Shared Care Tax Credit 2023

What is the Shared Care Tax Credit

The Shared Care Tax Credit is a tax benefit designed to assist families who share caregiving responsibilities for a dependent. This credit aims to alleviate some of the financial burdens associated with caregiving, making it easier for families to provide necessary support for their loved ones. It is particularly relevant for those who may be balancing work and caregiving duties, ensuring that they receive some financial relief during tax season.

Eligibility Criteria

To qualify for the Shared Care Tax Credit, taxpayers must meet specific criteria. Generally, the credit is available to individuals who are responsible for the care of a dependent, such as a child or elderly relative. The dependent must live with the caregiver for more than half of the year, and the caregiver must have provided at least half of the dependent's financial support. Additionally, income limits may apply, affecting the amount of credit available.

Steps to complete the Shared Care Tax Credit

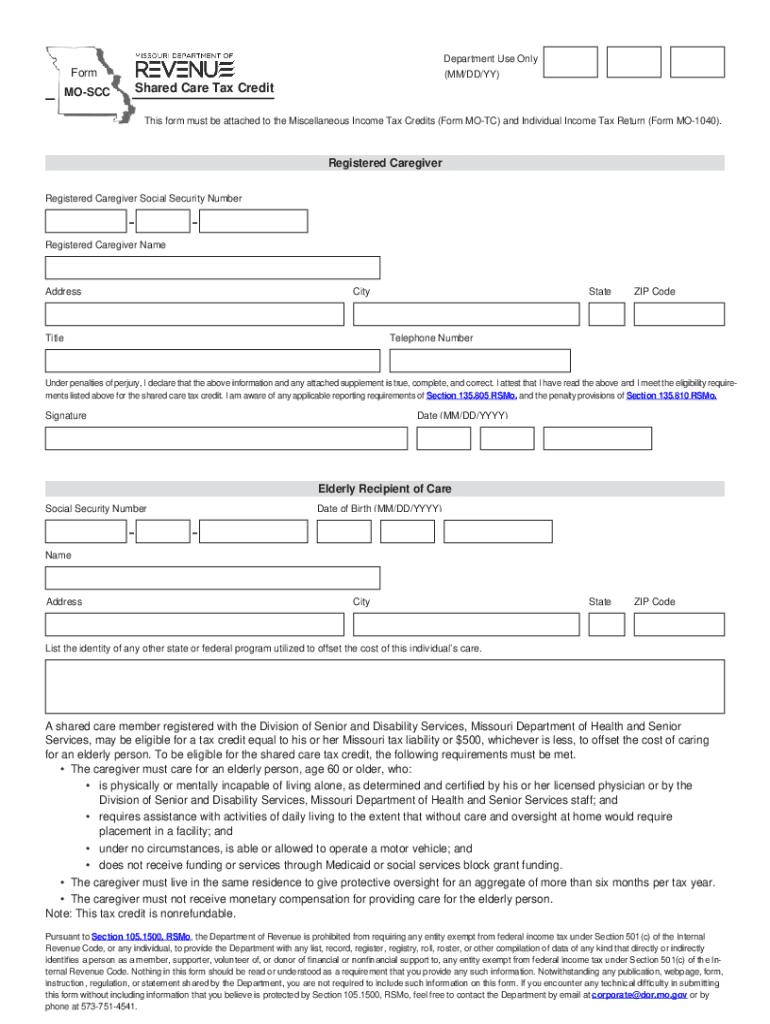

Completing the Shared Care Tax Credit involves several key steps. First, gather all necessary documentation, including proof of caregiving expenses and income information. Next, fill out the appropriate tax forms, ensuring that you accurately report your caregiving status and any related expenses. It is essential to review the IRS guidelines for the credit to ensure compliance with all requirements. Finally, submit your tax return by the designated deadline to claim the credit.

Required Documents

When applying for the Shared Care Tax Credit, certain documents are essential for a successful claim. These may include:

- Proof of relationship to the dependent, such as birth certificates or legal documents.

- Documentation of caregiving expenses, including receipts for services or supplies.

- Income statements, such as W-2 forms or 1099 forms, to verify eligibility.

Having these documents ready can streamline the application process and help ensure that you meet all requirements.

IRS Guidelines

The IRS provides specific guidelines regarding the Shared Care Tax Credit, outlining eligibility, documentation, and filing procedures. It is crucial to familiarize yourself with these guidelines to maximize your credit claim. The IRS may update these guidelines annually, so checking for the latest information is advisable. Understanding these rules can help prevent errors and ensure compliance, reducing the risk of penalties or audits.

Filing Deadlines / Important Dates

Taxpayers should be aware of key filing deadlines related to the Shared Care Tax Credit. Generally, tax returns must be filed by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete shared care tax credit

Fill out Shared Care Tax Credit effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Manage Shared Care Tax Credit on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Shared Care Tax Credit without hassle

- Locate Shared Care Tax Credit and click Obtain Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Finish button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Shared Care Tax Credit and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct shared care tax credit

Create this form in 5 minutes!

How to create an eSignature for the shared care tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Shared Care Tax Credit?

The Shared Care Tax Credit is a financial benefit designed to assist families providing care for disabled or elderly loved ones. It helps offset the costs associated with caregiving, making it an important resource for those who qualify. By understanding the Shared Care Tax Credit, you can maximize your financial support.

-

How can airSlate SignNow help with the Shared Care Tax Credit documentation?

airSlate SignNow simplifies the process of managing and eSigning documents necessary for claiming the Shared Care Tax Credit. Our platform allows you to securely send, receive, and store required documentation seamlessly. This not only saves time but ensures accuracy in submitting your claims.

-

What are the key features of airSlate SignNow that benefit Shared Care Tax Credit applicants?

Key features of airSlate SignNow include user-friendly eSignature capabilities, document templates tailored for tax credits, and compliance with legal standards. These features facilitate the efficient submission of necessary paperwork for the Shared Care Tax Credit, ensuring users can focus on caregiving rather than paperwork.

-

Is airSlate SignNow cost-effective for those applying for the Shared Care Tax Credit?

Yes, airSlate SignNow offers a cost-effective solution for individuals and families applying for the Shared Care Tax Credit. Our pricing plans are designed to cater to various budgets while providing essential features to streamline the documentation process. You'll gain signNow value without breaking the bank.

-

What integrations does airSlate SignNow offer to assist with the Shared Care Tax Credit?

airSlate SignNow integrates seamlessly with various applications that can assist in managing your Shared Care Tax Credit documents. From cloud storage solutions to project management tools, these integrations enhance your workflow and make it easier to organize your caregiving responsibilities alongside the required documentation.

-

How does eSigning help expedite the Shared Care Tax Credit application process?

eSigning with airSlate SignNow allows for quick approval of necessary documents for the Shared Care Tax Credit, reducing delays in your application process. By enabling signatures online, it eliminates the need for printing or mailing documents, ensuring a faster turnaround and timely submission.

-

What benefits do I gain from using airSlate SignNow for Shared Care Tax Credit applications?

Using airSlate SignNow for your Shared Care Tax Credit applications provides numerous benefits, including increased efficiency, enhanced security, and better document management. You'll have access to a reliable platform that helps you stay organized, focused on your caregiving tasks, and compliant with tax-related requirements.

Get more for Shared Care Tax Credit

- Trio program application pierce college ctcedu pierce ctc form

- Request amp volunteer worker applications and must be completed in full prior to submission form

- Phone 320308 2111 form

- Whole life claim form ivy tech

- Check the semester for which you are submitting your appeal form

- Register now for aua practice management conference aua form

- Articulation partnerships for concorde california form

- Funeral home establishment application tennessee form

Find out other Shared Care Tax Credit

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe