Adoption Carry Forward Tax Credit Error on Turbo Tax's Form 2023-2026

Understanding the Adoption Carry Forward Tax Credit

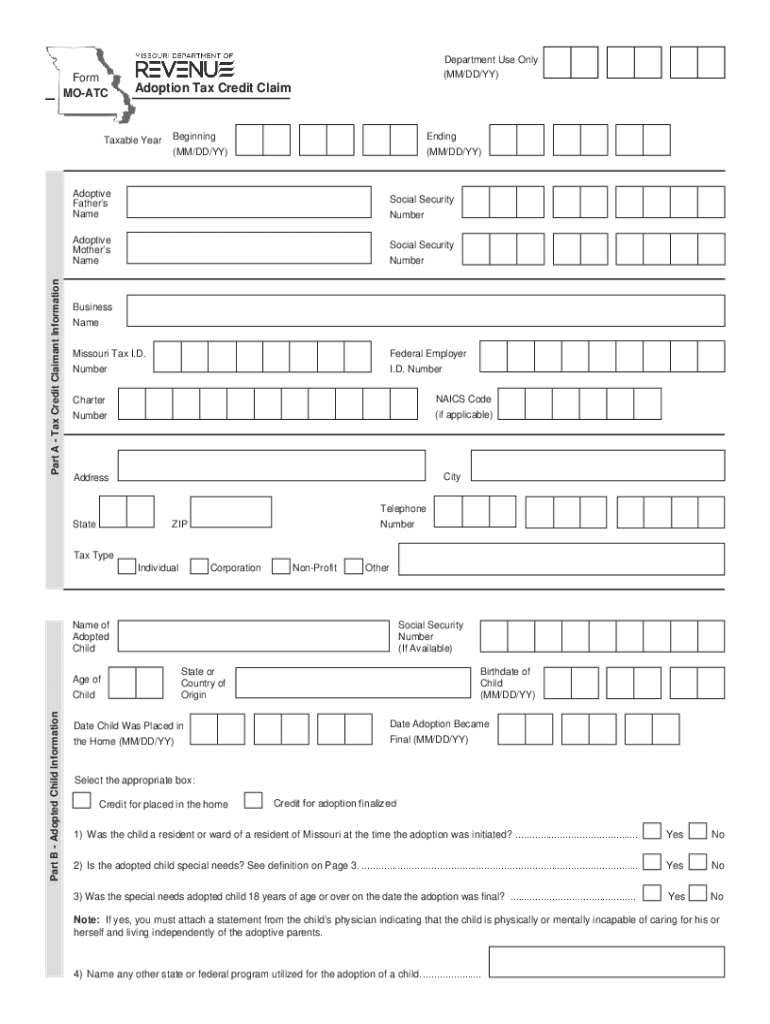

The Adoption Carry Forward Tax Credit allows taxpayers to claim a credit for qualified adoption expenses. This credit can be carried forward to future tax years if it exceeds the taxpayer's tax liability in the year the expenses were incurred. Understanding the eligibility criteria and the specific expenses that qualify is essential for maximizing this benefit.

Steps to Complete the Adoption Carry Forward Tax Credit Form

To complete the Adoption Carry Forward Tax Credit form accurately, follow these steps:

- Gather all necessary documentation related to your adoption expenses, including receipts and invoices.

- Fill out the form with your personal information, ensuring accuracy in your name, address, and Social Security number.

- Detail your qualified adoption expenses in the designated section of the form.

- Calculate the credit amount based on the total expenses and applicable limits for the tax year.

- Review the completed form for any errors before submission.

Required Documents for the Adoption Carry Forward Tax Credit

When applying for the Adoption Carry Forward Tax Credit, you will need to provide specific documents to support your claim. Required documents may include:

- Receipts for adoption-related expenses, such as agency fees and legal costs.

- Proof of the adoption's finalization, such as a court order.

- Any relevant tax forms from previous years if you are carrying forward unused credits.

IRS Guidelines for the Adoption Carry Forward Tax Credit

The IRS provides specific guidelines regarding the Adoption Carry Forward Tax Credit. Taxpayers should familiarize themselves with:

- The maximum allowable credit amount for each tax year.

- Specific qualifying expenses that can be claimed.

- The process for carrying forward unused credits to future tax years.

Filing Deadlines for the Adoption Carry Forward Tax Credit

It is important to be aware of the filing deadlines for claiming the Adoption Carry Forward Tax Credit. Generally, the deadline aligns with the federal tax return due date, which is typically April 15. However, if you file for an extension, ensure to submit the form by the extended deadline.

Eligibility Criteria for the Adoption Carry Forward Tax Credit

To qualify for the Adoption Carry Forward Tax Credit, taxpayers must meet certain eligibility criteria. Key criteria include:

- The adoption must be finalized within the tax year for which the credit is being claimed.

- Expenses must be directly related to the adoption process.

- Taxpayers must have a tax liability to offset with the credit.

Quick guide on how to complete adoption carry forward tax credit error on turbo taxs form

Prepare Adoption Carry Forward Tax Credit Error On Turbo Tax's Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Adoption Carry Forward Tax Credit Error On Turbo Tax's Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-focused process today.

How to edit and eSign Adoption Carry Forward Tax Credit Error On Turbo Tax's Form without breaking a sweat

- Obtain Adoption Carry Forward Tax Credit Error On Turbo Tax's Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to submit your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Adoption Carry Forward Tax Credit Error On Turbo Tax's Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct adoption carry forward tax credit error on turbo taxs form

Create this form in 5 minutes!

How to create an eSignature for the adoption carry forward tax credit error on turbo taxs form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the atc credit form and how does it work?

The atc credit form is a digital document that allows users to apply for credits efficiently. By using airSlate SignNow, you can complete the atc credit form electronically, ensuring faster processing and fewer errors. This user-friendly solution simplifies the paperwork involved in the credit application process.

-

How can I access the atc credit form using airSlate SignNow?

You can easily access the atc credit form by logging into your airSlate SignNow account and navigating to the templates section. From there, you can either create a new atc credit form or use an existing template. The platform allows seamless customization to meet your specific needs.

-

Is there a cost associated with using the atc credit form?

Using the atc credit form through airSlate SignNow comes with flexible pricing plans tailored for various business sizes. We offer competitive rates that ensure you can efficiently manage your credit applications without breaking the bank. Explore our pricing options to find the best fit for your business.

-

What features does airSlate SignNow offer for the atc credit form?

airSlate SignNow provides a host of features for the atc credit form, such as eSignature capabilities, document tracking, and secure data storage. Additionally, our platform allows for multiple users to collaborate on the atc credit form, speeding up the process while maintaining security. These features enhance your efficiency and provide peace of mind.

-

Can I integrate the atc credit form with other software?

Yes, airSlate SignNow allows seamless integration of the atc credit form with popular software applications like Google Drive, Dropbox, and CRM systems. This integration capability streamlines your workflow, making it easier to manage your documents. You can connect your existing tools to enhance productivity and efficiency.

-

What are the benefits of using airSlate SignNow for the atc credit form?

Using airSlate SignNow for the atc credit form comes with numerous benefits, including enhanced convenience, speed, and security. Digital signatures ensure that your applications are processed quickly while reducing the risk of paper loss. Additionally, the platform's user-friendly design allows anyone to use it effortlessly.

-

How secure is my information when filling out the atc credit form?

airSlate SignNow prioritizes your data security with bank-level encryption and secure data storage protocols. When filling out the atc credit form, all your information is protected to ensure compliance with regulations. We make security a top priority so you can focus on what matters most.

Get more for Adoption Carry Forward Tax Credit Error On Turbo Tax's Form

- Application for continuing certificate form

- Drivers ed packet from texas department of licensing and regulation form

- Nar 77 78 2011 form

- Tx contractor registration form

- Texas barber shop permit form

- Pwe 100 city houston standard form

- Houston works form

- City of houston instructions for filing form pwe 100 documents publicworks houstontx

Find out other Adoption Carry Forward Tax Credit Error On Turbo Tax's Form

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online