Dor Mo GovformsMO ATC2020Form MO ATC Adoption Tax Credit Claim 2022

What is the Missouri ATC Adoption Tax Credit Claim?

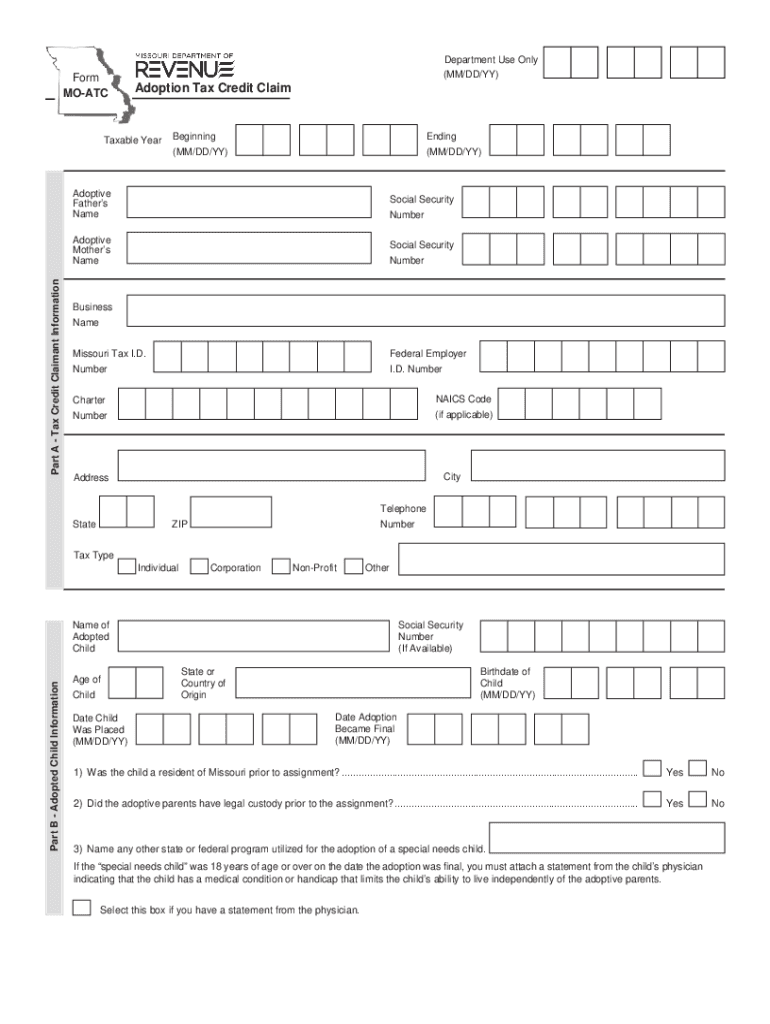

The Missouri ATC, or Adoption Tax Credit, is a tax benefit designed to assist families who adopt children. This credit helps offset the costs associated with adoption, making it more accessible for families in Missouri. The form used to claim this credit is known as the Missouri ATC form, specifically the 2022 version. It is essential for applicants to understand the eligibility criteria and the specific expenses that can be claimed under this program.

Steps to Complete the Missouri ATC Adoption Tax Credit Claim

Completing the Missouri ATC form involves several key steps:

- Gather all necessary documentation related to the adoption, including legal papers and receipts for qualifying expenses.

- Fill out the Missouri ATC form accurately, ensuring all required fields are completed.

- Calculate the total eligible adoption expenses to determine the credit amount.

- Review the form for accuracy before submission to avoid delays or rejections.

- Submit the completed form by the specified deadline, either online or via mail.

Eligibility Criteria for the Missouri ATC Adoption Tax Credit Claim

To qualify for the Missouri ATC, applicants must meet specific eligibility requirements. These include:

- The child must be under the age of eighteen at the time of adoption.

- The adoption must be finalized and legally recognized in Missouri.

- Applicants must have incurred qualifying expenses related to the adoption process.

- Income limits may apply, affecting the amount of credit available.

Required Documents for the Missouri ATC Adoption Tax Credit Claim

When applying for the Missouri ATC, certain documents are essential to substantiate the claim:

- Finalized adoption decree or court order.

- Receipts for all qualifying expenses, such as agency fees, legal costs, and travel expenses.

- Proof of income, if applicable, to determine eligibility based on income limits.

Form Submission Methods for the Missouri ATC Adoption Tax Credit Claim

The Missouri ATC form can be submitted through various methods to accommodate different preferences:

- Online submission through the Missouri Department of Revenue website, which may provide a faster processing time.

- Mailing the completed form to the appropriate address as indicated on the form.

- In-person submission at designated state offices, allowing for immediate confirmation of receipt.

Key Elements of the Missouri ATC Adoption Tax Credit Claim

Understanding the key elements of the Missouri ATC form is crucial for successful completion:

- Identification information, including the taxpayer's name, address, and Social Security number.

- Details about the adopted child, including their name, date of birth, and relationship to the taxpayer.

- A breakdown of qualifying expenses and the total amount being claimed for the tax credit.

Quick guide on how to complete dormogovformsmo atc2020form mo atc adoption tax credit claim

Complete Dor mo govformsMO ATC2020Form MO ATC Adoption Tax Credit Claim effortlessly on any device

Online document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Handle Dor mo govformsMO ATC2020Form MO ATC Adoption Tax Credit Claim on any device through airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Dor mo govformsMO ATC2020Form MO ATC Adoption Tax Credit Claim effortlessly

- Locate Dor mo govformsMO ATC2020Form MO ATC Adoption Tax Credit Claim and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure confidential information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which only takes a few seconds and bears the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to store your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Alter and eSign Dor mo govformsMO ATC2020Form MO ATC Adoption Tax Credit Claim to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dormogovformsmo atc2020form mo atc adoption tax credit claim

Create this form in 5 minutes!

People also ask

-

What is the Missouri ATC and how can airSlate SignNow help my business?

The Missouri ATC, or Missouri Alcohol and Tobacco Control, regulates the sale and distribution of alcohol and tobacco in Missouri. airSlate SignNow empowers businesses in compliance with Missouri ATC regulations by providing a streamlined solution for sending and eSigning essential documents. This ensures that your business adheres to local laws while optimizing document workflows.

-

How does airSlate SignNow ensure compliance with Missouri ATC regulations?

airSlate SignNow offers features that facilitate compliance with Missouri ATC by providing secure and verifiable eSignatures for contracts and permits. The platform's audit trails and document storage capabilities ensure that all signed documents meet the standards set by the Missouri ATC. This reduces risks and increases confidence in meeting regulatory requirements.

-

What are the pricing options for airSlate SignNow for Missouri ATC-related businesses?

airSlate SignNow offers various pricing plans tailored to different business needs, including those in industries regulated by Missouri ATC. Pricing is competitive and designed to be cost-effective for businesses looking to streamline their document processes. Check our website for specific pricing details, including monthly and annual plans.

-

What features does airSlate SignNow provide for Missouri ATC compliance?

airSlate SignNow comes equipped with features such as legally binding eSignatures, customizable templates, and robust security measures, which are essential for compliance with Missouri ATC. Additionally, it integrates seamlessly with other tools, facilitating an efficient workflow for businesses that need to manage documents related to alcohol and tobacco control in Missouri.

-

Can airSlate SignNow integrate with other software used for Missouri ATC documentation?

Yes, airSlate SignNow offers integrations with various applications commonly used in businesses dealing with Missouri ATC documentation. This includes CRM systems, project management software, and cloud storage solutions, allowing for a cohesive and efficient workflow while maintaining compliance with Missouri ATC requirements.

-

How does using airSlate SignNow benefit businesses working with the Missouri ATC?

Using airSlate SignNow benefits businesses by dramatically reducing the time spent on document management, which is particularly important when dealing with regulations from the Missouri ATC. The platform enhances productivity by allowing teams to collect eSignatures quickly and securely, enabling faster approval processes and increased compliance with state regulations.

-

Is airSlate SignNow suitable for small businesses that need to comply with Missouri ATC?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it suitable for small businesses in Missouri that must comply with ATC requirements. The platform provides essential tools for document management and eSigning without a steep learning curve or high cost, ensuring small businesses can stay compliant.

Get more for Dor mo govformsMO ATC2020Form MO ATC Adoption Tax Credit Claim

- New hampshire letter 497318655 form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase new hampshire form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant new hampshire form

- New hampshire landlord notice form

- New hampshire letter 497318659 form

- Temporary lease agreement to prospective buyer of residence prior to closing new hampshire form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction new form

- Letter from landlord to tenant returning security deposit less deductions new hampshire form

Find out other Dor mo govformsMO ATC2020Form MO ATC Adoption Tax Credit Claim

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors