Form CT 2658 E Certificate of Exemption from Partnership Estimated Tax Paid on Behalf of Corporate Partners Revised 1223 2023-2026

Understanding the Form CT 2658 E

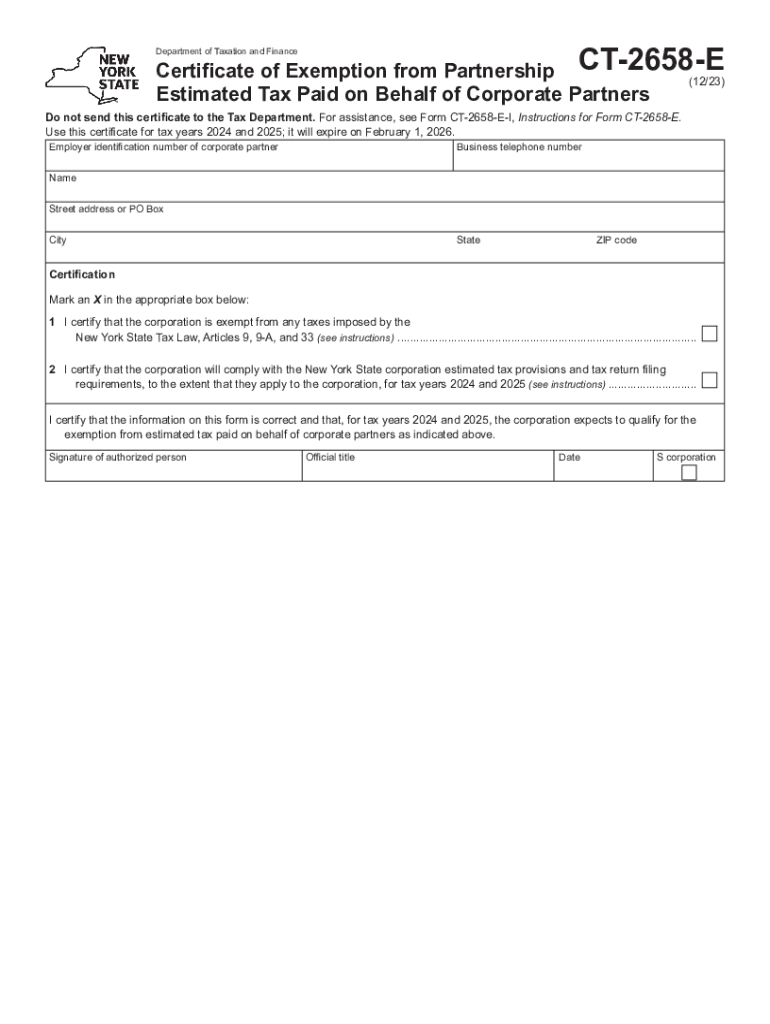

The Form CT 2658 E, officially known as the Certificate of Exemption From Partnership Estimated Tax Paid On Behalf Of Corporate Partners, is a crucial document for businesses in New York. This form allows corporate partners to claim an exemption from the estimated tax payments that partnerships are required to make on their behalf. It is specifically designed for corporate entities that are part of a partnership and seek to avoid double taxation on their income.

Steps to Complete the Form CT 2658 E

Completing the Form CT 2658 E involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the partnership's details and the corporate partner's information. Next, accurately fill out each section of the form, ensuring that all data is current and correctly reflects the partnership's tax obligations. After completing the form, review it for any errors before submission. Finally, retain a copy for your records, as it may be needed for future reference or audits.

Legal Use of the Form CT 2658 E

The legal use of the Form CT 2658 E is essential for corporate partners to maintain compliance with New York tax laws. This form serves as a declaration that the corporate partner qualifies for an exemption from estimated tax payments. It is important to understand the legal implications of submitting this form, as incorrect or fraudulent submissions can result in penalties or additional tax liabilities. Corporations should consult with tax professionals to ensure proper use and understanding of the form's requirements.

Eligibility Criteria for the Form CT 2658 E

Eligibility for using the Form CT 2658 E is typically limited to corporate partners within a partnership structure. To qualify, the corporate partner must meet specific criteria set forth by New York tax regulations. This often includes requirements regarding the nature of the business, income levels, and the partnership's overall tax status. It is advisable for corporations to review these criteria carefully to determine their eligibility before filing.

Filing Deadlines and Important Dates

Filing deadlines for the Form CT 2658 E are crucial for compliance. Corporations must be aware of the specific dates by which the form must be submitted to avoid penalties. Generally, the form is due on the same schedule as the partnership's estimated tax payments. Keeping track of these deadlines ensures that corporate partners can effectively manage their tax obligations and avoid unnecessary fines.

Examples of Using the Form CT 2658 E

Practical examples of using the Form CT 2658 E can help clarify its application. For instance, if a corporation is a partner in a real estate investment partnership, it may use this form to exempt itself from estimated tax payments on income generated from property sales. Another example includes a corporation involved in a joint venture that qualifies for specific tax exemptions under New York law. Understanding these scenarios can aid corporations in making informed decisions regarding their tax strategies.

Quick guide on how to complete form ct 2658 e certificate of exemption from partnership estimated tax paid on behalf of corporate partners revised 1223

Effortlessly Prepare Form CT 2658 E Certificate Of Exemption From Partnership Estimated Tax Paid On Behalf Of Corporate Partners Revised 1223 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Access Form CT 2658 E Certificate Of Exemption From Partnership Estimated Tax Paid On Behalf Of Corporate Partners Revised 1223 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and electronically sign Form CT 2658 E Certificate Of Exemption From Partnership Estimated Tax Paid On Behalf Of Corporate Partners Revised 1223 without hassle

- Locate Form CT 2658 E Certificate Of Exemption From Partnership Estimated Tax Paid On Behalf Of Corporate Partners Revised 1223 and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or errors that require printing additional copies. airSlate SignNow manages your document administration needs in just a few clicks from any device you choose. Edit and electronically sign Form CT 2658 E Certificate Of Exemption From Partnership Estimated Tax Paid On Behalf Of Corporate Partners Revised 1223 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 2658 e certificate of exemption from partnership estimated tax paid on behalf of corporate partners revised 1223

Create this form in 5 minutes!

How to create an eSignature for the form ct 2658 e certificate of exemption from partnership estimated tax paid on behalf of corporate partners revised 1223

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 2658 e and how does it relate to airSlate SignNow?

ct 2658 e refers to a specific electronic signature standard that airSlate SignNow fully supports. By utilizing ct 2658 e, businesses can ensure that their electronic signatures are compliant and legally binding. This enhances the trust factor for clients and makes document processes smoother.

-

How much does airSlate SignNow cost for using ct 2658 e?

The pricing for airSlate SignNow varies based on the selected plan, but it offers competitive rates for businesses wanting to incorporate ct 2658 e functionalities. You can choose from various subscription models that fit your budget and needs. Additionally, there is often a free trial to explore its features before committing financially.

-

What features does airSlate SignNow offer with ct 2658 e?

airSlate SignNow provides a robust set of features that include document creation, sharing, and the ability to eSign using ct 2658 e standards. Additionally, it offers templates, team collaboration, and tracking capabilities to manage your documents effectively. All these features are designed to streamline your workflow while ensuring compliance with e-signature legislation.

-

What are the benefits of using ct 2658 e with airSlate SignNow?

Using ct 2658 e with airSlate SignNow provides a secure and compliant way to handle electronic documents. The main benefits include increased efficiency, reduced paper usage, and enhanced security for sensitive information. It allows companies to close deals faster while maintaining legal integrity.

-

Can I integrate airSlate SignNow with other applications while using ct 2658 e?

Yes, airSlate SignNow offers integration capabilities with various applications and platforms while using ct 2658 e. This means you can easily connect to CRM systems, cloud storage, and productivity tools to enhance your document management process. Integrations ensure a seamless workflow that leverages the power of ct 2658 e.

-

Is it easy to get started with airSlate SignNow and ct 2658 e?

Absolutely! Getting started with airSlate SignNow and implementing ct 2658 e is straightforward. Simply sign up for an account, and you'll be guided through the process of setting up your documents for electronic signatures. The user-friendly interface makes it accessible for any employee to use without signNow training.

-

What types of documents can I sign using airSlate SignNow and ct 2658 e?

You can sign a wide variety of documents using airSlate SignNow with ct 2658 e, ranging from contracts and agreements to invoices and letters. The platform is versatile enough to handle both simple and complex documents. This flexibility allows businesses to adapt their signing processes to diverse needs.

Get more for Form CT 2658 E Certificate Of Exemption From Partnership Estimated Tax Paid On Behalf Of Corporate Partners Revised 1223

Find out other Form CT 2658 E Certificate Of Exemption From Partnership Estimated Tax Paid On Behalf Of Corporate Partners Revised 1223

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document