Form2023 Corporation Income Tax Payment Voucher in 2023

Understanding the income tax payment voucher PDF

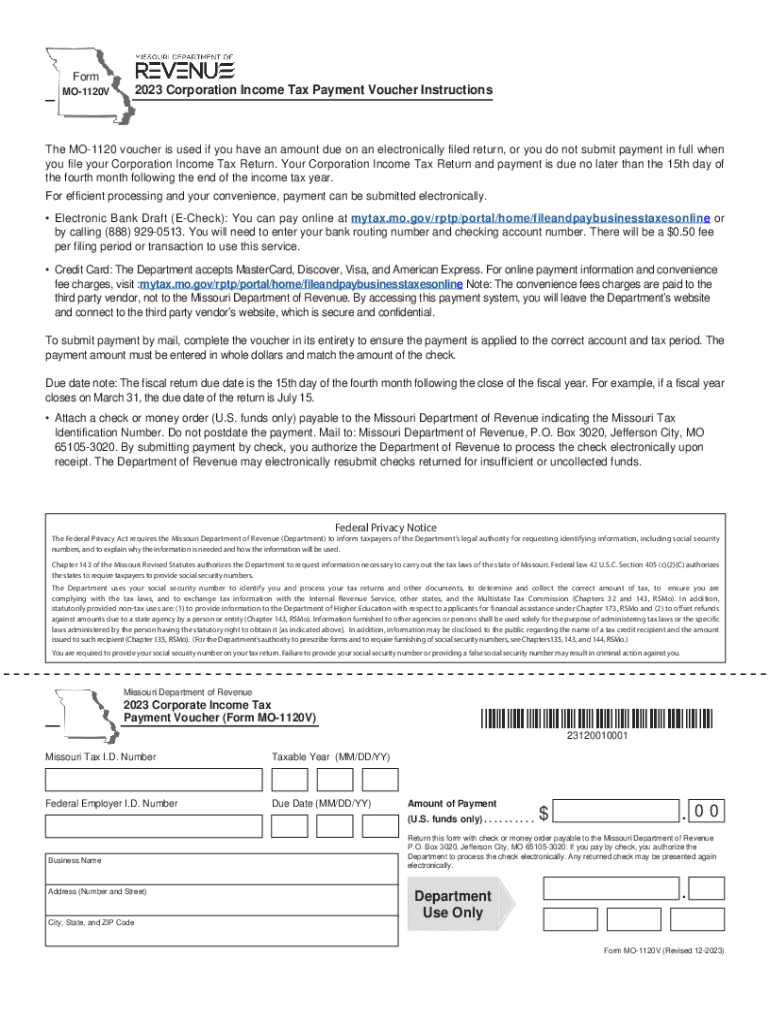

The income tax payment voucher PDF serves as an official document used by corporations to remit their tax payments to the Internal Revenue Service (IRS). This form is essential for ensuring that tax payments are properly documented and credited to the taxpayer's account. It is crucial for corporations to utilize this voucher to avoid any discrepancies in their tax payments.

How to fill out the income tax payment voucher PDF

Completing the income tax payment voucher PDF requires careful attention to detail. First, ensure that all corporate information, including the name, address, and Employer Identification Number (EIN), is accurately filled in. Next, indicate the amount being paid and the tax period for which the payment is being made. Finally, sign and date the voucher to validate the submission. Double-checking all entries helps prevent errors that could lead to payment issues.

Obtaining the income tax payment voucher PDF

The income tax payment voucher PDF can be obtained directly from the IRS website. It is available for download and can be printed for immediate use. Ensure you have the latest version to comply with current tax regulations. Additionally, local tax offices may provide copies upon request, making it accessible for businesses needing assistance.

Filing deadlines for the income tax payment voucher PDF

Corporations must adhere to specific filing deadlines when submitting their income tax payment voucher PDF. Generally, payments are due quarterly, with deadlines typically falling on the 15th day of the month following the end of each quarter. For example, the first quarter payment is due on April 15. It is essential to be aware of these dates to avoid penalties and interest on late payments.

Submission methods for the income tax payment voucher PDF

The income tax payment voucher PDF can be submitted through various methods. Corporations may choose to mail the completed voucher along with their payment to the appropriate IRS address. Alternatively, some businesses opt to make electronic payments through the IRS e-Pay system, which may not require a physical voucher. Understanding the preferred submission method can streamline the payment process.

Key elements of the income tax payment voucher PDF

Important components of the income tax payment voucher PDF include the corporate name, address, EIN, payment amount, and tax period. Additionally, the form typically contains instructions for proper completion and submission. Ensuring that all required fields are filled out accurately is essential for the effective processing of the payment.

Legal implications of the income tax payment voucher PDF

Using the income tax payment voucher PDF correctly is vital for legal compliance. Failure to submit the voucher or inaccuracies in the information provided can lead to penalties, interest charges, or even audits by the IRS. Corporations should maintain copies of submitted vouchers for their records to support their tax filings and payments in case of future inquiries.

Quick guide on how to complete form2023 corporation income tax payment voucher in

Complete Form2023 Corporation Income Tax Payment Voucher In effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can locate the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without lag. Handle Form2023 Corporation Income Tax Payment Voucher In on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Form2023 Corporation Income Tax Payment Voucher In with ease

- Locate Form2023 Corporation Income Tax Payment Voucher In and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that goal.

- Generate your eSignature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form2023 Corporation Income Tax Payment Voucher In and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form2023 corporation income tax payment voucher in

Create this form in 5 minutes!

How to create an eSignature for the form2023 corporation income tax payment voucher in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income tax payment voucher PDF?

An income tax payment voucher PDF is a document that enables taxpayers to pay their income tax dues efficiently. It serves as an official record of your payment and is required for submitting to tax authorities. Utilizing airSlate SignNow makes the process of generating and signing these vouchers seamless.

-

How does airSlate SignNow assist with income tax payment voucher PDFs?

airSlate SignNow streamlines the process of creating and managing income tax payment voucher PDFs. Our platform allows you to customize templates and eSign documents securely, ensuring that your tax payments are processed without delays. This helps you focus on your business rather than paperwork.

-

Can I integrate airSlate SignNow with my accounting software for income tax payment voucher PDFs?

Yes, airSlate SignNow offers integrations with popular accounting software, enabling you to manage income tax payment voucher PDFs effortlessly. This integration ensures that your financial data is consistent and up-to-date across platforms. Simplifying document management has never been easier.

-

What are the pricing options for using airSlate SignNow for income tax payment voucher PDFs?

airSlate SignNow provides flexible pricing plans to accommodate various business sizes and needs, including those focused on income tax payment voucher PDFs. You can choose from different tiers that offer various features tailored to your business requirements, ensuring you get value for your investment.

-

Is it safe to use airSlate SignNow for eSigning income tax payment voucher PDFs?

Absolutely! airSlate SignNow uses advanced security measures, including encryption, to protect all your documents, including income tax payment voucher PDFs. This ensures that your sensitive information remains confidential and secure while you eSign documents.

-

Can I track the status of my income tax payment voucher PDF with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your documents, including income tax payment voucher PDFs. You can easily monitor who has viewed, signed, or completed the document, giving you peace of mind and ensuring accountability in your tax payment processes.

-

Are there templates available for income tax payment voucher PDFs?

Yes, airSlate SignNow offers a variety of customizable templates for income tax payment voucher PDFs. This allows you to create documents quickly and efficiently, ensuring that you meet all regulatory requirements. Our user-friendly interface makes it easy to adapt templates to your specific needs.

Get more for Form2023 Corporation Income Tax Payment Voucher In

- 2018 2019 escc federal direct loan certification form

- Environmental questionnaire and disclosure timberland bank form

- Financial assistance application form atlanticare atlanticare

- Federal direct loan certification form escc

- Cdsc form

- Ncsl forms

- Business card order suny new paltz form

- Emergency rider form

Find out other Form2023 Corporation Income Tax Payment Voucher In

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation