Form MO SCC Shared Care Tax Credit 2024-2026

What is the Form MO SCC Shared Care Tax Credit

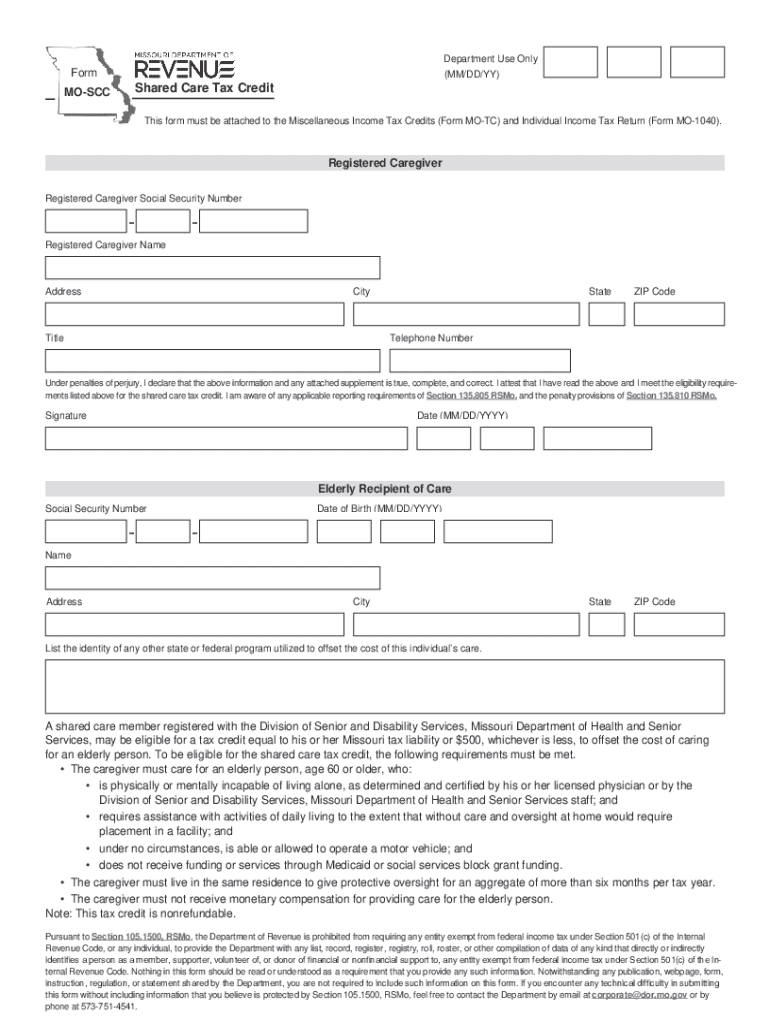

The Form MO SCC Shared Care Tax Credit is a state tax form used in Missouri to apply for a tax credit related to shared care expenses. This form is designed for taxpayers who provide care for dependents and wish to receive financial relief through tax credits. The credit aims to alleviate some of the costs associated with caring for individuals who require assistance, such as children or elderly family members. Understanding this form is essential for eligible taxpayers to maximize their benefits during tax season.

Eligibility Criteria

To qualify for the Form MO SCC Shared Care Tax Credit, applicants must meet specific eligibility requirements. Generally, the applicant must be a resident of Missouri and provide care for a qualifying individual. This may include children under a certain age or adults with disabilities. Additionally, the care provided must meet state guidelines, and the taxpayer must have incurred eligible expenses related to this care. It is important to review the detailed criteria outlined by the Missouri Department of Revenue to ensure compliance.

Steps to Complete the Form MO SCC Shared Care Tax Credit

Completing the Form MO SCC Shared Care Tax Credit involves several key steps. First, gather all necessary documentation, including proof of expenses related to shared care. Next, accurately fill out the form, ensuring that all required fields are completed. Pay special attention to any calculations related to the credit amount. After completing the form, review it for accuracy and completeness before submitting it. Finally, retain a copy of the form and all supporting documents for your records.

Filing Deadlines / Important Dates

Timely submission of the Form MO SCC Shared Care Tax Credit is crucial to ensure eligibility for the tax credit. The filing deadline typically aligns with the regular state tax return deadline, which is usually April fifteenth. However, taxpayers should verify specific dates for the current tax year, as extensions or changes may occur. Being aware of these deadlines helps avoid penalties and ensures that taxpayers can claim their credits without delay.

Required Documents

When completing the Form MO SCC Shared Care Tax Credit, several documents are required to substantiate the claim. Taxpayers should prepare receipts or invoices that detail the expenses incurred for shared care. Additionally, documentation proving the relationship to the dependent receiving care may be necessary. This could include birth certificates or legal guardianship papers. Having these documents ready will streamline the application process and support the validity of the claim.

Form Submission Methods

The Form MO SCC Shared Care Tax Credit can be submitted through various methods, including online, by mail, or in person. For those who prefer digital submission, the Missouri Department of Revenue offers an online portal for filing tax forms. Alternatively, taxpayers can print the completed form and mail it to the appropriate address provided by the state. In-person submissions may also be possible at designated tax offices. Each method has its own processing times, so it is advisable to choose the one that best fits the taxpayer's needs.

Key Elements of the Form MO SCC Shared Care Tax Credit

The Form MO SCC Shared Care Tax Credit includes several key elements that taxpayers must understand. These elements typically consist of personal information, details regarding the qualifying individual, and a section for documenting eligible expenses. Additionally, the form may require calculations to determine the credit amount based on the expenses reported. Familiarizing oneself with these components can help ensure accurate completion and maximize the potential tax credit received.

Create this form in 5 minutes or less

Find and fill out the correct form mo scc shared care tax credit 772045258

Create this form in 5 minutes!

How to create an eSignature for the form mo scc shared care tax credit 772045258

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form MO SCC Shared Care Tax Credit?

The Form MO SCC Shared Care Tax Credit is a tax credit available to eligible taxpayers in Missouri who provide care for a qualifying individual. This form allows caregivers to claim a credit for expenses incurred while caring for individuals with disabilities or elderly family members. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with the Form MO SCC Shared Care Tax Credit?

airSlate SignNow simplifies the process of managing documents related to the Form MO SCC Shared Care Tax Credit. With our eSigning capabilities, you can easily send, sign, and store necessary documents securely. This streamlines your workflow and ensures you meet all deadlines related to tax credit claims.

-

What features does airSlate SignNow offer for managing tax credit forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax credit forms like the Form MO SCC Shared Care Tax Credit. These features enhance efficiency and ensure that all necessary documentation is completed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for the Form MO SCC Shared Care Tax Credit?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses and individuals. Our pricing plans are flexible and cater to various needs, ensuring that you can manage your Form MO SCC Shared Care Tax Credit documentation without breaking the bank.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration allows you to manage your Form MO SCC Shared Care Tax Credit documents alongside your financial records, making the tax filing process more efficient.

-

What are the benefits of using airSlate SignNow for tax credit documentation?

Using airSlate SignNow for your tax credit documentation, including the Form MO SCC Shared Care Tax Credit, offers numerous benefits. You gain access to a user-friendly interface, enhanced security for sensitive documents, and the ability to track the status of your forms in real-time, ensuring a smooth process.

-

How secure is airSlate SignNow when handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive tax documents, including the Form MO SCC Shared Care Tax Credit. You can trust that your information is safe and secure while using our platform.

Get more for Form MO SCC Shared Care Tax Credit

- Physics 4a equation sheet form

- Calculus ii met ma 124 a1 form

- Ppd tb test form required for entry to colorado college

- Vehicle description form

- Form c section 504 parent notification of referralnotice of

- Carefirst cancellation form 2017 2019

- This rental agreement agreement united states pods form

- Section 1 it security checklist form

Find out other Form MO SCC Shared Care Tax Credit

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template