Managing documents online has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hassle. Control Installment Agreement 082023Layout 1 from any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest method to edit and electronically sign Installment Agreement 082023Layout 1 effortlessly

- Find Installment Agreement 082023Layout 1 and then click Get Form to initiate the process.

- Make use of the tools we provide to complete your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this function.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to preserve your modifications.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Installment Agreement 082023Layout 1 to maintain excellent communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct installment agreement 082023layout 1

Create this form in 5 minutes!

How to create an eSignature for the installment agreement 082023layout 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI power of attorney form?

The RI power of attorney form is a legal document that allows you to designate someone to make decisions on your behalf in Rhode Island. This form is essential for ensuring your wishes are carried out when you are unable to manage your affairs. With airSlate SignNow, completing and signing the RI power of attorney form is straightforward and efficient.

-

How do I complete the RI power of attorney form using airSlate SignNow?

You can complete the RI power of attorney form using airSlate SignNow by selecting the template on our platform and filling in the required fields. Our user-friendly interface guides you through the process, making it easy to provide your information. After completing the form, you can send it for eSignature immediately, ensuring quick and secure processing.

-

Is there a cost associated with the RI power of attorney form through airSlate SignNow?

Yes, using airSlate SignNow does involve a cost, but we offer competitive pricing that provides great value for our services. Our plans include unlimited access to templates, including the RI power of attorney form, along with eSignature capabilities. This cost-effective solution ensures you can manage your documents without breaking the bank.

-

What features does airSlate SignNow offer for the RI power of attorney form?

airSlate SignNow provides several features for the RI power of attorney form, including customizable templates, real-time collaboration, and secure storage. These features help streamline the creation and signing process, making it easier to manage important legal documents. Additionally, our platform ensures compliance with state regulations.

-

Can I integrate airSlate SignNow with other applications for the RI power of attorney form?

Yes, airSlate SignNow offers integrations with various applications that can enhance your experience when filling out the RI power of attorney form. You can connect it with platforms like Google Drive, Dropbox, and more to access your documents seamlessly. This integration helps you keep all your files organized and easily accessible.

-

What are the benefits of using airSlate SignNow for the RI power of attorney form?

Using airSlate SignNow for the RI power of attorney form offers numerous benefits, including faster turnaround times, enhanced security, and ease of use. Our platform allows you to complete and eSign documents online, reducing manual paperwork and ensuring your document is legally binding. This efficiency saves you time and effort in managing your legal affairs.

-

Is my information secure when completing the RI power of attorney form on airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your information while completing the RI power of attorney form. We use industry-standard encryption methods and secure data storage to protect your personal and sensitive information during the signing process. Your trust is essential to us, and we take every measure to maintain confidentiality.

Get more for Installment Agreement 082023Layout 1

- General accident form

- 2018 program application information packet medical assisting

- Bridge registration form

- Patient forms fyzical therapy amp balance centers pbc

- Tokio marine form

- State of connecticut human resources medical certificate form

- Application checklist for speech language pathology and form

- Oncology program patient and family advisory council application form application form for pfac

Find out other Installment Agreement 082023Layout 1

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online