Online Wisconsin Buyers Claim for Refund 2014

What is the Online Wisconsin Buyers Claim For Refund

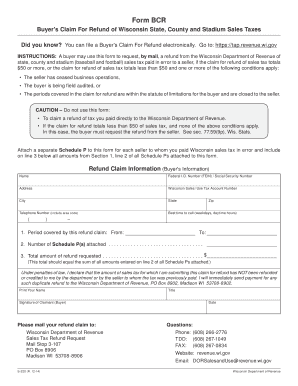

The Online Wisconsin Buyers Claim For Refund, commonly referred to as the s220 form, is a document that allows individuals and businesses to request a refund for sales tax paid on purchases that are later found to be exempt. This form is particularly relevant for Wisconsin residents who have made purchases for resale or for specific exempt purposes, such as manufacturing or agriculture. By utilizing this form, taxpayers can ensure they recover the appropriate amounts of sales tax, aligning with state regulations and guidelines.

Steps to Complete the Online Wisconsin Buyers Claim For Refund

Completing the s220 form involves several key steps to ensure accuracy and compliance with state requirements. Here’s a structured approach:

- Gather Necessary Information: Collect all relevant purchase receipts and documentation that support your claim for refund.

- Access the Form: Navigate to the appropriate online platform to access the s220 form, ensuring you have the latest version.

- Fill Out the Form: Provide accurate details, including your personal information, purchase details, and the amount of sales tax paid.

- Review Your Submission: Double-check all entries for accuracy to avoid delays or rejections.

- Submit the Form: Follow the online submission process, ensuring you receive confirmation of your claim.

Legal Use of the Online Wisconsin Buyers Claim For Refund

The s220 form is legally recognized for claiming refunds on sales tax under Wisconsin law. To ensure the form is valid, it must be completed in accordance with the Wisconsin Department of Revenue guidelines. This includes providing accurate information and supporting documentation. Failure to comply with these legal standards may result in denial of the refund request. It is crucial to understand the legal framework surrounding the form to safeguard against potential issues.

Required Documents

When completing the s220 form, certain documents are necessary to substantiate your claim. These typically include:

- Receipts: Proof of purchase for items for which a refund is being requested.

- Exemption Certificates: If applicable, documents that confirm the exempt status of the purchases.

- Previous Tax Returns: Any relevant tax filings that may support your claim.

Having these documents on hand will facilitate a smoother application process and enhance the likelihood of a successful refund claim.

Eligibility Criteria

To qualify for a refund using the s220 form, certain eligibility criteria must be met. Generally, applicants must:

- Be a resident or business entity registered in Wisconsin.

- Have made purchases that were subject to sales tax but are eligible for exemption.

- Submit the claim within the designated time frame set by the Wisconsin Department of Revenue.

Understanding these criteria is essential for ensuring that your claim is valid and has a greater chance of approval.

Form Submission Methods

The s220 form can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online Submission: Completing and submitting the form through the Wisconsin Department of Revenue's online portal.

- Mail Submission: Printing the completed form and sending it via postal service to the designated address.

- In-Person Submission: Delivering the form directly to a local Department of Revenue office, if preferred.

Choosing the appropriate submission method can streamline the process and ensure timely processing of your claim.

Quick guide on how to complete online wisconsin buyers claim for refund

Finish Online Wisconsin Buyers Claim For Refund effortlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate template and securely save it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without delays. Manage Online Wisconsin Buyers Claim For Refund on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign Online Wisconsin Buyers Claim For Refund without hassle

- Obtain Online Wisconsin Buyers Claim For Refund and click on Get Form to commence.

- Utilize the tools we provide to fill out your template.

- Emphasize important sections of your documents or obscure sensitive details with tools offered by airSlate SignNow designed specifically for this.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your document: via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and electronically sign Online Wisconsin Buyers Claim For Refund and guarantee excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct online wisconsin buyers claim for refund

Create this form in 5 minutes!

People also ask

-

What is the s220 form and why do I need it?

The s220 form is a vital document used for various business transactions, especially for tax purposes. It helps ensure compliance with regulatory requirements. By using airSlate SignNow to manage your s220 form, you can streamline your document signing process and enhance efficiency.

-

How can I electronically sign the s220 form using airSlate SignNow?

airSlate SignNow allows you to electronically sign the s220 form effortlessly. With its intuitive platform, you can upload your form, add your signature, and send it securely without any hassle. This simplifies the document workflow and saves time.

-

Is there a cost associated with using airSlate SignNow for the s220 form?

Yes, airSlate SignNow offers several pricing plans tailored to fit different business needs. The costs depend on the features you choose, but rest assured that it's a cost-effective solution for managing your s220 form and other documents. You can check our website for detailed pricing information.

-

What features does airSlate SignNow offer for managing the s220 form?

airSlate SignNow includes a variety of features to enhance your experience with the s220 form. You can easily create, send, and track documents, as well as collaborate with others in real-time. These features help ensure your paperwork is organized and efficient.

-

Can I integrate airSlate SignNow with other applications when handling my s220 form?

Absolutely! airSlate SignNow offers multiple integrations with popular applications, making it easier to manage your s220 form alongside other tools. Whether you use CRM systems or project management software, you can streamline your processes effectively.

-

How secure is the signing process for the s220 form on airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption to protect your data during the signing process, ensuring that your s220 form and personal information remain confidential and secure. You can sign with confidence.

-

What are the benefits of using airSlate SignNow for the s220 form over traditional paper methods?

Using airSlate SignNow for the s220 form offers numerous advantages over traditional paper methods. It speeds up the signing process, reduces printing costs, and eliminates the need for physical document storage. This not only saves time but also helps the environment.

Get more for Online Wisconsin Buyers Claim For Refund

- Covalent bond practice answer key form

- Virginia cna reciprocity form

- Global entry application form pdf

- International legal english second edition pdf form

- Medium of instruction certificate pdf form

- Schwab gift stock form

- Elac federal id number form

- Liability claim against the city of bakersfield form

Find out other Online Wisconsin Buyers Claim For Refund

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney