December S 220 Form BCR Buyer's Claim for Refund of Wisconsin State, County and Stadium Sales Taxes 2023

Understanding the December S-220 Form BCR

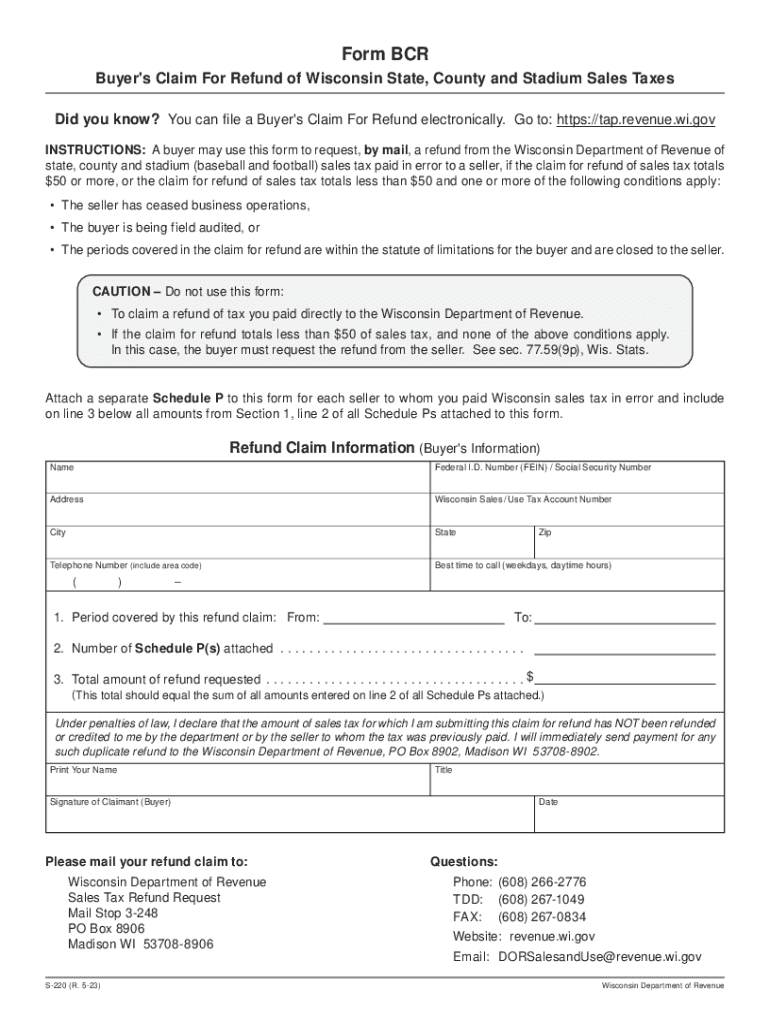

The December S-220 Form BCR, also known as the Buyer's Claim for Refund of Wisconsin State, County, and Stadium Sales Taxes, is designed for individuals and businesses seeking to reclaim sales tax paid on certain purchases in Wisconsin. This form is particularly relevant for those who have made qualifying purchases and wish to recover taxes that may have been overpaid or incorrectly charged. Understanding the specifics of this form is crucial for ensuring compliance and maximizing potential refunds.

Steps to Complete the December S-220 Form BCR

Completing the December S-220 Form BCR involves several key steps:

- Gather necessary documentation, including receipts and proof of payment.

- Fill out the form accurately, providing all required information such as your name, address, and details of the purchases.

- Calculate the total amount of sales tax you are claiming for refund.

- Review the completed form for accuracy before submission.

Each step is vital to ensure that your claim is processed smoothly and efficiently.

Eligibility Criteria for Filing the December S-220 Form BCR

To be eligible to file the December S-220 Form BCR, you must meet specific criteria. This includes being the purchaser of the goods for which you are claiming a refund and having paid sales tax on those purchases. Additionally, the purchases must fall within the categories specified by the Wisconsin Department of Revenue. Familiarizing yourself with these eligibility requirements can help streamline the refund process.

Required Documents for the December S-220 Form BCR

When filing the December S-220 Form BCR, it is essential to include the necessary documentation to support your claim. Required documents typically include:

- Receipts or invoices for the purchases.

- Proof of payment showing that sales tax was paid.

- Any additional documentation that may be requested by the Wisconsin Department of Revenue.

Having these documents ready can facilitate a quicker review and approval process for your refund claim.

Form Submission Methods for the December S-220 Form BCR

The December S-220 Form BCR can be submitted through various methods, allowing flexibility based on your preferences. You can choose to file the form online, mail it to the appropriate address, or submit it in person at designated locations. Each submission method has its own set of guidelines, so it's important to follow the instructions carefully to ensure your claim is received and processed without delays.

Key Elements of the December S-220 Form BCR

The December S-220 Form BCR contains several key elements that are crucial for a successful refund claim. These include:

- Identification of the claimant, including contact information.

- Details of the purchases for which the refund is being claimed.

- Calculation of the total sales tax amount being requested for refund.

Understanding these elements can help you complete the form accurately and increase the likelihood of a successful refund.

Quick guide on how to complete december s 220 form bcr buyers claim for refund of wisconsin state county and stadium sales taxes

Complete December S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And Stadium Sales Taxes with ease on any device

Online document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle December S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And Stadium Sales Taxes on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign December S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And Stadium Sales Taxes effortlessly

- Obtain December S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And Stadium Sales Taxes and then click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in several clicks from a device of your choice. Modify and eSign December S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And Stadium Sales Taxes and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct december s 220 form bcr buyers claim for refund of wisconsin state county and stadium sales taxes

Create this form in 5 minutes!

How to create an eSignature for the december s 220 form bcr buyers claim for refund of wisconsin state county and stadium sales taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to apply for a 2023 Wisconsin refund?

To apply for a 2023 Wisconsin refund, ensure that you have all necessary tax documents ready. You can file your state taxes online or through a tax preparer. Make sure to double-check your information for accuracy to avoid delays in receiving your 2023 Wisconsin refund.

-

How long does it take to receive a 2023 Wisconsin refund?

Typically, you can expect to receive your 2023 Wisconsin refund within 14 to 21 days if you file electronically. If you choose to file a paper return, it may take longer, up to 6 weeks. Always check the state’s website for the most current processing times for your specific situation.

-

Are there any fees associated with getting a 2023 Wisconsin refund?

There are no direct fees for receiving your 2023 Wisconsin refund if you file your taxes yourself. However, if you use a tax preparer's services or software, there may be associated costs. It's advisable to compare options to find a solution that fits your budget.

-

Can I track my 2023 Wisconsin refund status online?

Yes, you can easily track your 2023 Wisconsin refund status online through the Wisconsin Department of Revenue website. Simply enter your details in the refund status section to see the latest updates on your return. This allows you to stay informed about when to expect your funds.

-

What should I do if my 2023 Wisconsin refund is delayed?

If your 2023 Wisconsin refund is delayed, first check your status online for any updates. Ensure that your filing was accurate and complete, as mistakes can cause delays. If there are no updates after a few weeks, you might consider contacting the Wisconsin Department of Revenue for assistance.

-

How does airSlate SignNow help with tax document management for my 2023 Wisconsin refund?

airSlate SignNow can streamline your tax document management by allowing you to eSign and send necessary forms securely. This efficient solution ensures you have everything in order for a smooth filing process and maximizes your chances of a timely 2023 Wisconsin refund. It's an easy-to-use, cost-effective option for businesses.

-

Are there integrations that can assist with preparing my 2023 Wisconsin refund?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software tools. This integration allows you to gather, sign, and send all required documents for your 2023 Wisconsin refund quickly and efficiently. Review available integrations to enhance your filing experience.

Get more for December S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And Stadium Sales Taxes

Find out other December S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And Stadium Sales Taxes

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free