Withholding Exemption Certificate Form 499 R 4 Kevane Grant 2011

What is the Withholding Exemption Certificate Form 499 R 4 Kevane Grant

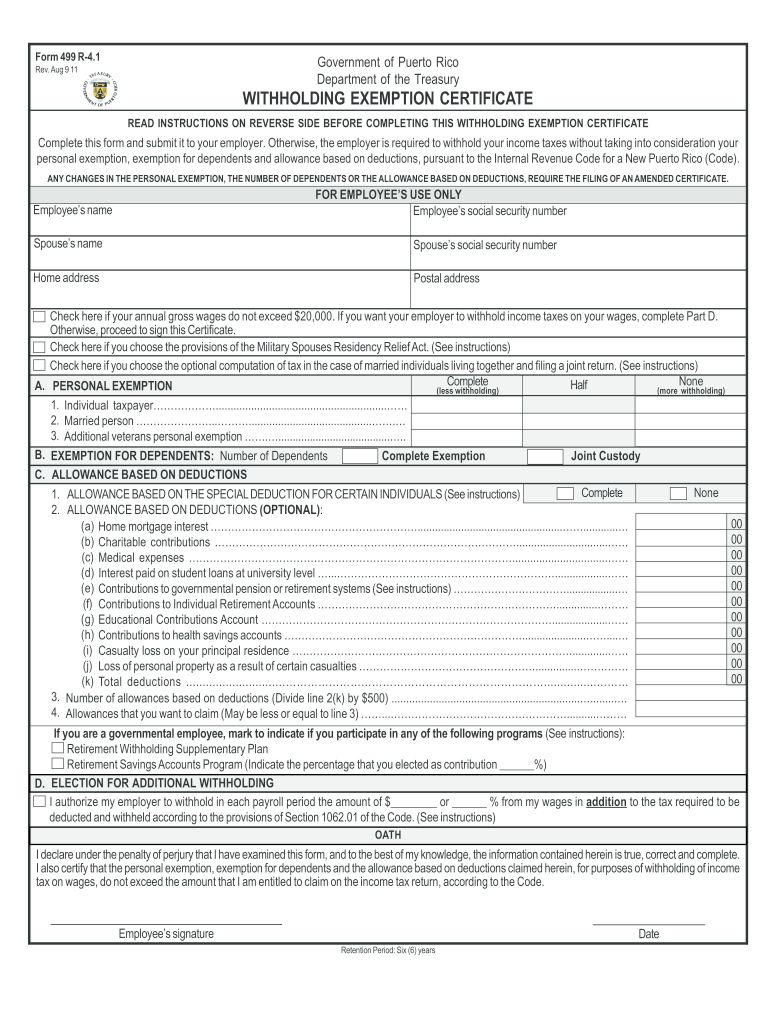

The Withholding Exemption Certificate Form 499 R 4 Kevane Grant is a tax-related document used by individuals to claim exemptions from withholding tax. This form is essential for those who qualify for a withholding exemption based on specific criteria, such as income levels or tax status. By submitting this form, taxpayers can ensure that the correct amount of tax is withheld from their income, which can help in managing their overall tax liability.

Steps to complete the Withholding Exemption Certificate Form 499 R 4 Kevane Grant

Completing the Withholding Exemption Certificate Form 499 R 4 Kevane Grant involves several key steps:

- Begin by downloading the form from a reliable source or accessing it through your tax software.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the reason for claiming the exemption, ensuring that it aligns with IRS guidelines.

- Review the form for accuracy and completeness to prevent any delays in processing.

- Sign and date the form, confirming that the information provided is true and correct.

How to use the Withholding Exemption Certificate Form 499 R 4 Kevane Grant

Using the Withholding Exemption Certificate Form 499 R 4 Kevane Grant is straightforward. Once completed, the form should be submitted to your employer or the relevant withholding agent. This informs them of your exemption status, allowing them to adjust the amount of tax withheld from your paycheck accordingly. It is advisable to keep a copy of the submitted form for your records and future reference.

Legal use of the Withholding Exemption Certificate Form 499 R 4 Kevane Grant

The legal use of the Withholding Exemption Certificate Form 499 R 4 Kevane Grant is governed by IRS regulations. Taxpayers must ensure that they meet the eligibility criteria for claiming an exemption. Misuse of this form can lead to penalties, including fines or increased tax liability. It is important to understand the legal implications and to use the form accurately to avoid any compliance issues.

Eligibility Criteria for the Withholding Exemption Certificate Form 499 R 4 Kevane Grant

To qualify for the Withholding Exemption Certificate Form 499 R 4 Kevane Grant, individuals must meet specific eligibility criteria. Generally, this includes having a low income or being exempt from federal income tax in the previous year. Additionally, the taxpayer must expect to owe no federal income tax in the current year. Understanding these requirements is crucial for ensuring that the form is used correctly and effectively.

Required Documents for the Withholding Exemption Certificate Form 499 R 4 Kevane Grant

When completing the Withholding Exemption Certificate Form 499 R 4 Kevane Grant, certain documents may be required to support your claims. This often includes proof of income, previous tax returns, and any other relevant financial documentation. Having these documents ready can facilitate a smoother completion process and help in verifying your eligibility for the exemption.

Filing Deadlines for the Withholding Exemption Certificate Form 499 R 4 Kevane Grant

Filing deadlines for the Withholding Exemption Certificate Form 499 R 4 Kevane Grant typically align with the tax year. It is important to submit the form to your employer before the start of the tax year to ensure proper withholding adjustments. Keeping track of these deadlines can help prevent unnecessary tax complications and ensure compliance with IRS regulations.

Quick guide on how to complete puerto rico exemption form 2011

Your assistance manual on how to prepare your Withholding Exemption Certificate Form 499 R 4 Kevane Grant

If you’re interested in learning how to generate and submit your Withholding Exemption Certificate Form 499 R 4 Kevane Grant, here are some brief instructions on how to simplify tax submission.

To begin, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, generate, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and return to revise information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and seamless sharing capabilities.

Adhere to the steps below to finalize your Withholding Exemption Certificate Form 499 R 4 Kevane Grant in just a few minutes:

- Establish your account and start handling PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to open your Withholding Exemption Certificate Form 499 R 4 Kevane Grant in our editing tool.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save your changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Be aware that filing in paper format can lead to increased return errors and postpone reimbursements. It is advisable to check the IRS website for submission regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct puerto rico exemption form 2011

FAQs

-

What are the dangers of living in Puerto Rico?

The answers I’ve read so far are both true. I speak from experience as I’m here write now trying to right this (wait, that’s wrong X-D ). In any case, seriously, I don’t know how much longer that will be possible due to the current difficulties imposed by the lack of gainful employment. To be sure, there are jobs, but the important factor for most, methinks, is finding a job that pays “livable wages”, a concept that apparently most budget allocators don’t take into consideration when filling vacancies, which is more and more often as people are leaving the island in droves. Unless you deal in some kind of specialty area (or have friends / relatives able to place a turtle atop a lamppost, as they saying goes), you’ll have to get creative to pay your bills. Case in point: one of my aunts decided to start renting her beautiful home, located around the foot or base of El Yunque rainforest, to visiting tourists (this happens once or twice a month, during which my aunt stays with her adult daughter), while she also continues to work as the senior copywriter at an ad agency 3 days a week, and she also does translations and articles on the side, all of it, just to make ends meet.I’m more or less in the same fun spot, saying yes to anything and everything that comes my way because, who knows about next month? It used to be that you could find a full-time job and live modestly off it, even if hand to mouth (in case you’re wondering, I studied literature and creative writing; alas! I should’ve listened to my grandma when she moaned I should at least learn some tangible trade, like shoemaker… I get it now…), but that has changed completely since 2008.So, to be brief (or briefer than I’ve been so far), the greatest danger is the lack of gainful employment and the ensuing bitterness of being forced to leave your island home because the middle class is an endangered species. I lived in New York City for a while, and also in Miami (north-ish of Miami Beach), and I felt neither in great danger nor astoundingly safer in either. I’m not sure of the grammatical correctness of this last sentence but I like to live on the edge so I’ll let it stay, just as here I stay, in Puerto Rico, for now, doing gymnastics with language.So what does it come down to, what are The Dangers of Living in PR? Hmm… it’s probably the same as any other place: you should get to know it before deciding it’s safe to walk to the store at 3 am. Basic awareness and all that. But do make sure to get a job that pays the bills! Otherwise, the lack of funds (and ensuing stress) will kill you faster than anything else.

-

How much does postage cost to Puerto Rico?

I will assume that you are talking about the United States Postal Service from within the United States. The answer is: exactly the same as it would cost you to mail the same package to your neighbor, which is the same as mailing from California to New York. First-class, priority and priority mail express cost the same to/from Puerto Rico, as it does in all 50 states. This is the same for Hawaii as well. Fedex, DHL, and UPS do charge more and believe they require 2nd Air to send any envelope/package over to the continental US. I assume this is the same for Hawaii and Alaska.

-

Who can I get to come and fill a 500 gallon water tank in Combate, Puerto Rico?

I use to live in Puerto Rico and we had a problem with the water pressure in our area, so when the electricity would go out the water pumps in the area would stop working, hence the lack of water. Our landlord solved the problem by installing two very large water tanks because his property was a three floor building and it was needed to supply water to these units. He gave it maintenance himself and would fill it himself because it was hooked to our water line in the building.So the person to fill that tank would be the owner of the property because it needs to be hooked to a water line that is in the property. So if you are the owner of the property, it would be you. I assume that your property has potable water available.

-

How will the Puerto Rico debt crisis play out?

You didn't really answer the question though I don't disagree with the commentary surrounding the US. At this point in time, hweover, the US still has pretty good access to capital (not so for PR). Last time I checked, PR's cash balance was expected to draw perilously close to zero by June of this year. #puertorico cash - Twitter Search

-

How important is Puerto Rico to the US?

Puerto Rico has always played a small but important part as a US Territory. Puerto Rician’s know they have always had the protection of the US. If Puerto Rico does/does not become a state. The US will always have the highest regard for Puerto Rico, just as the US has for her other 5 Territories. To Aaron George and others you should not concern yourselves if you think the US will let Puerto Rico and her people down. The US will always be in partnership/protector of the Island of Puerto Rico.

-

How can Trump threaten to pull out of Puerto Rico while FEMA is still in New Orleans?

Trump does not think before he speaks. He has a horrible habit of putting his foot in his mouth. I highly doubt he is aware that FEMA is still in New Orleans, or if he really cares.When Trump makes these statements, it is his way of puffing out his chest and demonstrating his authority and power. It’s toxic masculinity at its best, and it’s a power trip that he gets off on.Trump does not react well to criticism of any kind, much like a fifth grader.This statement equivocates to an “Oh yeah? Well if my aide wasn’t fast enough for you I can just take it away. Nah nah nahnahnah.”

-

Is living in Puerto Rico all it’s made out to be?

Bussiness as usual indeed.What else can anyone could expect out of the mess?Some grief, uncomfortable at times, watching the weather, above all dancing Salsa……. TUMBAO!!!!!Energy is flowing at its kWh rate for the time being. News are whispering for an slight increased just around the corner.Needless to say we are living to the best of the circumstances until the cows comes home.Be well.

Create this form in 5 minutes!

How to create an eSignature for the puerto rico exemption form 2011

How to make an electronic signature for your Puerto Rico Exemption Form 2011 online

How to make an eSignature for the Puerto Rico Exemption Form 2011 in Chrome

How to make an electronic signature for signing the Puerto Rico Exemption Form 2011 in Gmail

How to create an eSignature for the Puerto Rico Exemption Form 2011 from your smart phone

How to generate an eSignature for the Puerto Rico Exemption Form 2011 on iOS

How to make an electronic signature for the Puerto Rico Exemption Form 2011 on Android OS

People also ask

-

What is the Withholding Exemption Certificate Form 499 R 4 Kevane Grant?

The Withholding Exemption Certificate Form 499 R 4 Kevane Grant is a document used to establish exemptions from certain withholding taxes based on eligibility criteria. This form is essential for individuals and businesses looking to secure tax benefits provided under specific regulations. Understanding how to properly fill out and submit this form can help ensure compliance and avoid unnecessary taxation.

-

How can airSlate SignNow help with the Withholding Exemption Certificate Form 499 R 4 Kevane Grant?

airSlate SignNow provides a seamless platform for businesses to electronically sign and send the Withholding Exemption Certificate Form 499 R 4 Kevane Grant. The intuitive interface simplifies document handling, ensuring that the form is completed accurately and submitted timely. This streamlines your workflow and enhances overall productivity.

-

Is there a cost associated with using airSlate SignNow for the Withholding Exemption Certificate Form 499 R 4 Kevane Grant?

Yes, airSlate SignNow operates on a subscription model with competitive pricing tailored to fit various business needs. Customers can choose from multiple plans based on their usage and features required, enabling them to manage the Withholding Exemption Certificate Form 499 R 4 Kevane Grant efficiently. The affordability of the service makes it an excellent choice for businesses of all sizes.

-

What features does airSlate SignNow offer for completing the Withholding Exemption Certificate Form 499 R 4 Kevane Grant?

airSlate SignNow offers features such as customizable templates, electronic signatures, and document tracking for the Withholding Exemption Certificate Form 499 R 4 Kevane Grant. Users can edit forms directly within the platform, ensuring that all necessary information is included. Additionally, the automatic notifications keep stakeholders informed about the signing process, which enhances collaboration.

-

How secure is airSlate SignNow when handling the Withholding Exemption Certificate Form 499 R 4 Kevane Grant?

Security is a top priority for airSlate SignNow. The platform utilizes encryption and advanced security protocols to protect sensitive documents, including the Withholding Exemption Certificate Form 499 R 4 Kevane Grant. Compliance with industry regulations ensures that your data is safe and that the entire signing process is secure.

-

Can I integrate airSlate SignNow with other applications for managing the Withholding Exemption Certificate Form 499 R 4 Kevane Grant?

Absolutely! airSlate SignNow supports integrations with various applications, making it easier to manage your workflows including the Withholding Exemption Certificate Form 499 R 4 Kevane Grant. Whether using accounting software, CRM systems, or other business tools, you can easily connect and streamline your processes.

-

What are the benefits of using airSlate SignNow for the Withholding Exemption Certificate Form 499 R 4 Kevane Grant?

Using airSlate SignNow for the Withholding Exemption Certificate Form 499 R 4 Kevane Grant offers numerous benefits including time savings, reduced paperwork, and enhanced accuracy. The electronic signature process is quicker and eliminates the need for printing and scanning. With the ability to track document status in real-time, businesses can ensure timely submissions and avoid penalties.

Get more for Withholding Exemption Certificate Form 499 R 4 Kevane Grant

Find out other Withholding Exemption Certificate Form 499 R 4 Kevane Grant

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now