About Form 4466, Corporation Application for Quick 2022

What is the About Form 4466, Corporation Application For Quick

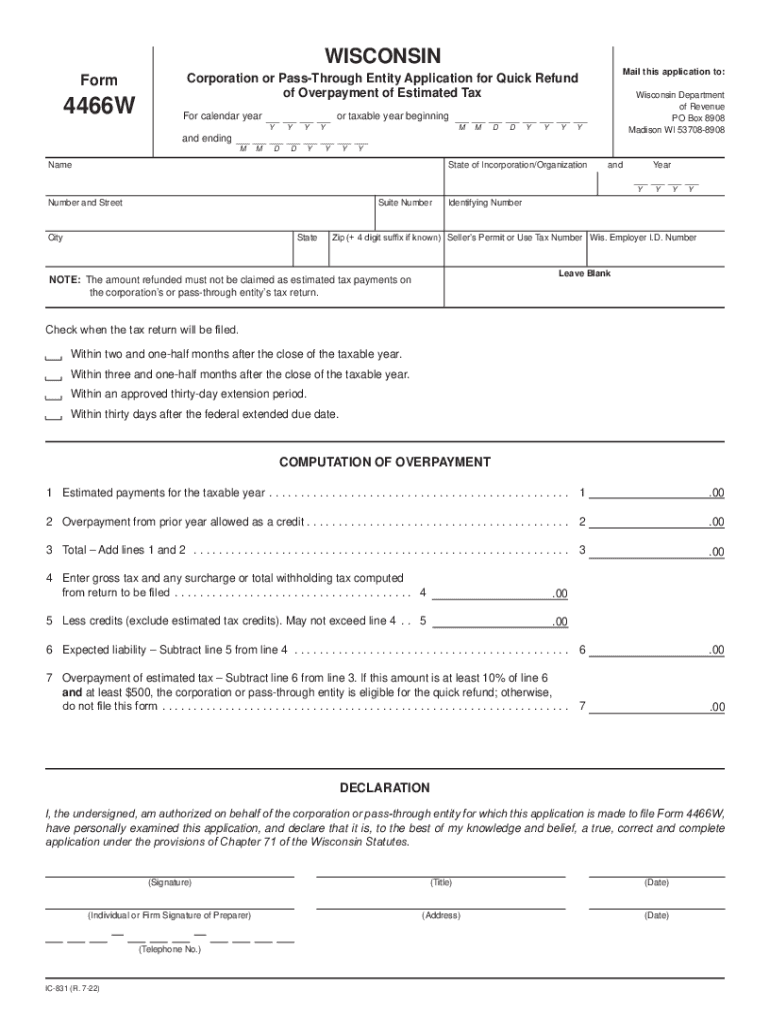

The About Form 4466, officially known as the Corporation Application For Quick Refund, is a tax form used by corporations to request a quick refund of overpaid taxes. This form is specifically designed for corporations that have filed their tax returns and believe they are entitled to a refund due to overpayment. The form streamlines the refund process, allowing corporations to receive their funds more efficiently than through standard refund procedures.

How to use the About Form 4466, Corporation Application For Quick

To utilize the About Form 4466, corporations must first ensure they meet the eligibility criteria, which typically includes having filed a corporate tax return and having overpaid taxes. Once eligibility is confirmed, the corporation should complete the form accurately, providing necessary information such as the tax year in question and the amount of overpayment. After filling out the form, it should be submitted to the IRS for processing. This form is particularly useful for corporations seeking expedited refunds.

Steps to complete the About Form 4466, Corporation Application For Quick

Completing the About Form 4466 involves several straightforward steps:

- Gather necessary documents, including previous tax returns and records of payments made.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check calculations to confirm the amount of overpayment.

- Submit the form to the IRS, either electronically or via mail, depending on the submission method chosen.

Eligibility Criteria

To be eligible to use the About Form 4466, corporations must meet specific criteria. These include being a corporation that has filed a tax return for the relevant tax year and demonstrating that they have overpaid their taxes. Additionally, the request for a quick refund must be made within a certain time frame following the filing of the original return. Understanding these criteria is essential for corporations to ensure they can successfully utilize this form.

Form Submission Methods

The About Form 4466 can be submitted to the IRS through various methods. Corporations may choose to file the form electronically, which is often the fastest option, or they can opt to mail a physical copy of the form. It is important for corporations to select the submission method that aligns with their operational capabilities and preferences, ensuring that they follow all IRS guidelines for submission.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the About Form 4466. These guidelines include instructions on how to fill out each section of the form, the required documentation to support the refund request, and the timelines for submission. Corporations should familiarize themselves with these guidelines to avoid errors that could delay the refund process.

Quick guide on how to complete about form 4466 corporation application for quick

Handle About Form 4466, Corporation Application For Quick effortlessly on any gadget

The management of online documents has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage About Form 4466, Corporation Application For Quick on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign About Form 4466, Corporation Application For Quick with ease

- Obtain About Form 4466, Corporation Application For Quick and click on Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive content with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and click the Done button to confirm your edits.

- Choose your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign About Form 4466, Corporation Application For Quick and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 4466 corporation application for quick

Create this form in 5 minutes!

How to create an eSignature for the about form 4466 corporation application for quick

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of About Form 4466, Corporation Application For Quick?

About Form 4466, Corporation Application For Quick, is designed for corporations seeking a quick refund of any overpayment of estimated tax. This form ensures a streamlined process for businesses to access their refunds efficiently, helping them manage their cash flow effectively.

-

How can airSlate SignNow assist with the submission of About Form 4466?

airSlate SignNow simplifies the process of submitting About Form 4466, Corporation Application For Quick, by allowing you to eSign and send documents securely online. Our platform ensures that your forms are completed accurately and submitted in a timely manner, enhancing your overall productivity.

-

What features does airSlate SignNow offer for managing About Form 4466?

airSlate SignNow offers features such as customizable templates, powerful eSignature capabilities, and real-time tracking for submissions like About Form 4466, Corporation Application For Quick. These features enable users to manage their documents with ease and maintain accuracy throughout the signing process.

-

Is there a cost associated with using airSlate SignNow for About Form 4466?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs, ensuring that using it for About Form 4466, Corporation Application For Quick is cost-effective. The pricing is structured to fit businesses of all sizes, providing access to required features without breaking the bank.

-

What benefits can I expect from using airSlate SignNow for About Form 4466?

Using airSlate SignNow for About Form 4466, Corporation Application For Quick, offers numerous benefits, including enhanced efficiency and faster processing times. The digital platform reduces paperwork and increases accuracy, freeing up valuable time for your business operations.

-

Does airSlate SignNow integrate with other software for managing About Form 4466?

Yes, airSlate SignNow seamlessly integrates with various software tools that can assist in managing About Form 4466, Corporation Application For Quick. This connectivity helps businesses maintain an organized workflow while utilizing their existing systems effectively.

-

Can multiple users collaborate on About Form 4466 with airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on About Form 4466, Corporation Application For Quick, ensuring that all necessary information is gathered with input from different team members. This collaborative feature facilitates teamwork and enhances the efficiency of your document processing.

Get more for About Form 4466, Corporation Application For Quick

Find out other About Form 4466, Corporation Application For Quick

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form