Your Return and Payment for the Full Amount of Tax Due Must Be Mailed by the Due Date of Your Federal Return Form

Understanding Your Return And Payment For The Full Amount Of Tax Due

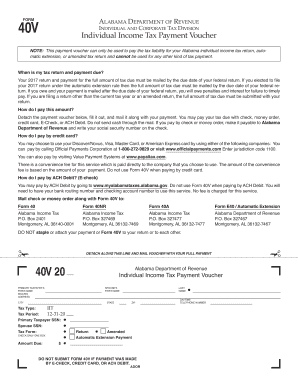

The form titled "Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return" is essential for U.S. taxpayers. It serves as a formal declaration of your income and the taxes owed to the federal government. Completing this form accurately ensures compliance with tax regulations and helps avoid penalties. It is crucial to understand the specific requirements and implications of this form to maintain good standing with the IRS.

Steps to Complete Your Return And Payment For The Full Amount Of Tax Due

Completing the form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, calculate your total income and determine the amount of tax owed. Fill out the form with precise information, ensuring that all entries are correct. Finally, sign and date the form before mailing it to the appropriate IRS address by the due date. Utilizing digital tools can streamline this process, allowing for easier data entry and secure electronic signatures.

Legal Use of Your Return And Payment For The Full Amount Of Tax Due

This form is legally binding when completed and submitted according to IRS guidelines. It must be signed by the taxpayer, affirming that the information provided is accurate to the best of their knowledge. Electronic signatures are accepted, provided that they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. Using a reliable eSignature platform can help ensure that your submission meets all legal requirements.

Filing Deadlines and Important Dates

Awareness of filing deadlines is crucial for avoiding penalties. The due date for mailing your return and payment typically aligns with the annual federal tax deadline, which is usually April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended. It is important to check the IRS website for any updates or changes to these dates each tax year. Marking your calendar with these deadlines can help you stay organized and compliant.

Form Submission Methods

There are various methods for submitting your return and payment. You can mail the completed form to the IRS, ensuring it is postmarked by the due date. Alternatively, you may choose to e-file your return, which is often faster and more secure. E-filing allows for immediate confirmation of receipt and can facilitate quicker processing of any refunds. Regardless of the method chosen, ensure that you retain copies of all submitted documents for your records.

Penalties for Non-Compliance

Failing to submit your return and payment by the due date can result in significant penalties. The IRS imposes late filing and late payment fees, which can accumulate quickly. Additionally, interest may accrue on any unpaid taxes. Understanding these potential penalties underscores the importance of timely and accurate submission of your return and payment. Staying informed and proactive can help mitigate these risks.

Quick guide on how to complete your 2017 return and payment for the full amount of tax due must be mailed by the due date of your federal return

Complete Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return effortlessly on any device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The simplest method for modifying and electronically signing Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return with ease

- Find Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to preserve your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Modify and electronically sign Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

How can we earn huge money online?

1. Take Online SurveysTaking online surveys is one of the easiest ways to earn extra money. And plenty of companies are looking for consumer feedback to improve their products or develop new ones.Brands hire survey sites to conduct online questionnaires on their behalf, gaining access to precious customer feedback. The sites in turn pay you for participating in their surveys. If you really want to rake in the cash, join several survey sites to maximize access to opportunities. Survey's, Global Test Market and American Consumer Opinion are just a few of the sites that will pay you to share your thoughts.2. Test WebsitesMany businesses pay people to visit their sites and test functionality and user friendliness. Fortunately, getting into website testing is relatively easy. Simply sign up for free on sites like Startup Lift, TryMyUI or UserTesting, which pays a $10 flat rate for each completed test.3. Participate in Mock TrialsYou don’t need to know insider lawyer secrets or have a law degree to make money in the legal sector. Websites such as eJury and OnlineVerdict pay users to participate in mock trials for their clients, who are mainly lawyers.Online juries give lawyers the chance to “pre-try” their cases before presenting them in court. The lawyers gain experience, and you earn a little something for your effort: eJury pays $5 to $10 depending on the length of the case.4. Get Paid to SearchServices such as Microsoft Rewards offer incentives to users who search and browse the web with Microsoft. You can then redeem the points for rewards like movies, games, gift cards and apps.Another site where you can earn points while you search, shop and watch is Swagbucks, which has paid out over $280 million to its members to date.5. Install SoftwareYou need your own website to take advantage of this nontraditional job opportunity. However, installing software is one of the easier ways to use technology to make money.Sites such as PerInstallCash offer money to users in exchange for hosting software on their pages. You get paid when visitors download and install the software from you.6. Become a BetaIn the digital world, feedback is a valuable asset. Before computer products are commercially released, beta testers offer a final round of evaluation, trying out a range of unfinished products before paying customers do.To get in on the beta action, explore sites and services such as Erli Bird, uTest and VMC’s Global Beta Test Network. You can sign up to become a beta tester for free and start making some green.7. Participate in Clinical TrialsMost people have spent money on healthcare, but few of us have had the experience of earning cash off the industry. However, medical clinics, hospitals and universities are regularly in search of people to participate in their studies in exchange for payment.Test subjects must sign release forms accepting the consequences of their trials, so do your homework to find out what you’re getting into. Sites like Home - ClinicalTrials.gov and CenterWatch allow you to search and connect with thousands of clinical studies across the U.S.8. Enter ContestsPerhaps the easiest way to make money fast is to win it. To get started, check out websites like Contestgirl to find out what contests and sweepstakes are available.You can treat entering contests like a job by getting organized and spending hours each day submitting forms; however, it’s important to know that you’re unlikely to be chosen as the winner of a contest that will set you up for life. Additionally, you will have to pay taxes on your winnings, so be sure to take that into account before spending all your “free money.”9. Enter CompetitionsIf you have time and a special skill, consider entering a competition with a cash prize. At worst, you participate, fail and wind up with a good story to tell. If you win, the prizes can be substantial.10. Get Paid to Watch Movie PreviewsYou don’t have to be a film critic to get paid for watching videos. Sites such as Swagbucks ask you to watch specific videos and “like” them. In the process, you earn Swagbucks, which you can redeem for gift cards.11. Install Mobile Apps That Collect Your DataMarket research involves collecting feedback on shopping trends and patterns. Check out apps such as ShopTracker, SavvyConnect and MobileXpression, and score rewards for sharing data on your purchase history and mobile data usage.12. Get Paid to Improve Search ResultsSites like Appen and Lionbridge pay users to help improve search results for their clients by making them more qualitative, relevant and useful. As an online content evaluator, you can earn money just by testing sites and answering questions.13. Rent Out Your BelongingsYou might as well make the possessions you’re not using work for you. Sites such as Loanables enable users to rent almost anything to anyone — and for a good profit.14. Rent Out an Extra RoomIf you have a furnished bedroom in your home that you rarely use, you can make money by renting it out to travelers. Finding people to fill your spare room is easy when you sign up to host on Airbnb or VRBO.If you don’t have extra space in your home, you can still make money by working as a neighborhood co-host with Airbnb. Co-hosts perform concierge-like services for people in their neighborhoods who have homes they want to share but lack the time or confidence to host. For example, co-hosts can screen and approve potential guests and organize other aspects of stays.15. Rent Out Your Studio SpaceCreative spaces can be tough to come by. If you have a guitar lying around and a place to jam, you could be sitting on a gold mine. Check out sites such as Sparkplug, where you can make money by renting out instruments, amps, mics and even rehearsal spaces.16. Rent Out Your Parking SpotParking spaces are prime real estate in big cities like New York or Chicago, and you can earn a good income if you have one to rent. Use Craigslist to list your spot for hundreds of dollars a month.Have a driveway that sits empty? You can rent that out, too.17. Rent Out Your AutomobileIf you hardly use your car or are heading out of town for a period of time, renting out your vehicle is an easy way to make some extra cash. Apps like Turo and Get around connect car owners to renters in their cities. Peer-to-peer car sharing is priced per vehicle on a per-day or per-hour basis.18. Deliver Meals on Two WheelsEven if you don’t have a car, it doesn’t mean you can’t break into food delivery. You can work for apps like Post mates where you’ll pick up and deliver meals, groceries or just about anything you can carry while riding on two wheels. Some companies can even help you rent an electric bike or scooter, which you can also adopt for personal use.19. Rent Out Your BoatDon’t stop at renting out your car or bike. If you have a boat that is sitting idle, there’s an easy way to rent it out and help cover the costs of boat ownership. With the website Sailo, you can conveniently list your boat for rent; as a bonus, the site provides captains.20. Rent Out Your ClothesIf you have a closet full of clothes, put them to work for you. Websites such as RentNotBuy and Loanables allow people to rent clothing by the day or week.21. Sell Your ArtThat hobby you’ve had since childhood might just help improve your financial circumstances. Websites such as ArtFire and ShopHandmade allow you to sell art of all kinds with ease.22. Sell Lesson PlansIf you’re a current or former teacher, you can pay it forward while getting paid yourself. Teachers, especially new ones, are often in the market for lesson plans. You can make their jobs easier by selling yours for a profit.Selling lesson plans online has become a lucrative industry, according to the Associated Press. Websites such as Teachers Pay Teachers provide a market for educators to sell and share their valuable resources.23. Sell Your ClothesOne of the easiest ways to make money while decluttering is by selling your unwanted clothes. Consignment sites such as thredUP enable you to get rid of old clothes and earn cash in the process. The site even provides kits to assist you in cutting down your wardrobe.24. Sell Old BooksIf you’re a devoted bibliophile, selling books can be a solid stream of extra income. You could even hit up your local thrift shop, buy used books for pennies and sell them for a profit.However, these days, you don’t have to leave the house to profit off book selling. Apps like BookScouter and Sell Textbooks For Cash - Sell Used Books make earning money online easy. Simply install the app, scan the book’s ISBN and discover the highest price you can sell it for online.25. Sell Your CDs, DVDs and Video GamesThey might be outdated, but you can still turn a profit selling CDs, DVDs, Blu-rays and old video games. Using an app like Decluttr, you can get a valuation for old media teams, box and ship them to the site for free and get paid by check, PayPal or direct deposit.26. Sell Your FurnitureThere’s nothing revolutionary about selling furniture for money. But with the internet, doing so is easier than ever. Along with selling directly to customers via Craigslist, you can sell furniture through online consignment stores, such as Chairish for vintage furniture or Viyet for pre-owned designer pieces.27. Sell Handmade CraftsWant to profit from your creativity? It’s easier than ever, thanks to sites like Craigslist and Etsy. One of the top sites for handmade crafts, Etsy lets you create a store for fee and stock it for 20 cents per product. Just beware that the site takes a 5 percent cut of anything you sell as a transaction fee in addition to payment processing fees.28. Sell Stock PhotosIf you’ve ever tried to buy stock photos online, then you know they don’t come cheap. Because demand for stock photos, videos and vector graphics remains high, skilled photographers can easily earn a profit. Sign up on stock photo sites like iStock, Shutterstock and Dreamstime to start cashing in.29. Sell Photos From Your PhoneIf friends and relatives praise your skill with an iPhone, you might be able to sell shots right from your photo library. Foap is a free app that enables you to upload photos you take on your smartphone and sell them. You earn 50 percent of the revenue for each photo you sell.30. Sell Virtual PropertyMassively multiplayer online role-playing games like World of Warcraft and Second Life can really eat up a lot of your time. But you can make this time more productive — and even profitable — by getting into virtual real estate.Skilled gamers make money selling virtual property and high-level characters, because these things have real-life value. One of the most notable pioneers in the field, Anshe Chung became a millionaire playing video games by selling property on Second Life.31. Sell Junk MailYou can earn rewards by recycling things in the virtual world, such as your junk mail. The Small Business Knowledge Center is a market research company that evaluates your direct mail and email, rewarding you with prepaid Visa cards once you earn enough points.32. Design and Sell ShirtsDesign By Humans and Teespring all allow users to design T-shirts for free and sell them. The sales processes vary by site.For example, on Teespring you set a sales goal and price for each item. This aspect is crucial because it affects how much the company will pay you per shirt sold. If you signNow your sales goal, the shirts will be printed and distributed, and you will be paid for your work.33. Work as a Virtual AssistantWorking as a virtual assistant is a lot like working as a secretary from your home, and with today’s technology, being a virtual assistant is easier than ever. From novelists to online business owners, a wide range of people are in need of professional assistance.To excel in this side hustle, sharpen your administrative skills, like email response and organization of information. Check out sites such as Zirtual if you want to make some quick cash this year.34. Work as a Virtual BookkeeperBookkeeping can be a potentially lucrative work-from-home business, and it doesn’t require an accounting degree. For a comprehensive guide to starting a career in this field, check out Bookkeeper Business Launch and learn from the site’s founder, CPA Ben Robinson.lechatnoir / Getty Images35. Start Affiliate MarketingAffiliate marketing involves advertising something in exchange for a commission on the sales. To cash in on affiliate marketing, you’ll need your own blog or website on which to promote an advertiser’s product. To promote, you could write a product review and provide a link to the product.Visitors to your site follow the product link to the advertiser’s site, where they can complete the sale. Investigate sites such as ClickBank for opportunities to earn money with affiliate marketing.36. Earn Money Posting on ForumsA key ingredient for creating a successful website is strong engagement with the online community. Online forums provide a conducive space for doing just that. Companies will pay people to post quality content on forums in order to promote increased interaction and web traffic.If you want to get your side job up and running, check out sites like Paid Forum Posting and myLot for paid forum writing opportunities. Posting doesn’t pay a lot, but combining this side income with other revenue streams makes it a viable option. Plus, if you develop your writing skills, perhaps you can turn this side hustle into a career.37. TelecommuteTelecommuters perform typical office jobs but from the comfort of their own homes. And these days, many jobs can be done over the internet.Use sites like FlexJobs to get connected with telecommuting jobs based on your skills and areas of interest.38. TutorIf you have a strong academic background and feel an unfulfilled urge to teach, tutoring could be an excellent pursuit.One of the easiest ways to get into tutoring is to use a website like TutorVista. You must be a postgraduate in your subject to qualify as a tutor. TutorVista offers both part-time and full-time opportunities, and tutors need only commit to four hours of work per day to get started.39. Earn Money WritingFreelance writing is an ideal job for many, as it can be done from nearly anywhere. All you need is a laptop and internet access.Sites like WritersDomain provide freelancers with article topics, word counts and other requirements, as well as the prices being offered. All you have to do is submit writing samples and pass a grammar test to start accepting jobs.40. Start Micro FreelancingThe boom in America’s gig economy has resulted in a similar increase in micro freelancing. Like the name suggests, micro freelancing involves performing tasks with comparably low pay; for example, the micro freelance site Damongo offers jobs that pay between $5 and $50. But when combined with other side jobs and alternate forms of income, micro freelancing can be lucrative.There are multiple micro freelance sites to choose from, including Microworkers.41. Work as a TranslatorIn our increasingly globalized world, translation and interpretation are some of the fastest-growing industries you can invest in. If you are bilingual, you stand to profit from this development.The demand for translating documents, as well as audio, video and other media, is greater than ever. Fortunately, many websites have sprung up to meet this demand. You can use sites like TRADUguide to find freelance translating jobs and even register with an agency.BONNINSTUDIO / Getty Images42. Become a TranscriptionistTranscribing audio and video content can be tedious work requiring a detail-oriented mind. However, if you possess strong grammar skills and spelling, you can earn a solid income with this side gig.KatarzynaBialasiewicz / Getty Images43. Get Paid for Giving AdviceIf you love giving your two cents, consider putting your hobby to good use and getting paid to provide advice. Sites like JustAnswer pay expert users to answer questions online after askers approve the responses. In fact, JustAnswer claims that its top experts earn thousands of dollars each month.Frederick M. Brown / Getty Images45. Apply to Be on a Game ShowOnly certain types of people apply to be on a game show. And the chances of getting selected are higher than you might think. If you’re good at trivia, apply to be on “Jeopardy!” Those who excel at educated guessing might do better on “The Price Is Right” or “Family Feud.”46. Coach Other ContestantsOnce you’ve made money as a contestant on a game show, take the next step and coach others to follow in your footsteps. Mark Richards, who has appeared on at least six different game shows including “To Tell the Truth,” “Wheel of Fortune” and “The Dating Game,” trained students on how to get on game shows in exchange for 20 percent of their winnings.48. Mow LawnsMany people are fond of keeping their outdoor foliage trimmed and orderly. And while knocking on doors with your lawnmower in tow might feel juvenile, the money makes any initial embarrassment well worth it.To get started, research the amount local landscaping companies charge to ensure you’re offering a fair rate. While you’ll never be able to manicure a lawn as quickly as a team of workers, you can do it for less, which many customers will appreciate.If you don’t want to find your own clients, consider signing up as a vendor with GreenPal, a service that connects homeowners with local landscapers.49. Be a Mystery ShopperCustomer reviews are often the deciding factor for consumers in choosing whether to make a purchase. In fact, according to a 2017 BrightLocal survey, 85 percent of consumers said they trusted online reviews as much as personal recommendations.It’s no surprise then that . Companies hire these shoppers to visit their stores and test services and products. Mystery shoppers interact with staff, ask about predetermined products and make purchases, for which the company reimburses them.Shoppers then fill out reports recounting their experiences. According to Indeed, the average salary for a mystery shopper is $15.54 per hour as of July 2018.50. Earn Cash by CookingPersonal chefs travel to their customers’ homes and cook meals for people in their own kitchens. If you have a talent for food prep, you can turn that into a lucrative business, provided that you know how to network.You’ll need to invest in marketing materials, like business cards, a website and advertisements. Word-of-mouth recommendations will be extremely valuable to you as well. Private chef salaries vary depending on your clients and how often you work, but the average private chef salary hovers around $63,000 per year, according to PayScale.51. Become a Ride-Share DriverRide-share services like Uber and Lyft are revolutionizing the way people get around. Even better, they make it easy for good drivers to score a little extra cash.You must meet several requirements before you can become a driver for a ride-share service. For example, to become a Lyft driver, you must have an in-state driver’s license and be at least 21 years old. Once you and your car are approved, making money is as easy as turning on the app and taking jobs.52. Deliver on Your CommuteMake your side job even more profitable by incorporating it into your regular work. Using Roadie, you can get paid to deliver items during your regular commute. You can earn up to $60 for local Roadie Gigs, while long-distance Gigs can net you up to $650.53. Wash CarsWashing cars is a good side hustle that requires little skill. There are some best practices, however. According to Consumer Reports, you should avoid household cleaners like dishwashing detergent and hand soap, refrain from scrubbing your sponge in circles and concentrate on washing the car section by section.54. Flip Flea Market FindsIf you believe “one man’s trash is another man’s treasure,” then you might be interested in becoming a flea market flipper. Flea market flippers find old furniture at garage sales, on Craigslist or — you guessed it — at flea markets, and then rework the old pieces into something new.To make money as a flipper, you must be able to sell your finished products for more than your original purchase prices, plus the cost of any supplies used for revamping. You can take photographs of your finished products and list them for sale online. Or, you could return to the flea market with your items in hopes of out-haggling bargain-hungry shoppers.55. Do Odd TasksTime is money for a lot of people, and you can make some extra cash by doing their tasks. Apps like TaskRabbit and Zaarly let people post their chores for a price. From building a bookcase to standing in line, get paid to do what other people don’t want to.56. BabysitBabysitting is an age-old way to make money. And while wide-eyed teens who lack child care experience can only expect to earn meager wages for watching their neighbors’ tots, experienced sitters can set their rates quite high.Word of mouth is a powerful method for finding good babysitting work, but you can also get in touch with potential clients by registering with Find Child Care, Senior Care, Pet Care and Housekeeping or Sittercity. Keep in mind that some parents might require you to have CPR certification and some early childhood education.57. Become an Election OfficerDon’t just vote on Election Day — make some money, too. Many localities need election officers, especially those who are bilingual. Hours can be long, but the pay isn’t bad for a day’s work. Rates vary, but election judges generally earn over $100 on Election Day.58. Start Your Own Subscription BoxTechnology is refashioning delivery services, and one of many ways to capitalize is by selling monthly subscription boxes like Birchbox. You can get in on the action with Cratejoy, a platform that enables you to build, run and scale your own subscription box business.59. Work for AmazonThe pay is small, but you can earn extra money performing micro tasks from Amazon Mechanical Turk. These are services that require human intelligence, such as selecting the correct spelling for search terms and determining if two products are the same.60. RecycleYou can earn money gathering recyclable materials and delivering them to local recycling facilities.Recycling facilities pay you for the items you bring in by weight, so you’re looking to get as much of one type of item as possible. You can also make money recycling through sites such as Gazelle, BoxCycle and uSell.61. Return Printer CartridgesThis side job is an oldie but a goodie. Round up your empty printer cartridges — and those belonging to friends — and take them to office supply stores like Office Depot and Staples to score rewards.62. Find Your Unclaimed Property Held by the StateState governments hold on to un-cashed dividend checks, returned utility deposits, unclaimed state tax refunds, uncollected insurance benefits and much more. You just have to know where to look for them.Using sites like MissingMoney.com Unclaimed Property FREE SEARCH, you can search for unclaimed property held by the state, file a claim and potentially collect money you didn’t know existed.63. Find Unclaimed Property Held by the FedsSimilarly, the federal government holds on to tax refunds that are returned to the IRS due to problems with mailing addresses or never claimed by taxpayers because they didn’t file returns. The government also holds forgotten savings bonds, government-guaranteed mortgage-insurance refunds and government pensions that were never claimed. The main drawback is that you need to check with individual federal agencies about missing funds.64. Get Cash From Class-Action SuitsMillions of dollars in class-action settlements never get claimed, because people aren’t aware they’re eligible to file. For example, people who bought Red Bull products between 2002 and 2014 were entitled to $10 to $15 through a class-action lawsuit brought on the company because of its slogan, “Red Bull Gives You Wings.”There are several tools you can use to find products you purchased, file a claim for class-action settlement money and receive money in the mail. Some of the top class-action claim sites include ClassActionRebates.65. Get Money Back for Things You Already BoughtUsing a service such as Paribus, you can sign up to get money back on items that dropped in price after you purchased them. Paribus saves you time by connecting to your email account and checking your receipts for you. If the retailer dropped a price, Paribus will automatically file a price adjustment claim on your behalf.66. Cash in Your Unused Gift CardsAll too often, gift cards are bought as presents but not utilized. Don’t let your unused gift cards go to waste. Convert them to cash by selling them online at sites such as Gift Card Granny, Cardpool and Raise. You won’t receive the full value of the card, but it still feels like getting free money.67. Make ReferralsA time-honored way to make easy money is to refer friends to products or services you currently use. Various businesses, from ride-sharing companies like Uber to credit card companies, pay out rewards to the referrer and referred. Research different referral programs to target the ones with the best ROI.68. Buy Groceries and Score RebatesA good way to cut down on cost-of-living expenses is to save on groceries. These days, you can actually earn cash by grocery shopping. Rebate apps like Ibotta offer cash rebates for grocery store purchases. Simply verify purchases by taking pictures of your grocery receipts with your phone.69. Lose Weight to Earn MoneyFinally, there’s a monetary reward for all your hard work at the gym. Sign up for HealthyWage and you can make money shedding pounds. Start by defining your goal weight and the amount of time needed to achieve it, and then place a bet on yourself.Depending on how much weight you lost, the time frame and the amount of money you wagered, you could win up to $10,000.70. Open a Checking AccountThere’s no shortage of banking promotions these days, and you can make a quick hundred or two when you open one of these checking accounts with sign-up bonuses.You can score up to $300 through accounts such as Chase Premier Plus Checking, among others.71. Open a Savings AccountSeveral savings accounts offer bonuses and promotions. Earn money for account anniversaries, signNowing savings goals and even just signing up.72. Donate Blood PlasmaTuck an extra $50 into your pocket each time you donate your plasma. The amount you are paid depends on the volume of permitted plasma, which is determined by your weight. Basically, the more you weigh, the more you’ll get paid. Check out sites like BloodBanker or CSL Plasma for more information.73. Get Paid to Watch TVIf you love watching TV, you can get paid to do so by downloading the Viggle app. The app knows what you’re watching by screening the audio coming out of your TV, and you play games and look at ads on your phone while you’re watching the big screen. You’ll get points through Viggle, which you can then redeem for rewards.74. Invest in a Turnaround CompanySure, investing in penny stocks can be risky. But there are also great opportunities to be found among the rubble. Do your research and identify failing companies with good bones. Investing in penny stocks and bankrupt companies isn’t something to do with your retirement nest egg, but if you have some play money and can stomach the risk, you can score a great return.75. Write an E-BookThere’s an old saying that everyone has a novel tucked away somewhere. If you want to make bank, finish yours, polish it up and publish it. You can release e-books through Amazon Kindle Direct Publishing or Nook Press. At Amazon, you’ll earn up to 70 percent royalties on sales.76. Invest in Mutual FundsIf you’re not a stock market wiz, don’t try to time the market. Instead, look for consistent returns rather than big ones. When it comes to investing in the best mutual funds, look for those run by managers who don’t change their stocks too often and view their investments as partnerships.77. Run a Virtual StorefrontIf you’re crafty, consider opening up a virtual storefront on a site like CafePress. The best thing about these sites is that you’ll only have to make the number of products that people order, so there’s no need to spend a lot in startup costs. CafePress and Zazzle take care of the actual production; all you have to do is supply the designs.78. Start a BlogIf you’re a natural storyteller and feel comfortable sharing your tales on a public platform, you can make money blogging online.Choose a blogging topic that you have a strong understanding, passion and expertise for, because you’ll want to write about it regularly. Once you have a consistent audience, you can start to make money off your blog through an ad network like Google AdSense or with affiliate marketing.Get started with a free blogging platform like WordPress, Blogger or Tumblr. If you decide that you love writing but running a blog isn’t for you, you’ll still end up with a portfolio of writing that you can use to land another gig.79. Become an Online Travel AgentIf you have a case of wanderlust, put your time perusing Expedia to good use by earning money as an online travel agent. You can find both part-time and full-time remote gigs on websites like Upwork and Indeed.Don’t jump on the first job post you see, however, as there are many scams out there. Make sure to vet the agency before signing up, and don’t take a job that requires you to use your own money or recruit other agents.80. Hold a Garage SaleIf you have an abundance of items you no longer want or need, make money fast by holding a garage sale.While you can price gently used or high-quality items at 30 percent to 35 percent of their original cost, you should only expect to recoup about 15 percent of the original cost for most items. You should also be prepared for potential buyers to haggle for even lower prices. If you have some items that you’re trying to sell for higher prices, consider listing them online instead.81. Recycle Scrap Metal and TiresMetals like copper, aluminum, brass and steel are widely desired at most recycling plants or scrap yards. It depends on the location, but you can earn around 9 cents per pound for magnetic metals, 45 cents to 55 cents for aluminum and up to $2.30 for bare bright copper wire.82. Sign Up for Free Gift CardsEbates will reward you with a $10 gift card when you sign up on the site and make a minimum purchase of $25 within 90 days.Signing up for Ebates is a great way to put money back in your pocket. Free to use, the site lets you find online retailers you want to shop with and get cash back for purchases.Additionally, you can sign up for MyPoints to shop online, take surveys and complete other tasks that earn points you can redeem for gift cards, travel miles or cash via PayPal.83. Score Free Gift Cards on Social MediaMonitor social media channels for your favorite brands. People selling products via social media often host Twitter and Facebook parties, for example, that can include giveaways. For best results, watch for hashtags related to gift cards and giveaways.84. Make Money Off PharmaciesWatch for promotional offers from pharmacies that want you to switch your prescription accounts to their companies. When you sign up for CVS ExtraCare Pharmacy and Health Rewards, for example, you can earn up to $50 in ExtraBucks Rewards, which is similar to a gift card.85. Shovel SnowIf you live where it snows, you already know that someone has to be responsible for clearing it from sidewalks, driveways and lawns. Most people don’t want to wake up early to clear snow away, and that’s where you come in.Depending on how quickly you can work, charging $10 to $20 a yard can be a great boon to you. A larger yard will justify a higher rate. If your business grows quickly, consider investing in a snow blower to increase your speed.86. Rake LeavesJust like snow, those fallen leaves need to be cleared away every autumn. If you’re raking leaves, you can also bring a ladder and offer an extra gutter-cleaning service. Consider purchasing your own workers’ compensation policy in advance to protect yourself and your loved ones in case of accidental injuries or falls on the job.87. Become a Ghost ShopperThere’s a fair chance you’ve never heard of ghost shopping. Like personal shopping, ghost shopping is a service that people seek out when they’re low on time but have cash to spare. If you have good taste and love hitting the mall, consider performing this task as a side gig.88. Go Dumpster Diving and Curb ShoppingWhether you’re fully committed to “freeganism” or simply want free stuff, dumpster diving is a potentially lucrative hobby. You can go curb shopping on your own or turn to sites that facilitate bartering, trading, sharing and other ways to get what you need for free.Check out neighborhoods that allow residents to leave items like furniture on the curb for bulk pickup and visit during garage sales, when sellers might leave items out for free after the sale is over. Sites that support bartering include Craigslist and BarterOnly.89. Clean HousesThere are probably plenty of professional maid services in your town, but that doesn’t mean you can’t get in on the cleaning game. There are a number of reasons that potential clients might want to hire you rather than a service.For one thing, individuals are less expensive. Maid services often provide more than one cleaner, which drives up costs. Additionally, services have to charge higher prices to cover other costs of operating their business. Finally, individual cleaners can often find work with family, friends and friends of friends, who would rather hire a trusted acquaintance than a stranger.90. Do Data EntryIf you’re a whiz on the keyboard and pay attention to detail, data entry could be the gig for you.Websites like Craigslist or Upwork post data entry and administrative jobs, most of which can be done from the comfort of your own home. Hourly wages start around $12.55 an hour, according to PayScale.91. Participate in an Online Focus GroupYour opinion could be worth money — if you share it with the right people. Participate as part of an online focus group like ProOpinion, and you’ll get paid for sharing your thoughts. Payments typically come in the form of gift cards or PayPal deposits. Joining the ProOpinion survey panel is free, and you can choose to log in to the site to take a survey immediately or receive emails that connect you to new surveys.92. Rate PizzasHave your dinner and get paid, too, when you sign up to visit and review local pizzerias.All you have to do to be considered for this job is fill out an application with The Source, an independent field agent database provider — no fees required. Once you’re approved, you can search out pizza shops in your area to rate. You’ll get paid twice per month via direct deposit or paper check for all your work.93. Model for ArtistsArtists are always in need of models to help them hone their drawing skills. This is especially true in areas with plenty of young artists, such as college towns.If you’re comfortable posing nude and are capable of holding poses for as long as 30 minutes, consider life modeling. Modeling sessions can last as long as three hours, and pay is typically around $20 per hour, according to ZipRecruiter. If you’re interested in becoming a life model, contact local colleges, art organizations and community centers.94. Coach a Youth Sports TeamIf you were a star athlete in high school or college and miss the thrill of the game, consider coaching a youth sports team.According to PayScale, a youth coach makes an hourly wage of $18.18 as of July 2018. You can find youth coaching jobs on career sites like Indeed and Glassdoor. However, make sure you fulfill the job requirements.95. Create Video Games OnlineIf you’re into gaming, consider making money by creating your own. You don’t need a degree for this career, but you do need creativity and a knack for building alternate worlds. With platforms like Roblox, you can create your very own family-friendly video games and charge users to play them.96. Watch Video AdsIf you enjoy watching videos online, you might as well earn money while doing so. For example, visit the InboxDollars website and you’ll find opportunities to earn money watching TV or video ads.97. Become an AirmuleFor those who prefer to bring as few items as possible when traveling, Airmule could be the ideal program to make a little money. Airmule is a free app that lets travelers sell their unused checked luggage space to shipping partners. You’ll earn up to $500 per round-trip flight, according to the Airmule website.98. Sell Gold and Silver for ScrapIf you have some old gold or silver jewelry lying around that you never wear, sell it for scrap.For gold, first determine the “melt value” by calculating the weight and purity. Be sure to shop around at different jewelers and metal dealers to get the best prices.For silver, check in with metal dealers online and in person for quotes.99. Maintain Fan PagesWho says socializing on Facebook and Twitter is a waste of time? On Fiverr, you can make money off your networking and social media skills by maintaining social fan pages for businesses, gaining likes and follows and more.100. Start a Resume Writing ServiceIf you love helping people find their dream jobs, consider launching a resume writing service. First, find out how much time it takes you to provide the service and what its value is in your area to gauge how much you should charge. Then, standardize portions of your service to make them more efficient and cost-effective. For example, you can create a questionnaire for people to fill out to help you tailor their resumes to get the jobs they’re after.Make sure you keep up with current resume writing and formatting trends, as well as what recruiters are looking for, so that you’re offering sound advice. When your clients benefit from your services, ask them if they’ll recommend you on your online profile, social media or other platforms so you can build your business.101. Start a Walking or Biking TourUse your knowledge of your community or city to earn cash from tourists looking for expert guides. Whether you start your own walking tour or join an organization that facilitates these tours, you can turn your home-turf advantage into a mutually beneficial, calorie-burning cultural exchange.If you’re starting your own walking tour business, make sure you understand your city’s business and safety laws. Whether you’re visiting famous spots or local hideaways, you need to know which areas are publicly accessible so that you don’t accidentally trespass.You could also get a job with a local business that offers guided tours. Depending on the organization, you might be able to share your knowledge with school kids on class trips or other groups on private tour events, in addition to tourists.Click to see ways to make more money this year.More on Making Money Through Side GigsLearn How to Make Money on YouTubeUp vote this answer and follow us on Quora to be the first having 1 Million followers 9999994 to go.Regards,Tech Expert

Create this form in 5 minutes!

How to create an eSignature for the your 2017 return and payment for the full amount of tax due must be mailed by the due date of your federal return

How to make an eSignature for your Your 2017 Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return online

How to generate an eSignature for your Your 2017 Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return in Chrome

How to make an electronic signature for putting it on the Your 2017 Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return in Gmail

How to create an electronic signature for the Your 2017 Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return right from your mobile device

How to make an eSignature for the Your 2017 Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return on iOS

How to make an electronic signature for the Your 2017 Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return on Android devices

People also ask

-

What is airSlate SignNow, and how does it relate to tax returns?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents electronically. When it comes to tax returns, it's crucial to remember that your return and payment for the full amount of tax due must be mailed by the due date of your federal return. By using SignNow, you can streamline the process of collecting signatures on tax documents, ensuring timely submissions.

-

How can airSlate SignNow help me meet tax deadlines?

With airSlate SignNow, you can efficiently manage and send your tax documents for signatures. This ensures that your return and payment for the full amount of tax due must be mailed by the due date of your federal return. By automating the signature process, you can reduce the risk of delays and penalties associated with late submissions.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers a range of flexible pricing plans to fit different business needs. Whether you're a small business or a larger organization, our plans ensure that your return and payment for the full amount of tax due must be mailed by the due date of your federal return without incurring extra costs. Review our plans to find the right fit for your eSignature needs.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes security and compliance, making it a trusted choice for handling sensitive tax documents. We ensure that your return and payment for the full amount of tax due must be mailed by the due date of your federal return while keeping your data safe with advanced encryption and secure storage.

-

Can I integrate airSlate SignNow with other software I use?

Yes, airSlate SignNow seamlessly integrates with various popular applications, enhancing your workflow efficiency. This means that your return and payment for the full amount of tax due must be mailed by the due date of your federal return can be managed alongside your existing systems, simplifying the entire process.

-

What features does airSlate SignNow offer to enhance document management?

airSlate SignNow offers a variety of features, including customizable templates, advanced tracking, and reminders to help you manage your documents effectively. These features ensure that your return and payment for the full amount of tax due must be mailed by the due date of your federal return, reducing the chances of oversight.

-

How can airSlate SignNow improve collaboration among my team?

airSlate SignNow facilitates easy collaboration by allowing multiple users to access and sign documents simultaneously. This collaborative approach means that your return and payment for the full amount of tax due must be mailed by the due date of your federal return can be prepared more efficiently, speeding up the overall process.

Get more for Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return

- Tax form 4810 rev 0110 2010

- Request for copy of the return estate or gift certificate form

- Puerto rico exemption form 2011

- Form as 2801

- Exhibit k departamento de hacienda gobierno de puerto rico hacienda gobierno form

- Puerto rico form 48040f

- Ocr is a short form of fill in the blanks

- Short form return ocr 2005 hacienda gobierno

Find out other Your Return And Payment For The Full Amount Of Tax Due Must Be Mailed By The Due Date Of Your Federal Return

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement