MO 1120V Corporation Income Tax Payment Voucher Instructions 2022

Understanding the Income Tax Payment Voucher

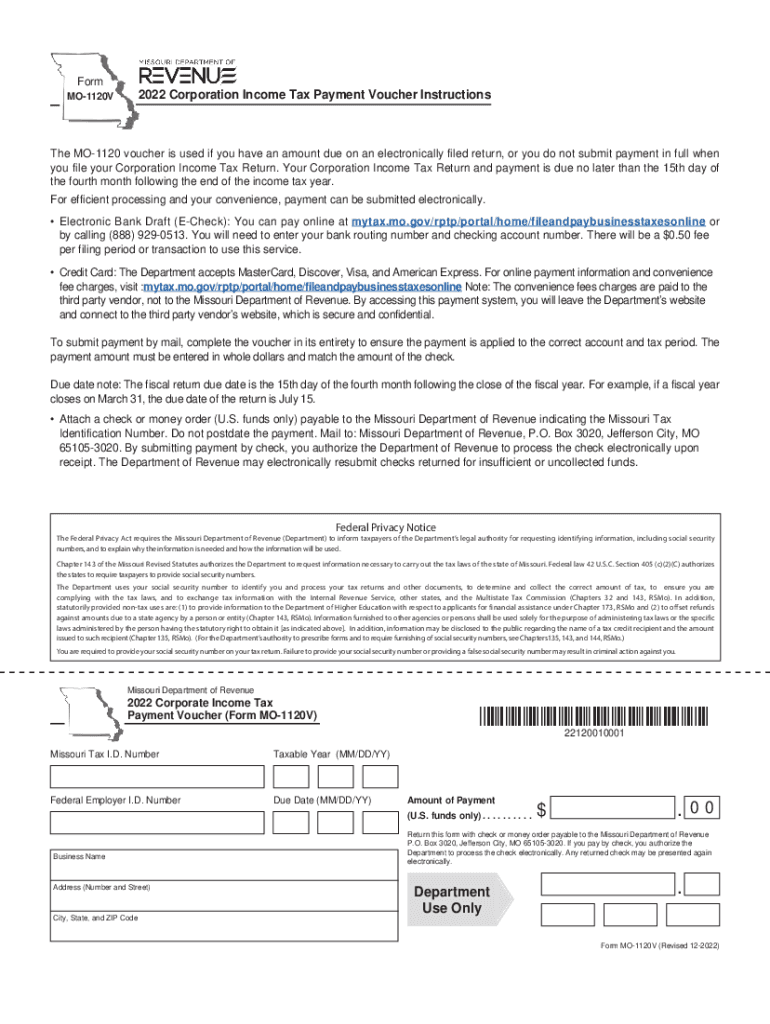

The income tax payment voucher is a crucial document for businesses and individuals who need to remit their tax payments to the Internal Revenue Service (IRS) or state tax authorities. This form serves as a record of the payment made and is essential for accurate tax filing. It typically includes important details such as the taxpayer's identification number, the amount due, and the tax period for which the payment is being made. Understanding how to properly complete and submit this voucher can help ensure compliance with tax obligations and avoid potential penalties.

Steps to Complete the Income Tax Payment Voucher

Completing the income tax payment voucher involves several key steps:

- Gather necessary information, including your taxpayer identification number and the amount owed.

- Clearly indicate the tax period for which the payment is being made.

- Fill out all required fields on the voucher, ensuring accuracy to prevent delays.

- Review the completed voucher for any errors or omissions.

- Sign and date the voucher where indicated.

Following these steps carefully will help ensure that your payment is processed smoothly.

Legal Use of the Income Tax Payment Voucher

The income tax payment voucher is legally recognized as a valid method for submitting tax payments. It is important to use this form correctly to avoid complications with tax authorities. By submitting the voucher along with your payment, you create a documented trail that can be referenced in case of audits or disputes. Always retain a copy of the completed voucher for your records, as it may be required for future reference.

Filing Deadlines and Important Dates

Timely submission of the income tax payment voucher is essential to avoid penalties. Key deadlines typically include:

- Quarterly estimated tax payment deadlines, which generally fall on the 15th of April, June, September, and January.

- Annual tax return filing deadlines, which are usually on April 15th for individuals and March 15th for corporations.

Staying informed about these dates can help ensure compliance with tax regulations.

Form Submission Methods

The income tax payment voucher can be submitted through various methods, including:

- Online payment through the IRS website or state tax authority portals.

- Mailing the completed voucher along with your payment to the appropriate tax office.

- In-person submission at designated tax offices, if available.

Choosing the right submission method can depend on personal preference and the urgency of the payment.

Penalties for Non-Compliance

Failure to submit the income tax payment voucher on time can result in significant penalties. These may include:

- Late payment penalties, which can accrue over time and increase the total amount owed.

- Interest charges on unpaid balances, compounding daily until the payment is made.

- Potential legal action from tax authorities for persistent non-compliance.

Understanding these consequences emphasizes the importance of timely and accurate submission of the voucher.

Quick guide on how to complete mo 1120v corporation income tax payment voucher instructions

Effortlessly Prepare MO 1120V Corporation Income Tax Payment Voucher Instructions on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without any delays. Handle MO 1120V Corporation Income Tax Payment Voucher Instructions on any platform through airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign MO 1120V Corporation Income Tax Payment Voucher Instructions with Ease

- Obtain MO 1120V Corporation Income Tax Payment Voucher Instructions and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes only moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to submit your form—via email, text message (SMS), invitation link, or download it onto your PC.

Eliminate concerns about lost or misplaced documents, tiresome form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign MO 1120V Corporation Income Tax Payment Voucher Instructions to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo 1120v corporation income tax payment voucher instructions

Create this form in 5 minutes!

How to create an eSignature for the mo 1120v corporation income tax payment voucher instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income tax payment voucher?

An income tax payment voucher is a document used by individuals and businesses to make payments towards their income tax liabilities. It is essential for ensuring that tax payments are properly recorded and attributed to the correct taxpayer. Utilizing tools like airSlate SignNow streamlines the process of managing and submitting these vouchers.

-

How does airSlate SignNow help with income tax payment vouchers?

airSlate SignNow provides a user-friendly platform for creating, sending, and electronically signing income tax payment vouchers. This simplifies the process for both individuals and businesses, ensuring that they can efficiently manage their tax obligations. Additionally, it enhances compliance and reduces errors associated with manual processing.

-

Is there a cost to use airSlate SignNow for income tax payment vouchers?

Yes, airSlate SignNow offers various pricing plans that accommodate different business needs. Each plan provides access to features that facilitate the creation and management of income tax payment vouchers. You can select a plan that fits within your budget while benefiting from our efficient services.

-

What features does airSlate SignNow offer for income tax payment vouchers?

airSlate SignNow offers several features beneficial for handling income tax payment vouchers, such as customizable templates, automated reminders, and secure electronic signatures. These features ensure that your tax vouchers are always accurate and submitted on time. Furthermore, the ease of use makes it ideal for both individuals and businesses.

-

Can I integrate airSlate SignNow with other accounting software for income tax payment vouchers?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software solutions. This integration allows users to easily manage their income tax payment vouchers within their existing workflows. It's a convenient way to ensure all financial documentation is in one place, enhancing overall productivity.

-

What benefits do I gain from using airSlate SignNow for income tax payment vouchers?

Using airSlate SignNow for income tax payment vouchers provides several benefits, including improved efficiency, reduced paper waste, and enhanced security. The electronic signing process ensures faster turnaround times for payment confirmations. Ultimately, it allows you to focus more on your business rather than paperwork.

-

How secure is the process of handling income tax payment vouchers with airSlate SignNow?

Security is a top priority for airSlate SignNow when managing income tax payment vouchers. The platform utilizes industry-standard encryption and secure data storage to protect sensitive information. You can trust that your tax and personal data will remain confidential while using our services.

Get more for MO 1120V Corporation Income Tax Payment Voucher Instructions

- Background history form bh 3

- Business license application city of lathrop ci lathrop ca form

- Dog licensethe city of santa anadog license feessanta cruz county animal shelteranimal licenseslos angeles animal form

- Greenport form

- Wwwfloridaprofessionallicenseattorneycomwpstate of florida department of business and professional form

- Trophy club txofficial websitetrophy club txofficial websitetrophy club txofficial website form

- Sf234 fire extinguisher license registration and test information

- Food service permit form

Find out other MO 1120V Corporation Income Tax Payment Voucher Instructions

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online