Ny Ct 2658 E 2019

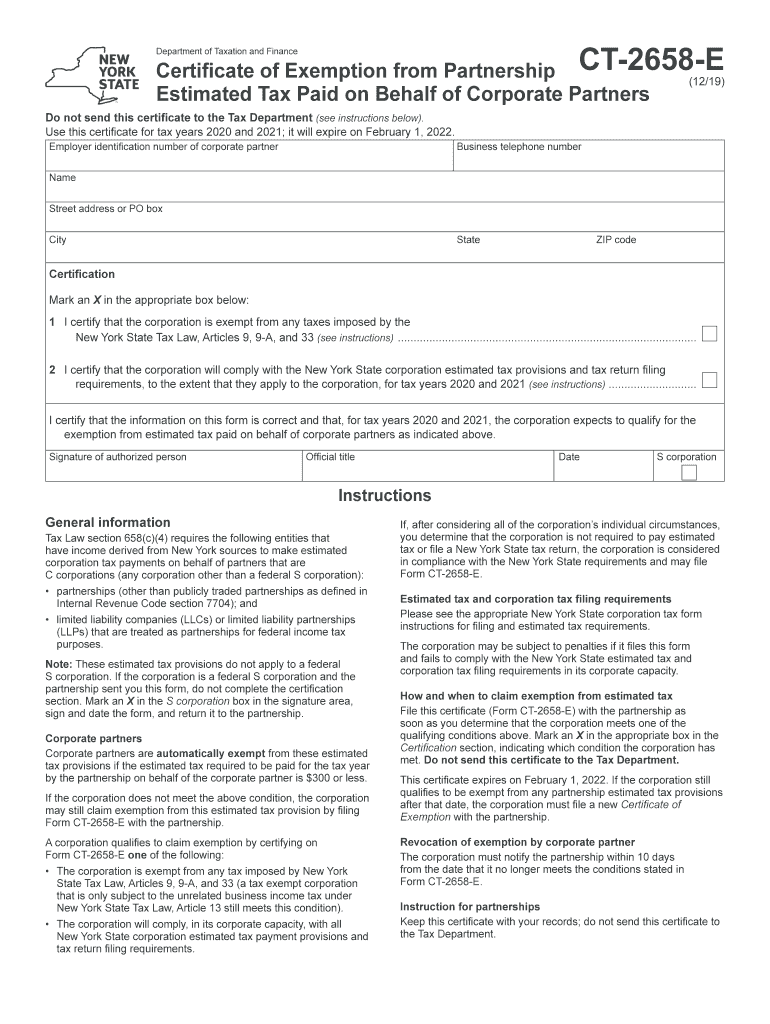

What is the NY CT 2658 E?

The NY CT 2658 E is a form used by partnerships in New York State to report estimated tax payments. This form is specifically designed for entities that expect to owe tax for the current tax year and want to make estimated payments to avoid penalties. It is essential for partnerships to fulfill their tax obligations and ensure compliance with state regulations. The CT 2658 E serves as a declaration of the estimated tax liability and helps in managing cash flow for the business.

How to use the NY CT 2658 E

Using the NY CT 2658 E involves several steps to ensure accurate reporting of estimated tax payments. First, partnerships must calculate their expected income for the year, considering any deductions or credits. Next, they should determine the estimated tax liability based on the current tax rates. Once the calculations are complete, the partnership can fill out the CT 2658 E form, providing necessary details such as the partnership name, address, and the amount of estimated tax due. Finally, the completed form can be submitted either online or via mail, depending on the partnership's preference.

Steps to complete the NY CT 2658 E

Completing the NY CT 2658 E requires careful attention to detail. Follow these steps:

- Gather financial information, including projected income, deductions, and credits.

- Calculate the estimated tax liability using the current tax rates applicable to partnerships.

- Fill out the CT 2658 E form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form either electronically through the New York State Department of Taxation and Finance website or by mailing it to the appropriate address.

Legal use of the NY CT 2658 E

The NY CT 2658 E is legally binding when completed and submitted according to the guidelines set forth by the New York State Department of Taxation and Finance. To ensure its legal validity, partnerships must comply with all relevant tax laws and regulations. This includes accurate reporting of income and adherence to deadlines for estimated tax payments. Failure to comply can result in penalties or interest charges, making it crucial for partnerships to understand their obligations under the law.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines associated with the NY CT 2658 E to avoid penalties. Typically, estimated tax payments are due quarterly, with specific deadlines that align with the tax calendar. The first payment is usually due on April 15, followed by subsequent payments on June 15, September 15, and January 15 of the following year. It is important for partnerships to mark these dates on their calendars to ensure timely submission of the CT 2658 E form and avoid any late fees.

Required Documents

To complete the NY CT 2658 E, partnerships need to gather several documents that support their estimated tax calculations. Required documents may include:

- Financial statements, including profit and loss statements.

- Prior year tax returns for reference.

- Records of any deductions or credits that may apply.

- Documentation of any changes in business structure or income projections.

Having these documents readily available will help ensure an accurate and efficient completion of the form.

Quick guide on how to complete certificate of exemption from partnership ct 2658 e

Complete Ny Ct 2658 E seamlessly on any device

Digital document management has become prevalent among companies and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can find the necessary template and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without holdups. Manage Ny Ct 2658 E on any device with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to edit and eSign Ny Ct 2658 E effortlessly

- Locate Ny Ct 2658 E and select Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from a device of your preference. Edit and eSign Ny Ct 2658 E to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct certificate of exemption from partnership ct 2658 e

Create this form in 5 minutes!

How to create an eSignature for the certificate of exemption from partnership ct 2658 e

How to generate an eSignature for your Certificate Of Exemption From Partnership Ct 2658 E in the online mode

How to make an electronic signature for the Certificate Of Exemption From Partnership Ct 2658 E in Google Chrome

How to make an eSignature for signing the Certificate Of Exemption From Partnership Ct 2658 E in Gmail

How to make an electronic signature for the Certificate Of Exemption From Partnership Ct 2658 E right from your smart phone

How to generate an eSignature for the Certificate Of Exemption From Partnership Ct 2658 E on iOS devices

How to make an electronic signature for the Certificate Of Exemption From Partnership Ct 2658 E on Android OS

People also ask

-

What is ct 2658 e and how does it relate to airSlate SignNow?

ct 2658 e refers to a specific electronic signature compliance standard that airSlate SignNow adheres to. By ensuring compliance with ct 2658 e, airSlate SignNow provides users with legally binding eSignatures that streamline document management and enhance security.

-

What are the key features of airSlate SignNow in relation to ct 2658 e compliance?

AirSlate SignNow offers several features that support ct 2658 e compliance, including advanced security protocols, audit trails, and user verification processes. These features ensure that every eSignature is traceable and conforms to the standards set by ct 2658 e.

-

Can airSlate SignNow help my business save money while ensuring ct 2658 e compliance?

Yes, airSlate SignNow is a cost-effective solution that can save businesses money by reducing paper usage and streamlining the signing process. By enabling compliant eSignatures under ct 2658 e, companies can avoid costly delays and legal complications related to document handling.

-

Is there a free trial available for airSlate SignNow to test ct 2658 e features?

Absolutely! AirSlate SignNow offers a free trial that allows businesses to explore its features, including ct 2658 e compliance. This trial helps prospective customers understand how the solution can meet their needs without any upfront commitment.

-

How does airSlate SignNow integrate with other tools while maintaining ct 2658 e standards?

AirSlate SignNow seamlessly integrates with various business tools and applications while ensuring that all signatures processed comply with ct 2658 e. This integration capability enhances workflow efficiency without sacrificing regulatory standards.

-

What are the benefits of using airSlate SignNow for ct 2658 e compliant documents?

Using airSlate SignNow for ct 2658 e compliant documents provides numerous benefits, such as increased efficiency, reduced turnaround time, and improved document security. Businesses can manage their signatures effectively, ensuring compliance while enhancing customer satisfaction and trust.

-

Does airSlate SignNow support mobile use for accessing ct 2658 e compliant features?

Yes, airSlate SignNow offers a mobile-friendly application that allows users to access ct 2658 e compliant features on-the-go. This flexibility enables businesses to manage their documents and eSignatures effortlessly, regardless of location.

Get more for Ny Ct 2658 E

- Ot observation hours form

- Meridian charity care application form

- Dbe personal net worth statementpdf connect ncdot north form

- Past 5 years work history form tufts health plan

- 3 0 application to rent apartments form

- Sound screening services application fillable form

- Micozzi management rental application apartments form

- Nahc form application

Find out other Ny Ct 2658 E

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF