Form MO SCC Shared Care Tax Credit 2021

What is the Form MO SCC Shared Care Tax Credit

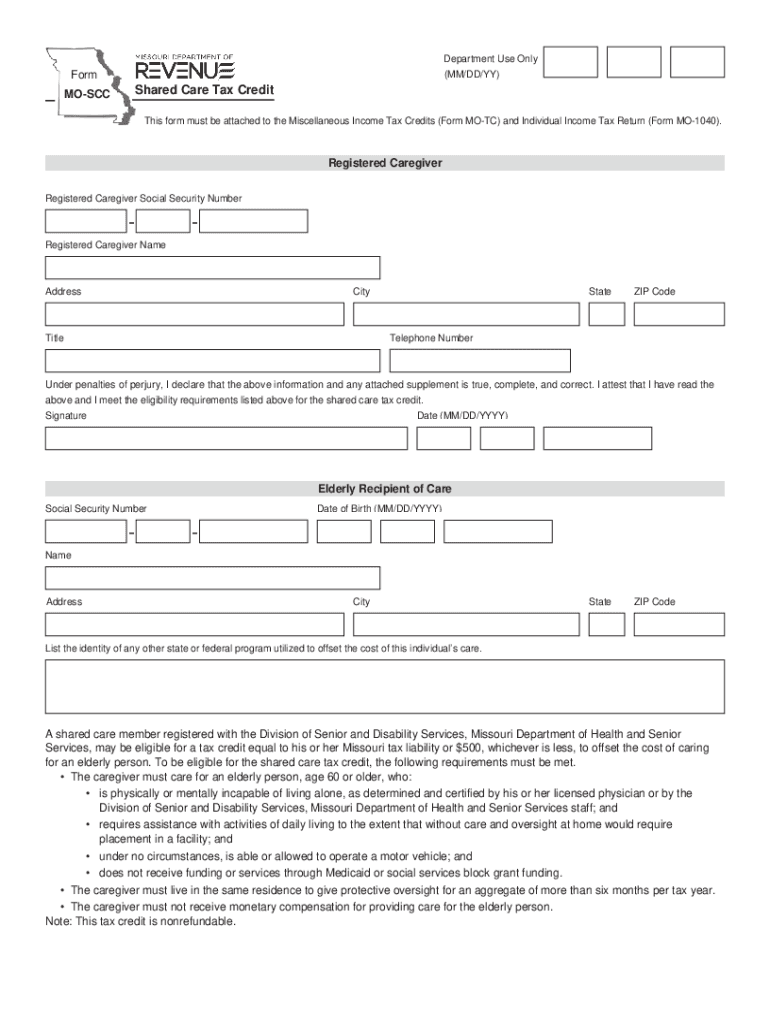

The Form MO SCC Shared Care Tax Credit is a tax form used in Missouri to claim a credit for shared care expenses. This form is designed for taxpayers who incur costs related to the care of dependents, specifically in situations where shared care arrangements are made. It aims to provide financial relief to families managing these expenses while ensuring compliance with state tax regulations.

How to use the Form MO SCC Shared Care Tax Credit

Using the Form MO SCC Shared Care Tax Credit involves several steps. First, gather all necessary documentation that supports your claim, including receipts and records of shared care expenses. Next, accurately fill out the form, ensuring that all required fields are completed. After completing the form, review it for accuracy before submitting it with your tax return. This process ensures that you maximize your potential credit while adhering to state requirements.

Steps to complete the Form MO SCC Shared Care Tax Credit

Completing the Form MO SCC Shared Care Tax Credit involves a systematic approach:

- Gather necessary documents, such as receipts for shared care expenses.

- Fill out personal information, including your name, address, and Social Security number.

- Detail the shared care expenses, specifying the nature of the care and the amount spent.

- Calculate the credit based on the guidelines provided by the state.

- Review the form for any errors or omissions.

- Submit the completed form with your state tax return.

Eligibility Criteria

To qualify for the Form MO SCC Shared Care Tax Credit, taxpayers must meet specific eligibility criteria. This includes having incurred eligible shared care expenses for dependents, being a resident of Missouri, and filing a state tax return. Additionally, the care must be provided by a qualified individual or organization, and the expenses must be substantiated with proper documentation.

Required Documents

When filing the Form MO SCC Shared Care Tax Credit, it is essential to provide supporting documents. Required documents typically include:

- Receipts for all shared care expenses.

- Proof of relationship to the dependent receiving care.

- Any relevant tax forms that may support your claim.

Having these documents ready can streamline the filing process and help ensure that your claim is processed smoothly.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form MO SCC Shared Care Tax Credit is crucial for timely submissions. Generally, the deadline aligns with the state tax return deadline, which is typically April fifteenth. However, taxpayers should verify any changes or extensions that may apply in a given tax year to avoid penalties.

Digital vs. Paper Version

Taxpayers can choose between submitting the Form MO SCC Shared Care Tax Credit digitally or via paper. The digital version often allows for quicker processing and confirmation of receipt, while the paper version may be preferred by those who are more comfortable with traditional filing methods. Regardless of the method chosen, ensuring that all information is accurately completed is vital for compliance and credit approval.

Quick guide on how to complete form mo scc shared care tax credit

Complete Form MO SCC Shared Care Tax Credit effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, alter, and electronically sign your documents swiftly without any hold-ups. Manage Form MO SCC Shared Care Tax Credit on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to amend and electronically sign Form MO SCC Shared Care Tax Credit smoothly

- Find Form MO SCC Shared Care Tax Credit and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or disorganized documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Form MO SCC Shared Care Tax Credit to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo scc shared care tax credit

Create this form in 5 minutes!

How to create an eSignature for the form mo scc shared care tax credit

The way to generate an e-signature for your PDF online

The way to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an e-signature for a PDF document on Android

People also ask

-

What is the formik reset form feature in airSlate SignNow?

The formik reset form feature in airSlate SignNow allows users to easily reset form fields to their initial state. This is particularly useful when users want to clear input data without manually deleting it. Overall, it streamlines the user experience when managing document forms.

-

How can formik reset form improve my document workflow?

Using the formik reset form can greatly enhance your document workflow by enabling quick resets of editable fields. This saves time and reduces errors during the document preparation process. Efficient document management is essential for businesses looking to optimize processes.

-

Is there a cost associated with using the formik reset form feature?

The formik reset form feature is included in all airSlate SignNow plans, allowing users access without additional fees. Our pricing model is designed to be cost-effective, so companies can benefit from powerful tools such as form reset functionality. Explore our pricing options to select a plan that fits your needs.

-

Does airSlate SignNow support integrations with formik?

Yes, airSlate SignNow seamlessly integrates with formik, enabling users to leverage the formik reset form feature alongside our comprehensive digital signing solutions. This integration facilitates a smooth user experience and effective document management. Check our integration options for more details on compatible services.

-

What are the primary benefits of using airSlate SignNow with formik?

Combining airSlate SignNow with formik provides users with enhanced form validation, better state management, and easy form resets. The formik reset form capability empowers businesses to maintain clean and organized documents, optimizing workflows. In addition, our solution is designed for simplicity and efficiency.

-

Can I customize the formik reset form functionality?

Absolutely! airSlate SignNow allows for a high level of customization with the formik reset form feature. Users can tailor the reset action to meet specific needs, making it flexible for various document workflows. Customization options ensure that your forms align with your business requirements.

-

Is training required to utilize the formik reset form efficiently?

No extensive training is necessary to utilize the formik reset form feature in airSlate SignNow. The interface is user-friendly, making it easy for anyone to reset forms quickly. However, we do provide resources and tutorials to help users get the most out of our platform.

Get more for Form MO SCC Shared Care Tax Credit

- Illinois owner llc form

- Illinois claim form 497306039

- Quitclaim deed from husband and wife to an individual illinois form

- Illinois deed to form

- Illinois foreclosure form

- Architect mechanics lien notice and claim corporation or llc illinois form

- Quitclaim deed trust 497306044 form

- Illinois warranty 497306045 form

Find out other Form MO SCC Shared Care Tax Credit

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile