SCHOLARSHIP APPLICATION M S in Taxation College of Tsengcollege Csun Form

What is the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun

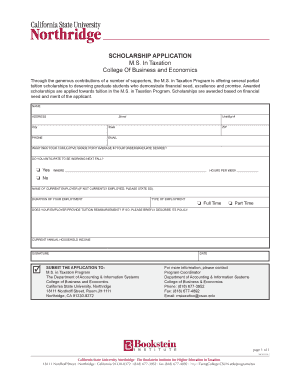

The SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun is a formal request for financial assistance aimed at students pursuing a Master of Science in Taxation at California State University, Northridge. This scholarship is designed to support eligible students in their academic journey, making higher education more accessible. The application typically requires candidates to demonstrate academic merit, financial need, and a commitment to the field of taxation.

Eligibility Criteria

To qualify for the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun, applicants must meet specific criteria. Generally, candidates should be enrolled or planning to enroll in the Master of Science in Taxation program. Additionally, they may need to maintain a minimum GPA, provide proof of financial need, and submit letters of recommendation. Each scholarship may have unique requirements, so it's essential for applicants to review the specific eligibility guidelines before applying.

Steps to complete the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun

Completing the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun involves several key steps:

- Gather necessary documents, including transcripts, financial information, and letters of recommendation.

- Access the scholarship application form through the official Tseng College website or designated portal.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or missing information.

- Submit the application by the specified deadline, either online or via mail, as directed.

Required Documents

Applicants for the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun must prepare several documents to support their application. Commonly required documents include:

- Official academic transcripts from previous institutions.

- A personal statement outlining the applicant's goals and reasons for pursuing the scholarship.

- Financial documentation, such as FAFSA results or proof of income.

- Letters of recommendation from academic or professional references.

Form Submission Methods

The SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun can typically be submitted through various methods, ensuring convenience for applicants. These methods may include:

- Online submission via the Tseng College application portal.

- Mailing a printed application to the designated scholarship office.

- In-person submission at the Tseng College administrative office during business hours.

Application Process & Approval Time

The application process for the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun generally involves several stages. After submission, applications are reviewed by a selection committee. The approval time can vary, but applicants can typically expect to receive notifications within a few weeks to a couple of months after the deadline. It is advisable for applicants to check their email regularly for updates regarding their application status.

Quick guide on how to complete scholarship application m s in taxation college of tsengcollege csun

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, as you can easily locate the right form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly and without holdups. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance your document-centric processes today.

The simplest way to modify and eSign [SKS] seamlessly

- Obtain [SKS] and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of the documents or obscure confidential information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the information and then click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at any stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun

Create this form in 5 minutes!

How to create an eSignature for the scholarship application m s in taxation college of tsengcollege csun

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun?

The SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun is a program designed to help students pursue advanced studies in taxation. This scholarship aims to make educational access easier for qualified students, providing financial assistance to cover tuition and related expenses.

-

How can I apply for the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun?

To apply for the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun, visit our official website or the college admissions page. You'll find detailed instructions regarding eligibility criteria, application forms, and submission deadlines.

-

What are the eligibility requirements for the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun?

Eligibility for the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun typically includes a minimum GPA, relevant coursework, and a demonstrated interest in taxation. Complete requirements can be found in the application guidelines on the college's website.

-

Are there any fees associated with the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun?

There are no application fees for the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun. This scholarship is designed to ease financial burdens, making it easier for students to access their education without additional costs.

-

What benefits does the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun offer?

The SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun offers financial support to cover tuition fees, which can signNowly reduce the financial strain on students. Additionally, recipients gain access to college resources and networking opportunities in the field of taxation.

-

Can I renew the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun yearly?

Yes, the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun can be renewed annually, provided that students meet the academic requirements set by the college. Regular performance evaluations help students maintain their eligibility for continued scholarship support.

-

What is the application deadline for the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun?

The application deadline for the SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun varies each year. It is advisable to check the college website for the most recent deadlines to ensure your application is submitted on time.

Get more for SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun

Find out other SCHOLARSHIP APPLICATION M S In Taxation College Of Tsengcollege Csun

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation