LOUISIANA Resident Louisiana Department of Revenue Revenue Louisiana Form

Understanding the LOUISIANA Resident Louisiana Department Of Revenue Revenue Louisiana

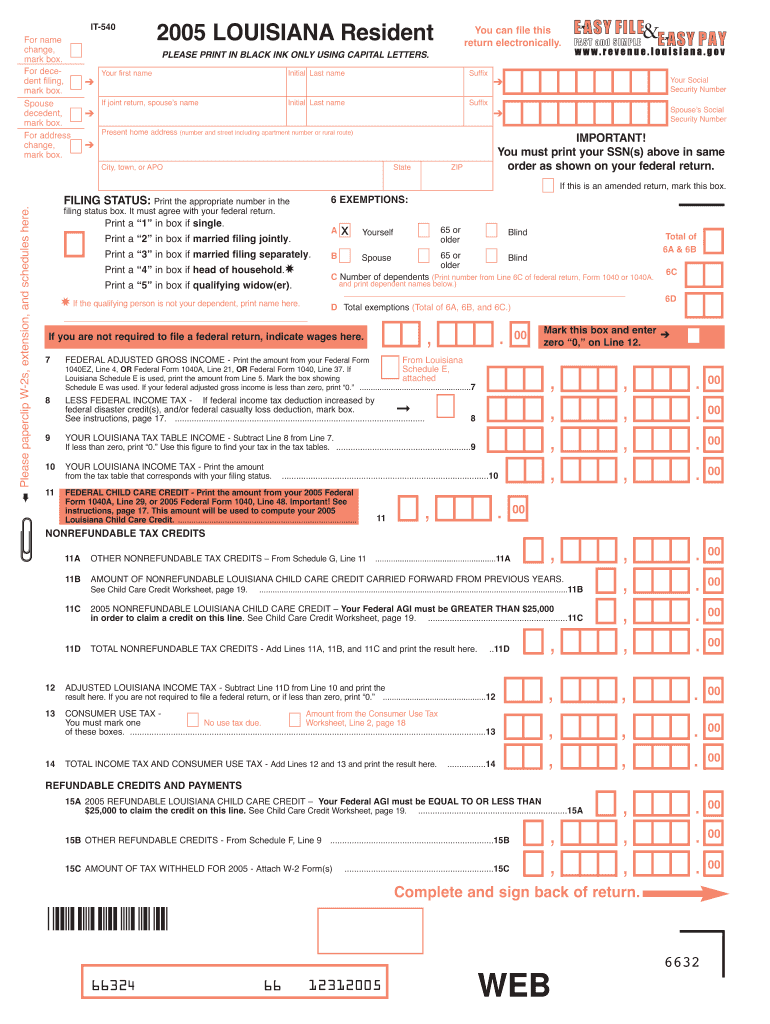

The LOUISIANA Resident form is a crucial document issued by the Louisiana Department of Revenue. This form is primarily used for tax purposes, allowing residents to report their income and calculate their tax obligations. It is essential for individuals who earn income in Louisiana to ensure compliance with state tax laws. The form captures various details such as income sources, deductions, and credits, which are vital for accurate tax filing.

Steps to Complete the LOUISIANA Resident Louisiana Department Of Revenue Revenue Louisiana

Completing the LOUISIANA Resident form involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any records of deductions. Next, accurately fill out the form by entering your personal information, income details, and applicable deductions. Ensure that all figures are correct to avoid discrepancies. Finally, review the completed form for accuracy before submission.

Required Documents for the LOUISIANA Resident Louisiana Department Of Revenue Revenue Louisiana

When filling out the LOUISIANA Resident form, specific documents are required to support your claims. These include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Any other relevant tax documents

Having these documents ready will facilitate a smoother filing process and ensure that all necessary information is included.

Form Submission Methods for the LOUISIANA Resident Louisiana Department Of Revenue Revenue Louisiana

The LOUISIANA Resident form can be submitted through various methods. You can file online through the Louisiana Department of Revenue’s website, which offers a convenient and efficient way to submit your form. Alternatively, you may also choose to mail a paper version of the form to the appropriate address provided by the department. In-person submissions are also accepted at designated locations.

Eligibility Criteria for the LOUISIANA Resident Louisiana Department Of Revenue Revenue Louisiana

To be eligible to file the LOUISIANA Resident form, you must be a resident of Louisiana for the entire tax year. This typically means you must have established your primary home in the state. Additionally, you should have earned income that is subject to Louisiana state tax. Understanding these criteria is essential to ensure that you are filing the correct form and complying with state regulations.

Penalties for Non-Compliance with the LOUISIANA Resident Louisiana Department Of Revenue Revenue Louisiana

Failing to file the LOUISIANA Resident form or submitting it inaccurately can result in penalties. The Louisiana Department of Revenue may impose fines for late submissions or underreporting income. It is important to file on time and ensure all information is accurate to avoid these penalties. Being aware of the consequences can motivate timely and correct filing.

Quick guide on how to complete louisiana resident louisiana department of revenue revenue louisiana

Manage [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign [SKS] and ensure seamless communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to LOUISIANA Resident Louisiana Department Of Revenue Revenue Louisiana

Create this form in 5 minutes!

How to create an eSignature for the louisiana resident louisiana department of revenue revenue louisiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of using airSlate SignNow for a LOUISIANA Resident dealing with the Louisiana Department Of Revenue?

For a LOUISIANA Resident, using airSlate SignNow can streamline the process of signing and submitting important documents to the Louisiana Department Of Revenue. It provides a secure and efficient way to eSign tax documents, ensuring compliance with Louisiana state regulations and enhancing overall productivity.

-

How does airSlate SignNow ensure compliance with Louisiana Department Of Revenue standards?

airSlate SignNow adheres to legal requirements set by the Louisiana Department Of Revenue by using secure encryption and providing an audit trail for every document. This ensures that all eSignatures are valid and can withstand scrutiny, making it ideal for LOUISIANA Residents navigating tax processes.

-

What features does airSlate SignNow offer to LOUISIANA Residents working with Revenue Louisiana?

airSlate SignNow offers features like customizable templates, real-time collaboration, and automatic reminders, specifically beneficial for LOUISIANA Residents managing their documents with Revenue Louisiana. These tools not only save time but also reduce the risk of errors during the eSigning process.

-

Is airSlate SignNow cost-effective for LOUISIANA Residents dealing with the Louisiana Department Of Revenue?

Yes, airSlate SignNow offers competitively priced plans that provide signNow value for LOUISIANA Residents. The cost-effective solution is designed to accommodate various budgets while facilitating efficient document management and electronic signatures required by the Louisiana Department Of Revenue.

-

Can airSlate SignNow integrate with other tools used by LOUISIANA Residents?

Absolutely, airSlate SignNow integrates seamlessly with various applications that LOUISIANA Residents may already be using, including popular productivity and accounting software. This integration makes it easy to streamline workflows, especially when collaborating with the Louisiana Department Of Revenue.

-

What are the benefits of using airSlate SignNow for eSigning documents for Revenue Louisiana?

Using airSlate SignNow for eSigning documents for Revenue Louisiana provides major benefits, including enhanced security and reduced turnaround time. LOUISIANA Residents can quickly and securely sign important documents without the hassle of physical paperwork, ensuring compliance with state requirements.

-

How does airSlate SignNow improve efficiency for LOUISIANA Residents?

airSlate SignNow signNowly improves efficiency for LOUISIANA Residents by automating the signing process and allowing for quick access to documents anytime, anywhere. This means that important submissions to the Louisiana Department Of Revenue can be completed faster, ultimately saving time and reducing stress.

Get more for LOUISIANA Resident Louisiana Department Of Revenue Revenue Louisiana

- Protecting traditional knowledge digitally a case study of tkdl form

- Irp cdn website com form

- Listening and learning from customer reviews pdffiller blog form

- Application for fund transfer customer copy nic asia form

- Msds for 28951 gen powder charcoal material safety data sheet form

- G a d elementary school supervision plan form

- Navsurfres 1534 1 form

- Psc bright form

Find out other LOUISIANA Resident Louisiana Department Of Revenue Revenue Louisiana

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure