505 Nonresident Income Tax Return Instructions 2023

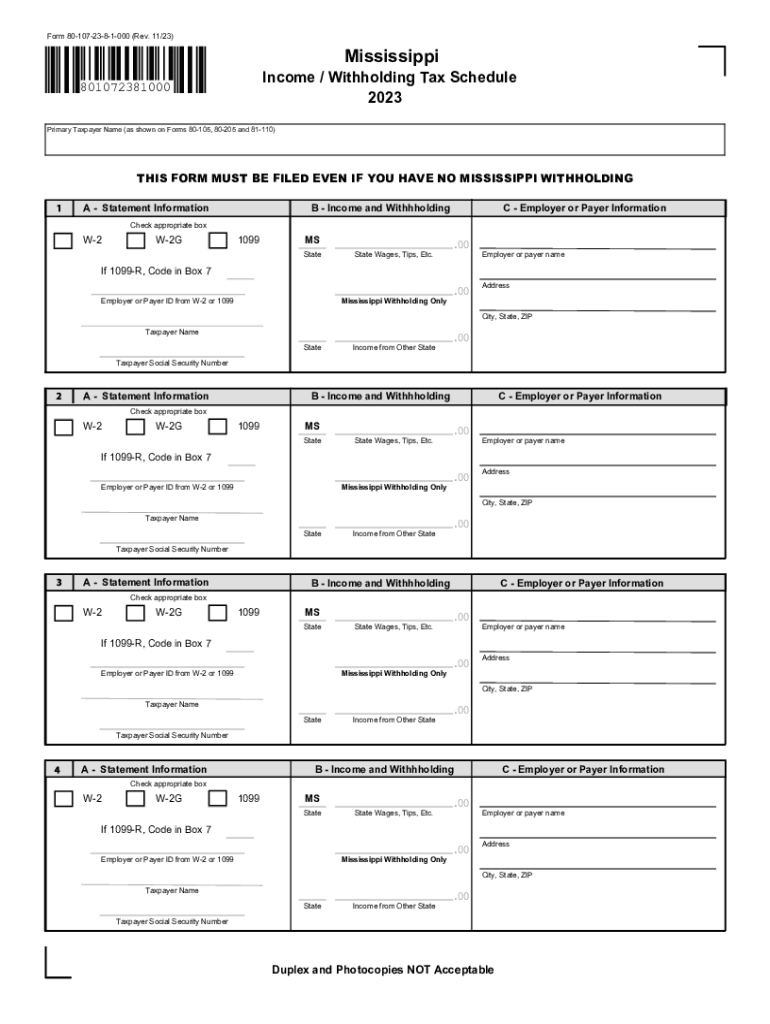

What is Form 107?

Form 107 is a tax document used primarily for reporting nonresident income tax obligations in the United States. This form is essential for individuals who earn income in a state where they do not reside. It allows nonresidents to accurately report their income and calculate the tax owed to the state where the income was generated. Understanding the purpose of Form 107 is crucial for compliance with state tax laws and for avoiding potential penalties.

Key Elements of Form 107

Form 107 includes several key elements that taxpayers must complete to ensure accurate reporting. These elements typically consist of:

- Personal Information: Taxpayers must provide their name, address, and Social Security number.

- Income Details: This section requires a breakdown of income earned in the state, including wages, rental income, and other sources.

- Deductions: Taxpayers can claim specific deductions applicable to nonresidents, which may reduce their taxable income.

- Tax Calculation: This part of the form guides users through calculating the total tax owed based on the reported income and applicable rates.

Steps to Complete Form 107

Completing Form 107 involves several straightforward steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out the personal information section accurately.

- Report all income earned in the state where you are filing.

- Apply any eligible deductions to your total income.

- Calculate the tax owed based on the state’s tax rates.

- Review the form for accuracy before submission.

Filing Deadlines for Form 107

It is important to be aware of the filing deadlines associated with Form 107 to avoid penalties. Typically, the deadline for submitting Form 107 aligns with the federal tax filing deadline, which is April 15 each year. However, some states may have different deadlines, so it is advisable to check the specific requirements for the state in which you are filing.

Penalties for Non-Compliance

Failure to file Form 107 or inaccuracies in reporting can lead to significant penalties. States may impose fines, interest on unpaid taxes, and even legal action for non-compliance. It is essential to ensure that Form 107 is completed accurately and submitted on time to avoid these consequences.

Legal Use of Form 107

Form 107 is legally recognized as a valid document for reporting nonresident income tax. It is essential for individuals who earn income in a state where they do not reside, ensuring compliance with state tax laws. Proper use of this form helps maintain transparency with tax authorities and supports the accurate assessment of tax obligations.

Quick guide on how to complete 505 nonresident income tax return instructions

Complete 505 Nonresident Income Tax Return Instructions effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the right form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without any holdups. Handle 505 Nonresident Income Tax Return Instructions on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest way to modify and eSign 505 Nonresident Income Tax Return Instructions without any hassle

- Find 505 Nonresident Income Tax Return Instructions and then click Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Select relevant sections of your documents or conceal sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Determine how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate the printing of new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and eSign 505 Nonresident Income Tax Return Instructions and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 505 nonresident income tax return instructions

Create this form in 5 minutes!

How to create an eSignature for the 505 nonresident income tax return instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 107 and how is it used in airSlate SignNow?

Form 107 refers to a specific document template available in airSlate SignNow that streamlines the process of eSigning documents. Users can easily fill out and sign this form electronically, reducing paperwork and ensuring faster transaction times. With airSlate SignNow, managing Form 107 is simple and efficient, making it ideal for businesses of all sizes.

-

How much does it cost to use airSlate SignNow for managing Form 107?

airSlate SignNow offers various pricing plans designed to accommodate different business needs. Whether you are a small business or a large enterprise, you can find an affordable plan that includes features for effectively handling Form 107. Check the pricing page for specific details and any promotional offers available.

-

What features does airSlate SignNow provide for Form 107?

AirSlate SignNow offers numerous features to enhance the handling of Form 107, including customizable templates, automated workflows, and real-time tracking. Users can easily set up reminders for signers and ensure compliance with legal standards. These features ensure that your form processing is not only faster but also secure.

-

Can I integrate Form 107 with other software using airSlate SignNow?

Yes, airSlate SignNow supports a variety of integrations with popular software applications, enabling seamless handling of Form 107. You can connect it with CRM systems, cloud storage solutions, and other business tools. This flexibility allows users to streamline their workflows and enhance overall productivity.

-

What are the benefits of using airSlate SignNow for Form 107?

Using airSlate SignNow for Form 107 provides several benefits, including enhanced speed, security, and convenience. Users can eSign documents from anywhere, eliminating the need for physical signatures and paper handling. Additionally, the platform ensures that all data is secure and complies with legal standards.

-

Is it easy to get started with airSlate SignNow for Form 107?

Absolutely! Getting started with airSlate SignNow for Form 107 is straightforward and user-friendly. Simply create an account, access the Form 107 template, and begin customizing your documents in just a few clicks. The intuitive interface makes it easy for anyone, regardless of technical expertise, to navigate.

-

How does airSlate SignNow ensure the security of documents like Form 107?

AirSlate SignNow employs advanced security measures to protect documents like Form 107. The platform uses encryption protocols during data transmission, ensuring that sensitive information remains confidential. Additionally, users can set access controls and audit trails to maintain compliance and secure all transactions.

Get more for 505 Nonresident Income Tax Return Instructions

Find out other 505 Nonresident Income Tax Return Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors