Mississippi Income Withholding Tax Schedule Form 2024-2026

What is the Mississippi Income Withholding Tax Schedule Form

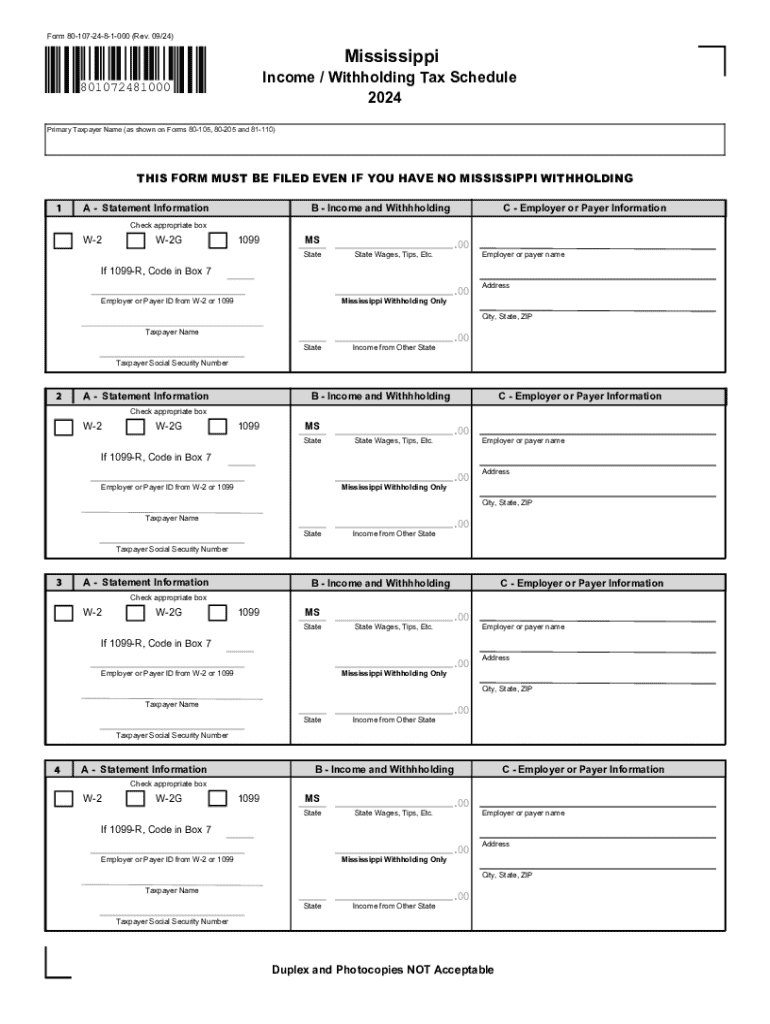

The Mississippi Income Withholding Tax Schedule Form, commonly referred to as the MS 80 107, is a crucial document used by employers to report and remit state income tax withheld from employees' wages. This form is designed to ensure compliance with Mississippi tax laws and to facilitate the proper collection of state income taxes. Employers must accurately complete this form to reflect the total amount withheld during a specific reporting period, thereby contributing to the state's revenue system.

How to use the Mississippi Income Withholding Tax Schedule Form

To effectively use the MS 80 107 form, employers should first gather all necessary payroll information, including total wages paid, the amount withheld for state income tax, and any exemptions that may apply. The form requires detailed entries, including employee names, Social Security numbers, and the corresponding amounts withheld. After completing the form, employers must submit it to the Mississippi Department of Revenue by the specified deadlines to avoid penalties.

Steps to complete the Mississippi Income Withholding Tax Schedule Form

Completing the MS 80 107 form involves several key steps:

- Gather payroll records for the reporting period.

- Enter the total wages paid to each employee.

- Calculate and input the total amount of state income tax withheld.

- Include any applicable exemptions or adjustments.

- Review the form for accuracy before submission.

Once completed, the form can be submitted online, by mail, or in person, depending on the employer's preference.

Key elements of the Mississippi Income Withholding Tax Schedule Form

The MS 80 107 form includes several key elements that are essential for accurate reporting. These elements typically include:

- Employer information, including name, address, and tax identification number.

- Employee details, such as names and Social Security numbers.

- Total wages paid during the reporting period.

- Total state income tax withheld.

- Signature of the employer or authorized representative.

Each of these components must be filled out correctly to ensure compliance with state regulations.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the MS 80 107 form to avoid penalties. Typically, the form is due on a quarterly basis, with deadlines falling on the last day of the month following the end of each quarter. For example, the deadlines for the first quarter are April 30, for the second quarter are July 31, for the third quarter are October 31, and for the fourth quarter are January 31 of the following year. It is essential for employers to keep track of these dates to ensure timely submissions.

Penalties for Non-Compliance

Failure to submit the MS 80 107 form on time or inaccuracies in reporting can result in penalties imposed by the Mississippi Department of Revenue. These penalties may include fines based on the amount of tax due, interest on unpaid taxes, and potential legal action for continued non-compliance. Employers are encouraged to maintain accurate records and submit the form promptly to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct mississippi income withholding tax schedule form

Create this form in 5 minutes!

How to create an eSignature for the mississippi income withholding tax schedule form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ms 80 107 and how does it relate to airSlate SignNow?

The ms 80 107 is a specific designation that refers to a set of features and functionalities within airSlate SignNow. This designation helps users understand the capabilities of our eSigning solution, ensuring they can efficiently manage document workflows. By leveraging ms 80 107, businesses can streamline their signing processes and enhance productivity.

-

How much does airSlate SignNow cost for users interested in ms 80 107?

Pricing for airSlate SignNow varies based on the features included in the ms 80 107 package. We offer flexible subscription plans that cater to different business sizes and needs. For detailed pricing information, it's best to visit our pricing page or contact our sales team for a personalized quote.

-

What features are included in the ms 80 107 package?

The ms 80 107 package includes essential features such as document templates, advanced eSigning capabilities, and integration options with popular applications. These features are designed to enhance user experience and streamline document management. By utilizing ms 80 107, businesses can ensure a seamless signing process.

-

What are the benefits of using airSlate SignNow with ms 80 107?

Using airSlate SignNow with the ms 80 107 designation provides numerous benefits, including increased efficiency, reduced turnaround times, and improved document security. This solution allows businesses to manage their signing processes from anywhere, making it ideal for remote work. Additionally, ms 80 107 ensures compliance with industry standards.

-

Can I integrate airSlate SignNow with other software using ms 80 107?

Yes, airSlate SignNow supports integrations with various software applications, enhancing the functionality of the ms 80 107 package. This allows users to connect their existing tools and streamline workflows. Popular integrations include CRM systems, cloud storage services, and project management tools.

-

Is there a free trial available for the ms 80 107 features?

Yes, airSlate SignNow offers a free trial that allows users to explore the features included in the ms 80 107 package. This trial period enables prospective customers to experience the benefits firsthand before committing to a subscription. Sign up today to start your free trial and see how ms 80 107 can transform your document workflows.

-

How secure is airSlate SignNow when using ms 80 107?

Security is a top priority for airSlate SignNow, especially with the ms 80 107 features. Our platform employs advanced encryption and security protocols to protect sensitive documents. Additionally, we comply with industry regulations to ensure that your data remains safe and secure throughout the signing process.

Get more for Mississippi Income Withholding Tax Schedule Form

Find out other Mississippi Income Withholding Tax Schedule Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors