Form MO 1040V Individual Income Tax Payment Voucher 2023

Understanding the Form MO 1040V Individual Income Tax Payment Voucher

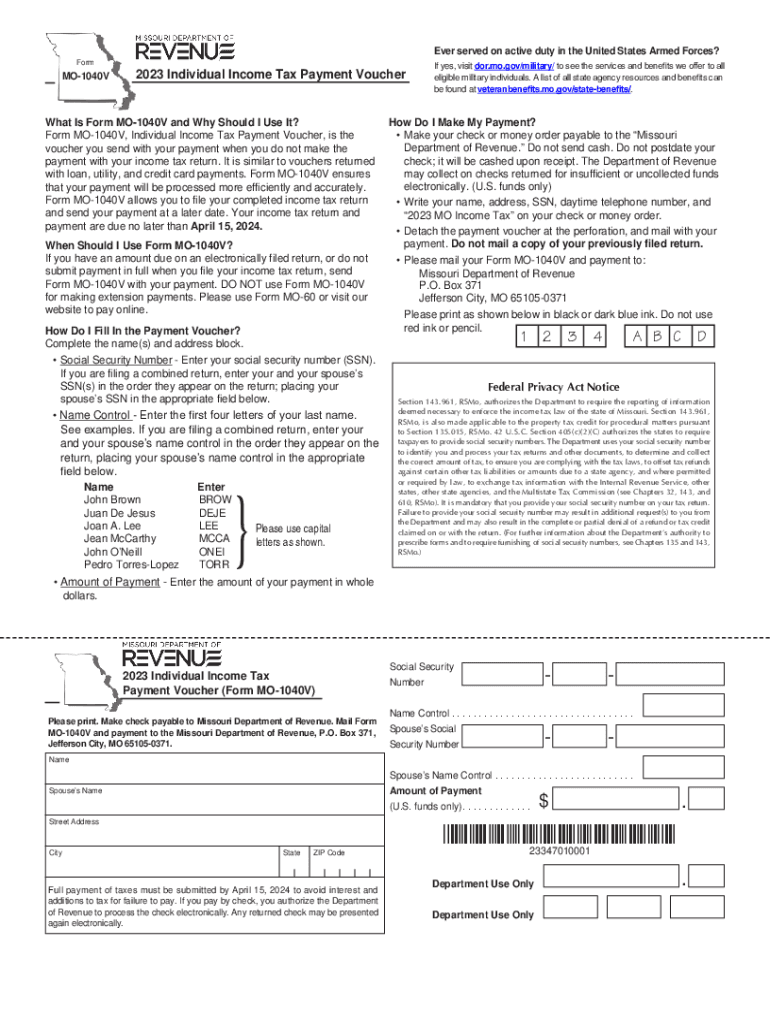

The Form MO 1040V is a crucial document for individuals in Missouri who need to make income tax payments. This voucher allows taxpayers to submit payments directly to the Missouri Department of Revenue, ensuring that their tax obligations are met in a timely manner. The form is specifically designed for those who are filing their income taxes and wish to pay any balance due. By using the MO 1040V, taxpayers can streamline their payment process and avoid potential penalties associated with late payments.

How to Complete the Form MO 1040V

Filling out the Form MO 1040V is a straightforward process. Begin by entering your personal information, including your name, address, and Social Security number. Next, indicate the amount you are paying and ensure that it matches the balance due on your income tax return. It is essential to double-check all entries for accuracy to prevent delays in processing. After completing the form, sign and date it before submitting it along with your payment.

Obtaining the Form MO 1040V

The Form MO 1040V can be easily obtained from the Missouri Department of Revenue's official website. It is available for download in PDF format, allowing taxpayers to print and fill it out at their convenience. Additionally, physical copies of the form may be available at local tax offices or public libraries. Ensuring you have the most current version of the form is important, as outdated versions may not be accepted.

Important Filing Deadlines for the Form MO 1040V

Timely submission of the Form MO 1040V is critical to avoid penalties. The payment voucher must be submitted along with your payment by the tax filing deadline, which is typically April 15 for most individuals. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Missouri Department of Revenue's website for any updates or changes to the filing schedule.

Methods for Submitting the Form MO 1040V

Taxpayers have several options for submitting the Form MO 1040V. Payments can be made online through the Missouri Department of Revenue's ePayment system, which provides a secure and efficient way to handle tax payments. Alternatively, taxpayers may choose to mail the completed form along with their payment to the appropriate address provided on the form. In-person submissions are also accepted at designated tax offices throughout the state.

Key Elements of the Form MO 1040V

The Form MO 1040V includes several key elements that are essential for proper completion. These elements consist of the taxpayer's identification information, the payment amount, and a section for the taxpayer's signature. Additionally, the form contains instructions for where and how to submit the payment. Understanding these components is vital for ensuring that the payment is processed without issues.

Legal Use of the Form MO 1040V

The Form MO 1040V serves as an official document for making income tax payments in Missouri. It is legally binding and must be completed accurately to fulfill tax obligations. Failure to use the form correctly or to submit it on time can result in penalties, including interest on unpaid taxes. Therefore, it is important for taxpayers to familiarize themselves with the legal implications of using the MO 1040V.

Quick guide on how to complete form mo 1040v individual income tax payment voucher

Effortlessly Prepare Form MO 1040V Individual Income Tax Payment Voucher on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Handle Form MO 1040V Individual Income Tax Payment Voucher on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign Form MO 1040V Individual Income Tax Payment Voucher with Minimal Effort

- Find Form MO 1040V Individual Income Tax Payment Voucher and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive details using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form MO 1040V Individual Income Tax Payment Voucher and ensure excellent communication at each step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1040v individual income tax payment voucher

Create this form in 5 minutes!

How to create an eSignature for the form mo 1040v individual income tax payment voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri tax payment form and why is it important?

The Missouri tax payment form is a crucial document for individuals and businesses to report their tax obligations to the state. This form ensures that taxpayers comply with state tax laws and fulfill their financial responsibilities in a timely manner, avoiding penalties and interest.

-

How can I electronically sign my Missouri tax payment form?

With airSlate SignNow, you can easily eSign your Missouri tax payment form electronically. Our platform offers a secure and efficient way to sign documents online, streamlining the process and ensuring your form is submitted accurately and on time.

-

What features does airSlate SignNow offer for completing a Missouri tax payment form?

airSlate SignNow provides various features for completing your Missouri tax payment form, including customizable templates, easy drag-and-drop document editing, and real-time collaboration with team members. These features enhance efficiency and accuracy in form submission.

-

Is airSlate SignNow a cost-effective solution for processing the Missouri tax payment form?

Yes, airSlate SignNow offers competitive pricing plans that cater to both individuals and businesses, making it a cost-effective solution for processing the Missouri tax payment form. Our pricing tiers provide flexibility and access to essential features without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing my Missouri tax payment form?

Absolutely! airSlate SignNow can seamlessly integrate with numerous applications, including CRM and accounting software. This integration makes managing your Missouri tax payment form more streamlined and helps you maintain organized records across platforms.

-

How does airSlate SignNow ensure the security of my Missouri tax payment form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect your Missouri tax payment form and sensitive data, ensuring that only authorized users can access and manage your information.

-

Can I track the status of my Missouri tax payment form with airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your Missouri tax payment form. You can receive notifications about document progress and ensure that your submissions are completed promptly.

Get more for Form MO 1040V Individual Income Tax Payment Voucher

Find out other Form MO 1040V Individual Income Tax Payment Voucher

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free