MO 5090 New Operating Loss Addition Modofication Sheet 2023

What is the MO 5090 New Operating Loss Addition Modification Sheet

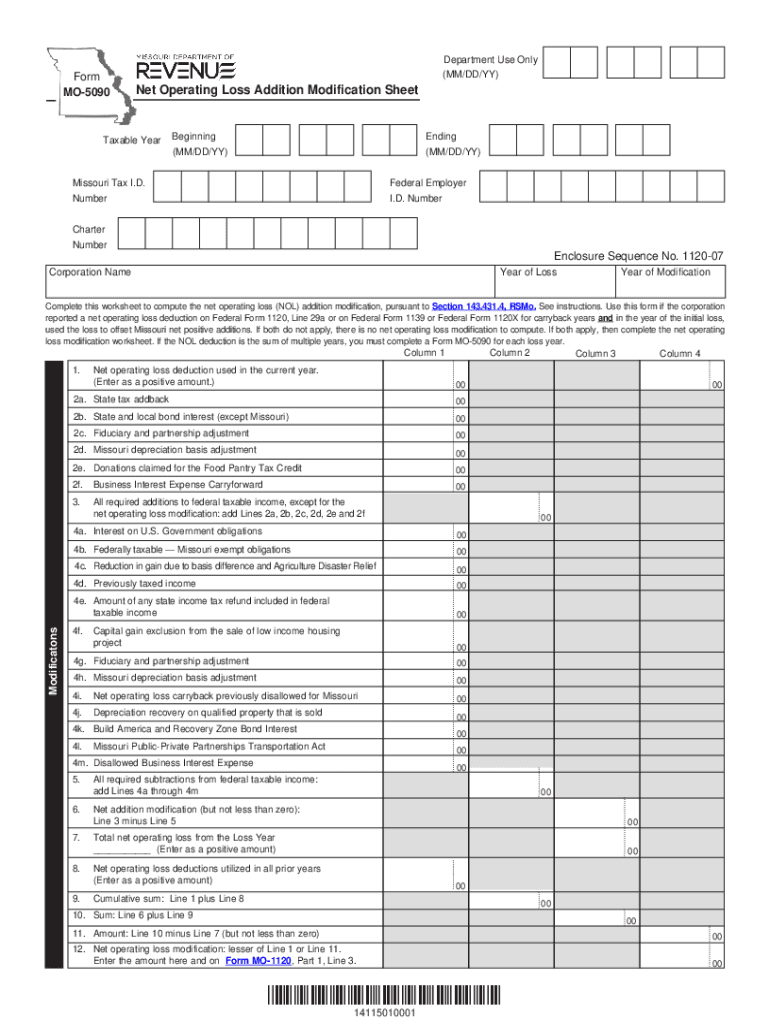

The MO 5090 New Operating Loss Addition Modification Sheet is a specific form used by businesses in Missouri to report and calculate net operating losses. This form allows taxpayers to add modifications to their net operating loss, ensuring compliance with state tax regulations. It is essential for businesses that have incurred losses in a tax year and wish to apply those losses against future taxable income. Understanding the purpose of this form is crucial for accurate tax reporting and maximizing potential tax benefits.

How to use the MO 5090 New Operating Loss Addition Modification Sheet

Using the MO 5090 form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents that reflect your business's income and expenses. Next, fill out the form by entering your total net operating loss and any required modifications. It is important to follow the instructions carefully to avoid errors that could lead to delays in processing. Once completed, the form should be submitted according to the guidelines provided by the Missouri Department of Revenue.

Steps to complete the MO 5090 New Operating Loss Addition Modification Sheet

Completing the MO 5090 form requires careful attention to detail. Here are the steps to follow:

- Begin by entering your business information, including the name, address, and tax identification number.

- Report the total amount of your net operating loss for the applicable tax year.

- Include any modifications required by state law, such as additions or subtractions that affect your net operating loss.

- Double-check all entries for accuracy to prevent any potential issues with your filing.

- Sign and date the form before submission.

Legal use of the MO 5090 New Operating Loss Addition Modification Sheet

The MO 5090 form must be used in accordance with Missouri tax laws. It is legally binding and should only be submitted when accurate and complete information is provided. Misrepresentation or failure to comply with the regulations can result in penalties or audits. Businesses should ensure that they understand the legal implications of their entries on this form to maintain compliance with state tax obligations.

Eligibility Criteria

To utilize the MO 5090 form, businesses must meet specific eligibility criteria. Generally, only those entities that have incurred a net operating loss during the tax year can apply. This includes various business structures, such as corporations, partnerships, and sole proprietorships. Additionally, the losses must be properly documented and must adhere to the guidelines set forth by the Missouri Department of Revenue to qualify for the modifications allowed on the form.

Required Documents

When preparing to complete the MO 5090 form, certain documents are necessary to support your claims. These typically include:

- Financial statements reflecting income and expenses for the relevant tax year.

- Prior year tax returns to establish a history of losses.

- Any additional documentation that supports the modifications being claimed on the form.

Having these documents ready will facilitate a smoother completion process and ensure that all claims are substantiated.

Quick guide on how to complete mo 5090 new operating loss addition modofication sheet

Complete MO 5090 New Operating Loss Addition Modofication Sheet seamlessly on any gadget

Web-based document organization has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your forms quickly without hurdles. Manage MO 5090 New Operating Loss Addition Modofication Sheet on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

How to modify and eSign MO 5090 New Operating Loss Addition Modofication Sheet with ease

- Locate MO 5090 New Operating Loss Addition Modofication Sheet and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize signNow sections of your documentation or redact sensitive information with tools offered specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign MO 5090 New Operating Loss Addition Modofication Sheet to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo 5090 new operating loss addition modofication sheet

Create this form in 5 minutes!

How to create an eSignature for the mo 5090 new operating loss addition modofication sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mo net in the context of airSlate SignNow?

Mo net refers to the monetary value you can save by using airSlate SignNow for your digital signature needs. By streamlining the signing process, businesses can signNowly reduce costs associated with paper documents and manual workflows, making it a smart financial choice.

-

How does airSlate SignNow enhance productivity related to mo net?

With airSlate SignNow, businesses can achieve greater productivity by reducing the time spent on document handling and signature collection. This leads to higher mo net as employees can focus on value-adding tasks instead of administrative burdens.

-

What are the pricing options available for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans tailored to different business needs, enabling you to maximize your mo net. Plans range from basic to advanced features, ensuring you only pay for what you need, making it a cost-effective solution for any organization.

-

What features does airSlate SignNow provide that contribute to mo net savings?

AirSlate SignNow provides essential features like template creation, bulk sending, and automated workflows, all of which contribute to increased mo net. These tools streamline the signing process and enhance efficiency, ultimately saving both time and money.

-

Can airSlate SignNow integrate with other applications to improve mo net?

Yes, airSlate SignNow seamlessly integrates with various applications like CRM and project management tools, optimizing your workflows and increasing mo net. This integration allows businesses to connect their existing systems, enhancing operational efficiency and reducing costs.

-

What benefits does airSlate SignNow offer that impact the overall mo net?

The key benefits of airSlate SignNow include enhanced document security, compliance assurance, and a user-friendly interface, all of which positively impact your mo net. By ensuring documents are signed securely and efficiently, businesses can minimize risks and avoid costly delays.

-

How does airSlate SignNow support remote work in relation to mo net?

AirSlate SignNow supports remote work by allowing users to eSign documents from anywhere, directly contributing to mo net. This flexibility means businesses can maintain productivity and efficiency, regardless of their team's location, ultimately leading to cost savings.

Get more for MO 5090 New Operating Loss Addition Modofication Sheet

- Form 8804 pdf internal revenue service

- Tut appilcation form for employment

- Tafe payment plan form

- Dd form 2752 nsep service agreement for scholarship and fellowship awards november 2014

- Adobe reader 8 or higher adobe support community form

- Vet payment plan applicationpdf form

- Pdf imm 0008e schedule 2 refugees outside canada canadaca form

- About the forms village settlements

Find out other MO 5090 New Operating Loss Addition Modofication Sheet

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement