MO 1120V Corporation Income Tax Payment Voucher Instructions 2024-2026

What is the MO 1120V Corporation Income Tax Payment Voucher?

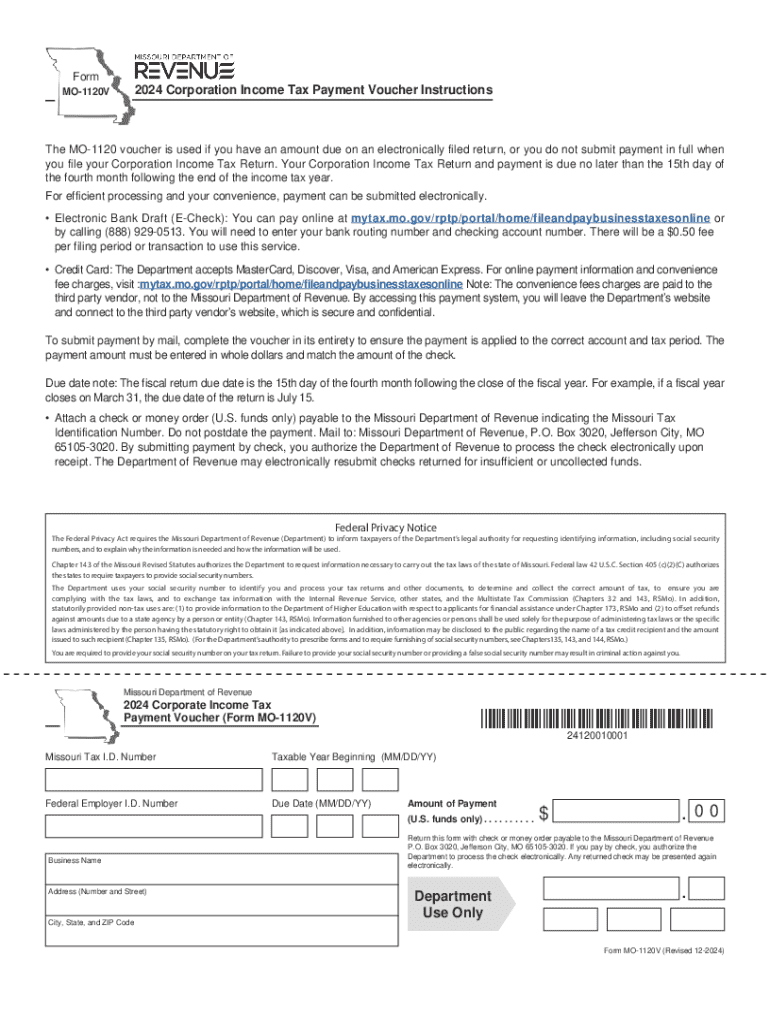

The MO 1120V Corporation Income Tax Payment Voucher is a form used by corporations in Missouri to submit their income tax payments. This voucher serves as a record of the payment made towards the corporation's tax liability. It is essential for ensuring that payments are correctly applied to the corporation's tax account with the Missouri Department of Revenue. Understanding the purpose of this voucher is crucial for compliance with state tax regulations.

How to Use the MO 1120V Corporation Income Tax Payment Voucher

To effectively use the MO 1120V Corporation Income Tax Payment Voucher, corporations need to complete the form accurately. This involves entering the corporation's name, address, and tax identification number. Additionally, the amount of payment being submitted must be clearly stated. Once completed, the voucher should accompany the payment, whether sent by mail or submitted in person. Proper usage of this voucher helps ensure timely processing of tax payments.

Steps to Complete the MO 1120V Corporation Income Tax Payment Voucher

Completing the MO 1120V Corporation Income Tax Payment Voucher involves several key steps:

- Gather necessary information, including the corporation's tax identification number and payment amount.

- Fill in the corporation's name and address in the designated fields on the voucher.

- Clearly indicate the payment amount and ensure it matches the amount due.

- Review the completed voucher for accuracy before submission.

Following these steps helps reduce errors and ensures the payment is processed efficiently.

Filing Deadlines and Important Dates

Corporations must be aware of the filing deadlines associated with the MO 1120V Corporation Income Tax Payment Voucher. Typically, payments are due on the same date as the corporation's income tax return. It is essential to stay informed about any changes to these dates to avoid penalties. Marking these deadlines on a calendar can help ensure timely submissions.

Penalties for Non-Compliance

Failure to submit the MO 1120V Corporation Income Tax Payment Voucher on time can result in penalties. These may include late fees or interest on unpaid amounts. Understanding the potential consequences of non-compliance emphasizes the importance of timely and accurate submissions. Corporations should prioritize adherence to tax obligations to avoid unnecessary financial burdens.

Who Issues the Form

The MO 1120V Corporation Income Tax Payment Voucher is issued by the Missouri Department of Revenue. This state agency is responsible for administering tax laws and collecting revenue. Corporations should ensure they are using the most current version of the voucher to comply with state requirements. Regularly checking for updates from the Department of Revenue can help maintain compliance.

Create this form in 5 minutes or less

Find and fill out the correct mo 1120v corporation income tax payment voucher instructions 772011896

Create this form in 5 minutes!

How to create an eSignature for the mo 1120v corporation income tax payment voucher instructions 772011896

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income tax payment voucher?

An income tax payment voucher is a document used to make payments towards your income tax obligations. It provides essential details such as the taxpayer's information and the amount due. Using an income tax payment voucher ensures that your payments are properly recorded and processed by tax authorities.

-

How can airSlate SignNow help with income tax payment vouchers?

airSlate SignNow simplifies the process of creating and sending income tax payment vouchers. Our platform allows you to easily eSign and share these documents securely, ensuring that your tax payments are submitted on time. With airSlate SignNow, you can streamline your tax payment process and reduce the risk of errors.

-

Is there a cost associated with using airSlate SignNow for income tax payment vouchers?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage your income tax payment vouchers efficiently. You can choose a plan that fits your budget while enjoying all the features we offer.

-

What features does airSlate SignNow offer for managing income tax payment vouchers?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for income tax payment vouchers. These tools help you create professional-looking vouchers quickly and ensure that you can monitor their status. Our platform enhances your workflow, making tax payments easier and more efficient.

-

Can I integrate airSlate SignNow with other software for income tax payment vouchers?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to manage your income tax payment vouchers seamlessly. Whether you use accounting software or other business tools, our integrations help streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for income tax payment vouchers?

Using airSlate SignNow for your income tax payment vouchers offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform ensures that your documents are signed and sent quickly, reducing the risk of late payments. Additionally, the secure storage of your vouchers protects sensitive information.

-

How does airSlate SignNow ensure the security of my income tax payment vouchers?

airSlate SignNow prioritizes the security of your income tax payment vouchers by employing advanced encryption and secure cloud storage. Our platform complies with industry standards to protect your data from unauthorized access. You can trust that your sensitive tax information is safe with us.

Get more for MO 1120V Corporation Income Tax Payment Voucher Instructions

- Semester to semester plan form

- Csd template form

- Bmo resp withdrawal form

- Domestic partner affidavit section 1 employeedomestic bb gpc form

- Lithium battery safety document template 210062639 form

- Grease interceptor cleaning record lcats form

- Auto draft payment agreement form

- Idaho state board of social work examiners idaho d form

Find out other MO 1120V Corporation Income Tax Payment Voucher Instructions

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement