IC 831 Form 4466W Wisconsin Corporation or Pass through Entity Application for Quick Refund of Overpayment of Estimated Tax 2023

What is the IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax

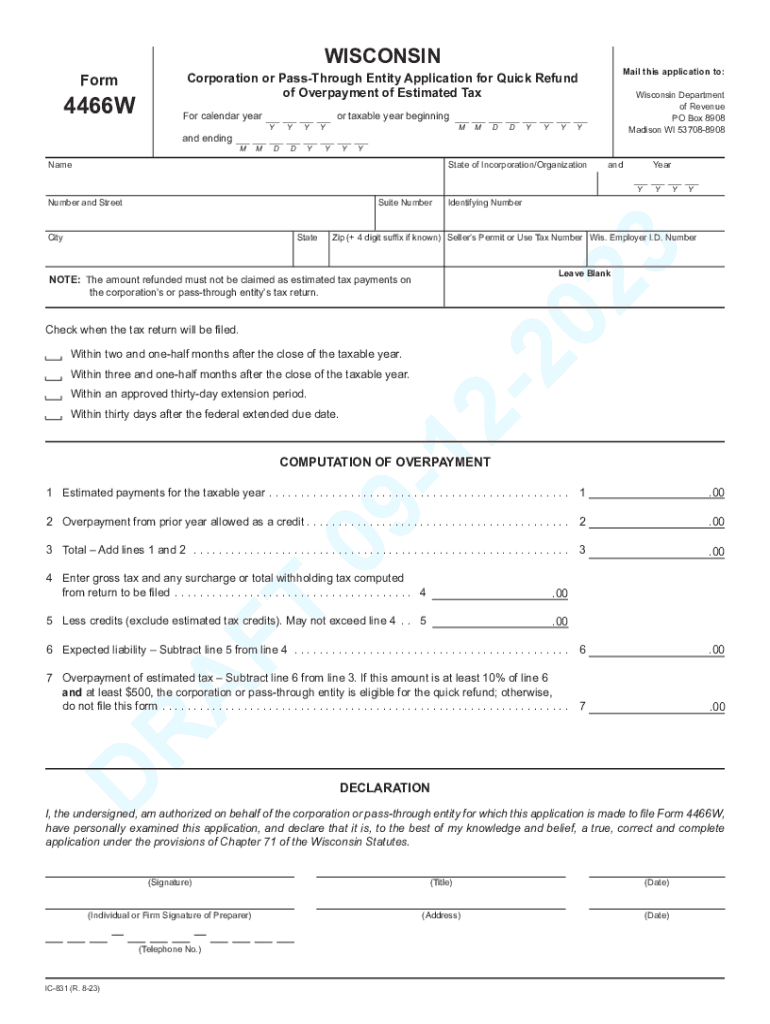

The IC 831 Form 4466W is a specific application used by corporations and pass-through entities in Wisconsin to request a quick refund of any overpayment made on estimated taxes. This form is essential for businesses that have overpaid their estimated tax obligations and wish to recover those funds efficiently. By submitting this form, entities can streamline the refund process, ensuring timely access to their overpaid amounts.

Steps to complete the IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax

Completing the IC 831 Form 4466W involves several key steps:

- Gather necessary financial information, including estimated tax payments made and any relevant documentation.

- Fill out the form accurately, ensuring that all required fields are completed, including the entity's name, address, and tax identification number.

- Calculate the total overpayment of estimated tax and provide this figure on the form.

- Review the completed form for accuracy and completeness to avoid delays in processing.

- Submit the form via the preferred submission method, whether online, by mail, or in person.

Key elements of the IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax

Understanding the key elements of the IC 831 Form 4466W is crucial for successful completion. Important components include:

- Entity Information: Details about the corporation or pass-through entity, including name and tax identification number.

- Overpayment Amount: The specific amount of estimated tax overpaid, which is the basis for the refund request.

- Signature: The form must be signed by an authorized representative of the entity to validate the request.

- Date: The date of submission should be clearly indicated to establish the timeline for processing.

Eligibility Criteria

To qualify for a refund using the IC 831 Form 4466W, entities must meet specific eligibility criteria. These include:

- The entity must be a corporation or a pass-through entity registered in Wisconsin.

- There must be a documented overpayment of estimated tax for the applicable tax year.

- The request for a refund must be made within the designated time frame established by the Wisconsin Department of Revenue.

Form Submission Methods

The IC 831 Form 4466W can be submitted through various methods, providing flexibility for entities. These methods include:

- Online Submission: Entities can complete and submit the form electronically through the Wisconsin Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address as specified by the Wisconsin Department of Revenue.

- In-Person: Entities may also choose to submit the form in person at designated Wisconsin Department of Revenue offices.

Filing Deadlines / Important Dates

Awareness of filing deadlines is critical for timely processing of the IC 831 Form 4466W. Important dates include:

- The form must be submitted within a specific period after the estimated tax overpayment has been identified.

- Entities should refer to the Wisconsin Department of Revenue's guidelines for exact deadlines to ensure compliance.

Quick guide on how to complete ic 831 form 4466w wisconsin corporation or pass through entity application for quick refund of overpayment of estimated tax

Effortlessly Prepare IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax on any platform using airSlate SignNow's Android or iOS applications and enhance your document-driven activities today.

How to Modify and Electronically Sign IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax with Ease

- Locate IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal standing as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ic 831 form 4466w wisconsin corporation or pass through entity application for quick refund of overpayment of estimated tax

Create this form in 5 minutes!

How to create an eSignature for the ic 831 form 4466w wisconsin corporation or pass through entity application for quick refund of overpayment of estimated tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax?

The IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax is a form used by Wisconsin corporations or pass-through entities to request a quick refund of any overpayments made towards estimated taxes. This form streamlines the refund process, ensuring businesses can access their funds promptly.

-

How can airSlate SignNow help with the IC 831 Form 4466W?

airSlate SignNow provides an efficient platform for filling out and eSigning the IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax. Our easy-to-use tool simplifies document management, making the submission process faster and more reliable.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to different business needs. By choosing a suitable plan, businesses can efficiently manage their documents, including the IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax, at a cost-effective rate.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers multiple integrations with popular productivity and document management tools. This allows users to seamlessly incorporate the IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax into their existing workflows, enhancing overall efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features like eSigning, document templates, and tracking for all of your forms. These features are particularly beneficial for handling the IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax, ensuring compliance and speed in document processes.

-

How does airSlate SignNow enhance security for sensitive forms?

Security is a top priority at airSlate SignNow, featuring advanced encryption and authentication processes. This robust security ensures that documents like the IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax are protected throughout the signing process.

-

What are the benefits of using airSlate SignNow for tax-related forms?

Using airSlate SignNow for tax-related forms, including the IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax, simplifies the process and reduces the likelihood of errors. This efficiency can save time and lead to quicker refunds for businesses.

Get more for IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax

Find out other IC 831 Form 4466W Wisconsin Corporation Or Pass Through Entity Application For Quick Refund Of Overpayment Of Estimated Tax

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document