Towards Matching User Mobility Traces in Large Scale Datasets 2020

IRS Guidelines

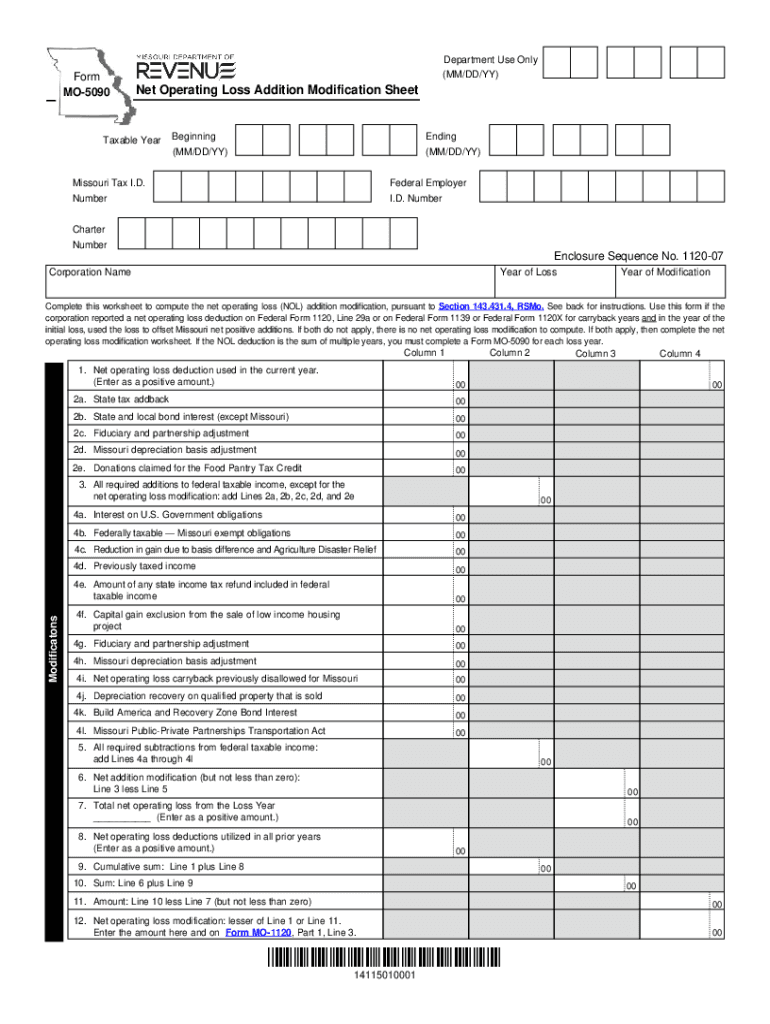

The IRS provides specific guidelines for completing Form 1120, particularly regarding line 29a, which pertains to net operating losses. Understanding these guidelines is essential for accurate reporting and compliance. The IRS outlines how to calculate net operating losses, including the adjustments required for prior year losses. This ensures that businesses can effectively utilize their losses to offset taxable income in future years.

Filing Deadlines / Important Dates

Filing deadlines for Form 1120 are crucial for compliance. Generally, corporations must file their tax returns by the fifteenth day of the fourth month after the end of their tax year. For calendar year corporations, this means April 15. It is important to note that extensions can be requested, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

When preparing to file Form 1120, several documents are necessary to ensure accurate completion. These include financial statements, records of income and expenses, and any documentation supporting deductions and credits claimed on the form. Specifically for line 29a, documentation of net operating losses from previous years is essential, as it supports the calculations made on the form.

Penalties for Non-Compliance

Failure to comply with IRS regulations regarding Form 1120 can result in significant penalties. Late filing penalties can accrue if the form is not submitted by the due date, while inaccuracies on the form can lead to additional fines. Understanding the implications of non-compliance is vital for businesses to avoid unexpected financial burdens.

Form Submission Methods (Online / Mail / In-Person)

Form 1120 can be submitted through various methods, including online filing through the IRS e-file system, mailing a paper form, or delivering it in person to the appropriate IRS office. Each method has its own set of requirements and processing times, so businesses should choose the option that best suits their needs while ensuring timely submission.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios can influence how Form 1120 is filled out and submitted. For instance, corporations that are part of a larger group may need to consider consolidated returns. Additionally, understanding how net operating losses apply to various business structures, such as LLCs or corporations, is essential for accurate reporting and tax planning.

Eligibility Criteria

Eligibility to file Form 1120 primarily depends on the business structure. Corporations, including C corporations and S corporations, must adhere to specific criteria set by the IRS. Understanding these eligibility requirements is crucial for businesses to determine their filing obligations and ensure compliance with tax laws.

Quick guide on how to complete towards matching user mobility traces in large scale datasets

Effortlessly Prepare Towards Matching User Mobility Traces In Large scale Datasets on Any Device

Digital document management has gained signNow traction among organizations and individuals. It presents an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Towards Matching User Mobility Traces In Large scale Datasets on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to Modify and Electronically Sign Towards Matching User Mobility Traces In Large scale Datasets with Ease

- Obtain Towards Matching User Mobility Traces In Large scale Datasets and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically designed for that by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled records, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and electronically sign Towards Matching User Mobility Traces In Large scale Datasets, ensuring excellent communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct towards matching user mobility traces in large scale datasets

Create this form in 5 minutes!

How to create an eSignature for the towards matching user mobility traces in large scale datasets

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is form 1120 line 29a?

Form 1120 line 29a refers to the area on the U.S. Corporation Income Tax Return where corporations report dividends received. Understanding this line is crucial for accurate tax filings, as it directly affects the company’s taxable income.

-

How does airSlate SignNow help with form 1120 line 29a filings?

airSlate SignNow streamlines the document signing process, ensuring that all necessary forms, including those related to form 1120 line 29a, are filled out and submitted efficiently. Our platform permits easy collaboration among teams, enhancing accuracy and compliance.

-

What features does airSlate SignNow offer for managing tax documents?

With airSlate SignNow, you get features such as customizable templates, document tracking, and secure eSigning, all of which make managing tax documents like form 1120 line 29a hassle-free. These features help maintain organization and facilitate quicker turnaround times for tax filings.

-

Is airSlate SignNow affordable for small businesses filing form 1120 line 29a?

Yes! airSlate SignNow offers a cost-effective solution suitable for small businesses, allowing them to manage their tax documentation, including form 1120 line 29a, without breaking the bank. With various pricing plans, businesses can choose one that fits their budget and needs.

-

Can I integrate airSlate SignNow with my existing tax software?

Absolutely! airSlate SignNow is designed for seamless integration with many popular tax software solutions, making it easy to manage forms like form 1120 line 29a within your existing workflows. This integration simplifies the process and ensures your data remains consistent and accurate.

-

What benefits does using airSlate SignNow provide for tax compliance?

Using airSlate SignNow ensures that all signature captures and document submissions related to form 1120 line 29a are performed securely and in compliance with regulations. Our platform offers a comprehensive audit trail which helps in maintaining compliance during tax reviews.

-

How does airSlate SignNow enhance collaboration for tax filings?

airSlate SignNow promotes collaboration by allowing multiple stakeholders to access, edit, and eSign documents related to form 1120 line 29a in real-time. This ensures everyone involved is on the same page, ultimately improving efficiency and reducing the risk of errors.

Get more for Towards Matching User Mobility Traces In Large scale Datasets

Find out other Towards Matching User Mobility Traces In Large scale Datasets

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format