MO 5090 New Operating Loss Addition Modofication Sheet 2024-2026

What is the MO 5090 New Operating Loss Addition Modification Sheet

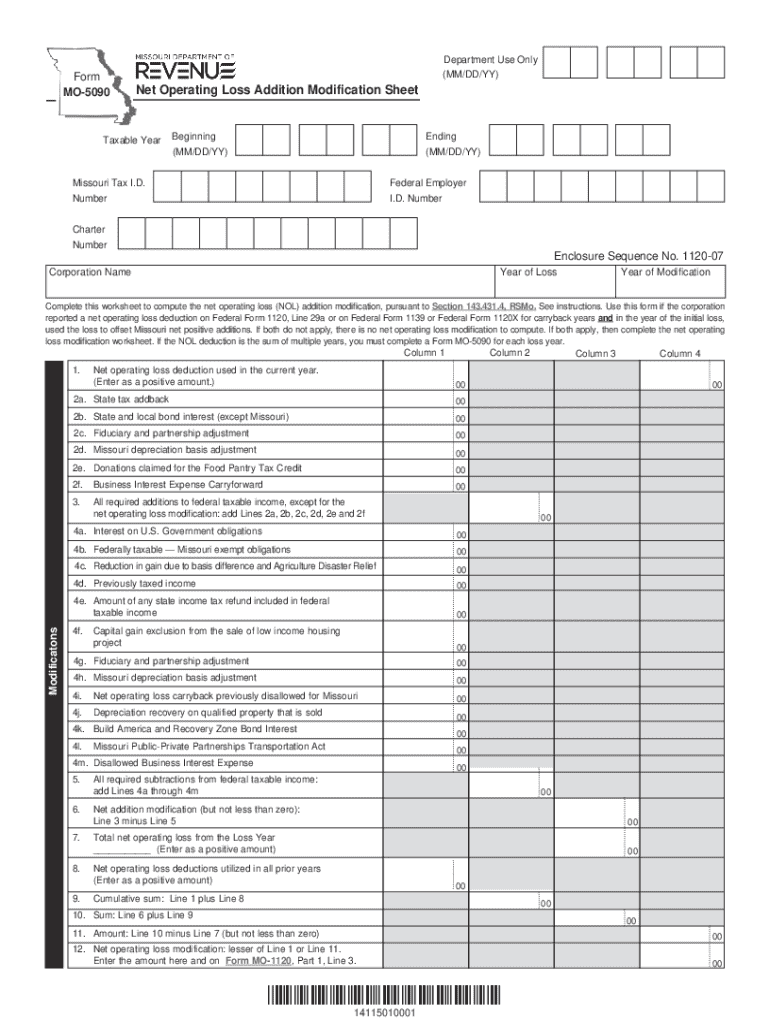

The MO 5090 New Operating Loss Addition Modification Sheet is a specific form used in the state of Missouri for tax purposes. It allows businesses to report new operating losses that can be added to their tax returns. This form is essential for ensuring that losses are accurately reported and can be utilized to offset future taxable income, thereby reducing overall tax liability. Understanding this form is crucial for businesses aiming to maximize their tax benefits while remaining compliant with state regulations.

How to use the MO 5090 New Operating Loss Addition Modification Sheet

Using the MO 5090 New Operating Loss Addition Modification Sheet involves several key steps. First, gather all necessary financial documents that detail the operating losses incurred. Next, accurately fill out the form with the required information, ensuring that all figures are correct and align with your financial records. After completing the form, review it for accuracy before submission. This careful approach helps prevent delays in processing and ensures that you receive any potential tax benefits associated with your reported losses.

Steps to complete the MO 5090 New Operating Loss Addition Modification Sheet

Completing the MO 5090 New Operating Loss Addition Modification Sheet requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents that detail your operating losses.

- Obtain the MO 5090 form from the appropriate state resources.

- Fill in your business information, including name, address, and tax identification number.

- Detail the operating losses in the designated sections of the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the MO 5090 New Operating Loss Addition Modification Sheet

The MO 5090 New Operating Loss Addition Modification Sheet must be used in accordance with Missouri tax laws. This form is legally binding and should be completed truthfully to avoid potential penalties. Misrepresentation of losses can lead to audits or legal repercussions. It is important to ensure that all information provided is supported by accurate financial records, as this will uphold the integrity of your tax filings.

Key elements of the MO 5090 New Operating Loss Addition Modification Sheet

Key elements of the MO 5090 form include sections for reporting the type of losses, the amount of losses, and relevant tax years. Additionally, the form may require information about the business entity type and any associated tax identification numbers. Understanding these elements is vital for accurately reporting losses and ensuring compliance with state tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the MO 5090 New Operating Loss Addition Modification Sheet typically align with the overall tax filing deadlines in Missouri. It is crucial for businesses to be aware of these dates to avoid late penalties. Generally, forms must be submitted by the standard tax return due date, which is usually April fifteenth for most businesses. Keeping track of these deadlines ensures that you can take full advantage of any tax benefits associated with operating losses.

Create this form in 5 minutes or less

Find and fill out the correct mo 5090 new operating loss addition modofication sheet 772045257

Create this form in 5 minutes!

How to create an eSignature for the mo 5090 new operating loss addition modofication sheet 772045257

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO 5090 New Operating Loss Addition Modification Sheet?

The MO 5090 New Operating Loss Addition Modification Sheet is a crucial document for businesses looking to report operating losses for tax purposes. It allows organizations to accurately modify their tax filings and ensure compliance with state regulations. Understanding this sheet is essential for effective financial management.

-

How can airSlate SignNow help with the MO 5090 New Operating Loss Addition Modification Sheet?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign the MO 5090 New Operating Loss Addition Modification Sheet. Our user-friendly interface ensures that you can complete this important document quickly and efficiently. This saves time and reduces the risk of errors in your tax filings.

-

Is there a cost associated with using airSlate SignNow for the MO 5090 New Operating Loss Addition Modification Sheet?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, ensuring that you can manage documents like the MO 5090 New Operating Loss Addition Modification Sheet without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the MO 5090 New Operating Loss Addition Modification Sheet?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the MO 5090 New Operating Loss Addition Modification Sheet. These features enhance the efficiency of your document management process. Additionally, our platform ensures that all your documents are stored securely and are easily accessible.

-

Can I integrate airSlate SignNow with other software for the MO 5090 New Operating Loss Addition Modification Sheet?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the MO 5090 New Operating Loss Addition Modification Sheet alongside your existing tools. This integration capability enhances your workflow and ensures that all your documents are synchronized across platforms.

-

What are the benefits of using airSlate SignNow for the MO 5090 New Operating Loss Addition Modification Sheet?

Using airSlate SignNow for the MO 5090 New Operating Loss Addition Modification Sheet provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the eSigning process, allowing you to focus on your core business activities. Additionally, it helps ensure that your tax documents are accurate and submitted on time.

-

Is airSlate SignNow secure for handling the MO 5090 New Operating Loss Addition Modification Sheet?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your MO 5090 New Operating Loss Addition Modification Sheet is handled with the utmost care. We utilize advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe with us.

Get more for MO 5090 New Operating Loss Addition Modofication Sheet

- Arbonne my wellness profile hasse nationdream big form

- Pitch count v2 warringah baseball club form

- Carrier set up package cornerstone systemscom form

- Appeal form de 1000aa

- Certificate in supervisory management scciob form

- Adventurer registration form gulf states conference

- Cpa ontario transcript assessment form cpa ontario transcript assessment form

- Schedule of liabilities form 2015 2019

Find out other MO 5090 New Operating Loss Addition Modofication Sheet

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free