January S 220 Form BCR Buyer's Claim for Refund of Wisconsin State, County and City Sales Taxes 2025-2026

What is the January S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And City Sales Taxes

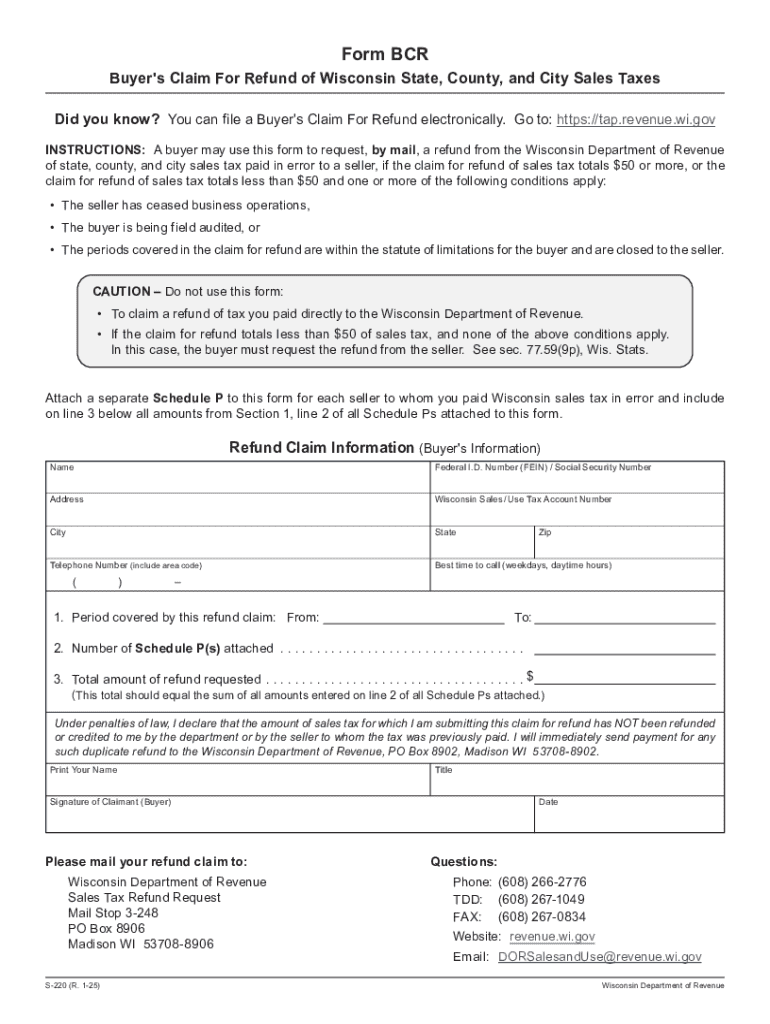

The January S 220 Form BCR is a specific tax form used by buyers in Wisconsin to claim refunds for overpaid state, county, and city sales taxes. This form is essential for individuals and businesses that have made purchases subject to these taxes and believe they have paid more than required. The form facilitates the process of requesting a refund from the appropriate tax authorities, ensuring that taxpayers can recover excess amounts paid.

How to use the January S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And City Sales Taxes

To use the January S 220 Form BCR effectively, follow these steps: first, gather all necessary documentation, including receipts and proof of tax payments. Next, accurately fill out the form, providing details about the purchases and the taxes paid. Ensure all required fields are completed to avoid delays. After completing the form, submit it to the designated tax authority, either online or via mail, depending on the submission methods available.

Steps to complete the January S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And City Sales Taxes

Completing the January S 220 Form BCR involves several key steps:

- Obtain the form from the Wisconsin Department of Revenue website or other authorized sources.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Detail the items purchased, including dates and amounts, as well as the corresponding sales taxes paid.

- Attach supporting documents, such as receipts and any relevant correspondence.

- Review the completed form for accuracy before submission.

Required Documents

When filing the January S 220 Form BCR, certain documents are essential to support your claim. These include:

- Receipts for all purchases for which you are claiming a refund.

- Proof of payment of sales taxes, such as invoices or transaction records.

- Any correspondence with the tax authorities related to the claim.

Eligibility Criteria

To be eligible to file the January S 220 Form BCR, you must meet specific criteria. Generally, you should have made purchases that were subject to Wisconsin sales tax and have overpaid this tax. Additionally, the claim should be submitted within the designated time frame set by the Wisconsin Department of Revenue. It is important to ensure that all information provided on the form is accurate and that you have the necessary documentation to support your claim.

Form Submission Methods

The January S 220 Form BCR can be submitted through various methods, ensuring flexibility for taxpayers. You may choose to file the form online through the Wisconsin Department of Revenue's website, which often provides a faster processing time. Alternatively, you can print the completed form and mail it to the appropriate tax office. In-person submissions may also be possible at designated tax offices, depending on local regulations.

Create this form in 5 minutes or less

Find and fill out the correct january s 220 form bcr buyers claim for refund of wisconsin state county and city sales taxes

Create this form in 5 minutes!

How to create an eSignature for the january s 220 form bcr buyers claim for refund of wisconsin state county and city sales taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the January S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And City Sales Taxes?

The January S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And City Sales Taxes is a form used by businesses to claim refunds on sales taxes paid to state, county, and city governments in Wisconsin. This form is essential for ensuring that businesses can recover overpaid taxes and maintain accurate financial records.

-

How can airSlate SignNow help with the January S 220 Form BCR?

airSlate SignNow provides an easy-to-use platform for businesses to complete and eSign the January S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And City Sales Taxes. Our solution streamlines the document management process, making it simple to fill out, sign, and submit your claims efficiently.

-

What are the pricing options for using airSlate SignNow for the January S 220 Form BCR?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. By choosing our service, you can access features that simplify the completion of the January S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And City Sales Taxes at a competitive price, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the January S 220 Form BCR?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all designed to enhance your experience with the January S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And City Sales Taxes. These tools help you manage your claims efficiently and ensure compliance with state regulations.

-

Are there any benefits to using airSlate SignNow for the January S 220 Form BCR?

Using airSlate SignNow for the January S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And City Sales Taxes offers numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform allows you to focus on your business while we handle the complexities of document management.

-

Can I integrate airSlate SignNow with other software for the January S 220 Form BCR?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing you to streamline your workflow when handling the January S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And City Sales Taxes. This integration capability ensures that you can manage your documents alongside your existing tools for maximum efficiency.

-

Is airSlate SignNow secure for handling the January S 220 Form BCR?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your data related to the January S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And City Sales Taxes is protected. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the document signing process.

Get more for January S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And City Sales Taxes

Find out other January S 220 Form BCR Buyer's Claim For Refund Of Wisconsin State, County And City Sales Taxes

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form