ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta Form

Understanding the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta

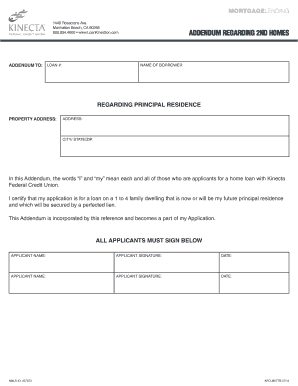

The ADDENDUM REGARDING 2ND HOMES from Kinecta Federal Credit is a crucial document for members who own or are considering purchasing a second home. This addendum outlines specific terms and conditions related to financing, including interest rates, loan limits, and eligibility criteria. It is designed to ensure that members fully understand their obligations and rights when dealing with second home purchases. This document is particularly relevant for those looking to secure a mortgage or refinance an existing loan on a second property.

How to Utilize the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta

To effectively use the ADDENDUM REGARDING 2ND HOMES, individuals should first review the document thoroughly to understand all stipulations. It is advisable to consult with a financial advisor or a representative from Kinecta to clarify any uncertainties. Once familiar with the terms, members can proceed to fill out the necessary forms and submit them to Kinecta for processing. This ensures that all requirements are met and that the financing process for the second home can move forward smoothly.

Steps for Completing the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta

Completing the ADDENDUM REGARDING 2ND HOMES involves several key steps:

- Gather necessary documentation, including proof of income, credit history, and details about the second home.

- Carefully read through the addendum to understand all terms and conditions.

- Fill out the required forms accurately, ensuring that all information is correct and complete.

- Submit the completed addendum along with any supporting documents to Kinecta Federal Credit for review.

- Follow up with Kinecta to confirm receipt and address any additional requirements.

Key Elements of the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta

The key elements of the ADDENDUM REGARDING 2ND HOMES include:

- Loan Terms: Details on interest rates, repayment periods, and any special conditions.

- Eligibility Requirements: Criteria that borrowers must meet to qualify for financing.

- Property Specifications: Guidelines on what constitutes a second home and related property details.

- Obligations: Responsibilities of the borrower, including maintenance and insurance requirements.

Legal Considerations for the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta

When dealing with the ADDENDUM REGARDING 2ND HOMES, it is essential to understand the legal implications. This document serves as a binding agreement between the borrower and Kinecta Federal Credit. Members should be aware of state-specific laws that may affect their obligations under this addendum. Consulting with a legal expert can provide clarity on how local regulations may impact the terms outlined in the addendum.

Obtaining the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta

To obtain the ADDENDUM REGARDING 2ND HOMES, members can contact Kinecta Federal Credit directly through their customer service channels or visit a local branch. The addendum is typically provided as part of the loan application process for second homes. Additionally, it may be available on the Kinecta website or through member resources. Ensuring that you have the most current version of the addendum is important for compliance and understanding your rights.

Quick guide on how to complete addendum regarding 2nd homes kinecta federal credit kinecta

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly and without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to initiate the process.

- Utilize the tools we offer to fill in your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee outstanding communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta

Create this form in 5 minutes!

How to create an eSignature for the addendum regarding 2nd homes kinecta federal credit kinecta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta?

The ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta is a specific document that outlines the terms and conditions related to financing a second home through Kinecta Federal Credit Union. This addendum is essential for borrowers to ensure compliance with the specific guidelines set by Kinecta.

-

How can I obtain the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta?

To obtain the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta, you can contact your Kinecta loan officer or download it from their website. Having this form handy can streamline your loan application process for a second home.

-

What are the costs associated with the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta?

The costs associated with the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta may vary depending on your loan terms and conditions. It is advisable to discuss these costs with a Kinecta representative to understand the specifics related to your situation.

-

What features does the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta offer?

The ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta offers features such as clear loan guidelines, flexible financing options, and detailed risk assessments for second homes. These features are designed to meet the needs of borrowers seeking additional property financing.

-

What are the benefits of using the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta?

The benefits of using the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta include better clarity on loan terms, streamlined paperwork, and an overall smoother home buying experience. This addendum is critical for borrowers to avoid common pitfalls associated with second home financing.

-

Are there any integrations available for the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta?

Yes, the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta can be integrated into various document management systems and platforms. This integration helps facilitate eSignature processes, making it easier to manage your documents digitally.

-

Can airSlate SignNow help with the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta process?

Absolutely! airSlate SignNow streamlines the eSigning process for the ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta, allowing you to easily send, sign, and manage your document online. This easy-to-use platform ensures your documents are securely managed and legally binding.

Get more for ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta

- Modesto police department request to inspect public records form

- Tdg forms

- Nothing but firing readworks answer key form

- Rapaport price list pdf form

- Certificate of enrollment carleton university form

- Www nycourts gov courts nyc civil forms civ sc 50 pdf

- Special events permit city of stamford form

- Msa 699 evaluation form

Find out other ADDENDUM REGARDING 2ND HOMES Kinecta Federal Credit Kinecta

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online