Form IL 4562 Instructions for Tax Years Ending on or After 2023-2026

Overview of the 2021 Illinois IL 4562 Form

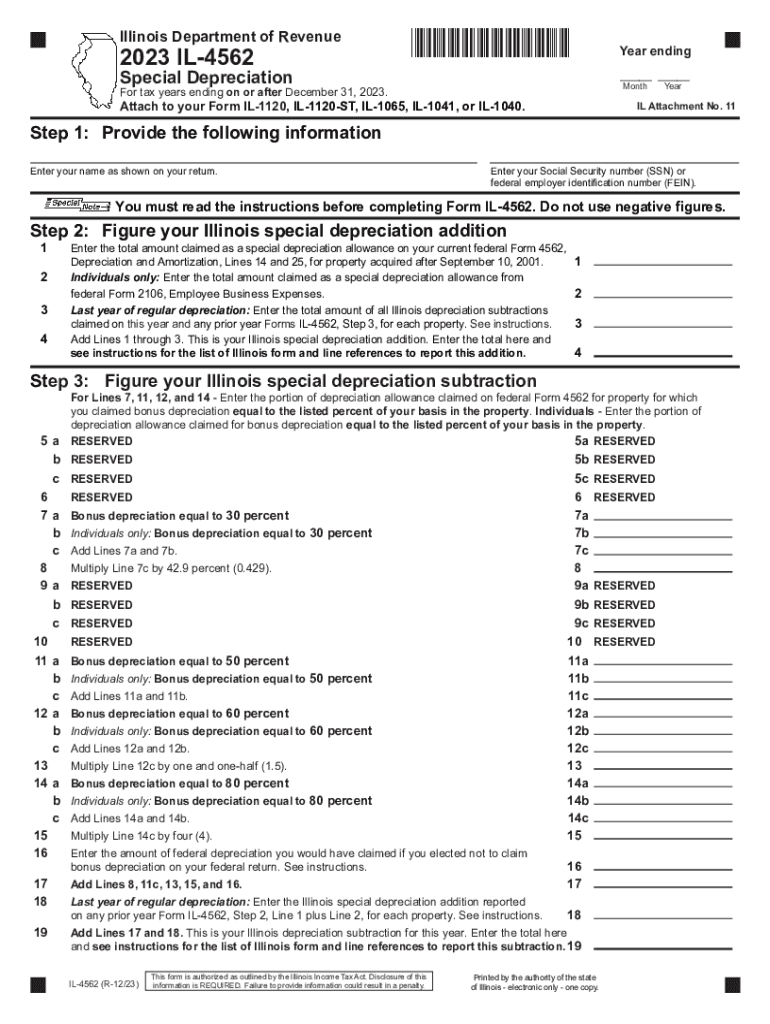

The 2021 Illinois IL 4562 form is used for reporting depreciation and amortization for property placed in service during the tax year. This form is essential for individuals and businesses to accurately calculate their allowable deductions related to property depreciation. Understanding the specific instructions and requirements associated with this form is crucial for ensuring compliance with Illinois tax laws.

Steps to Complete the 2021 Illinois IL 4562 Form

Completing the 2021 Illinois IL 4562 form involves several key steps:

- Gather all necessary documentation, including details of the property, acquisition date, and cost basis.

- Fill out the form by entering the required information in the appropriate sections, ensuring accuracy.

- Calculate the depreciation amount using the appropriate methods as specified in the form instructions.

- Review the completed form for any errors or omissions before submission.

Key Elements of the 2021 Illinois IL 4562 Form

The key elements of the 2021 Illinois IL 4562 form include:

- Property Description: A detailed description of the property for which depreciation is being claimed.

- Cost Basis: The total cost of the property, including any additional expenses incurred during acquisition.

- Depreciation Method: The method chosen for calculating depreciation, such as straight-line or declining balance.

- Year Placed in Service: The tax year in which the property was first put into use.

Filing Deadlines for the 2021 Illinois IL 4562 Form

It is important to be aware of the filing deadlines associated with the 2021 Illinois IL 4562 form. Typically, this form must be filed along with your annual Illinois income tax return. Ensure that you check the specific deadlines for the tax year to avoid penalties.

Legal Use of the 2021 Illinois IL 4562 Form

The 2021 Illinois IL 4562 form is legally required for taxpayers who wish to claim depreciation on their property. Proper completion and submission of this form ensure compliance with state tax regulations and help avoid potential legal issues related to misreporting or underreporting of income.

Examples of Using the 2021 Illinois IL 4562 Form

Examples of scenarios where the 2021 Illinois IL 4562 form may be used include:

- A small business claiming depreciation on newly purchased equipment.

- An individual reporting depreciation on rental property improvements.

- A corporation deducting costs associated with vehicles used for business purposes.

Quick guide on how to complete form il 4562 instructions for tax years ending on or after

Effortlessly prepare Form IL 4562 Instructions For Tax Years Ending On Or After on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing easy access to the right form and secure online storage. airSlate SignNow provides you with all the tools necessary to produce, edit, and electronically sign your documents swiftly without delays. Manage Form IL 4562 Instructions For Tax Years Ending On Or After on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Form IL 4562 Instructions For Tax Years Ending On Or After with ease

- Find Form IL 4562 Instructions For Tax Years Ending On Or After and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form IL 4562 Instructions For Tax Years Ending On Or After and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form il 4562 instructions for tax years ending on or after

Create this form in 5 minutes!

How to create an eSignature for the form il 4562 instructions for tax years ending on or after

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2021 Illinois IL4562 form and why is it important?

The 2021 Illinois IL4562 form is used for reporting property tax assessments in Illinois. It plays a crucial role in ensuring accurate assessment of property values for taxation. Understanding this form helps businesses stay compliant with state tax regulations and avoid penalties.

-

How can airSlate SignNow help with the 2021 Illinois IL4562 form?

airSlate SignNow provides an efficient way to electronically sign and send the 2021 Illinois IL4562 form. Our platform simplifies the document workflow, making it easier for businesses to ensure timely submissions and compliance with state requirements.

-

What are the pricing options for using airSlate SignNow to manage the 2021 Illinois IL4562?

airSlate SignNow offers various pricing plans tailored for different business needs. Whether you need basic eSigning features or advanced document management tools for the 2021 Illinois IL4562, we have flexible options that cater to businesses of all sizes.

-

What features does airSlate SignNow offer for handling documents like the 2021 Illinois IL4562?

airSlate SignNow includes features such as customizable templates, easy document sharing, and status tracking that enhance the management of documents like the 2021 Illinois IL4562. These tools streamline the signing process and ensure all parties have access to necessary documents.

-

Are there any integrations available for airSlate SignNow when dealing with the 2021 Illinois IL4562?

Yes, airSlate SignNow integrates with various applications, including CRMs and cloud storage platforms, making it easy to manage the 2021 Illinois IL4562. These integrations enhance productivity by allowing users to access and sign documents seamlessly across multiple platforms.

-

What benefits does airSlate SignNow provide for businesses filing the 2021 Illinois IL4562?

Using airSlate SignNow for filing the 2021 Illinois IL4562 offers numerous benefits, including increased efficiency and reduced turnaround time for document processing. Additionally, our secure platform ensures that sensitive information is protected throughout the signing process.

-

Is airSlate SignNow user-friendly for preparing the 2021 Illinois IL4562?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to prepare the 2021 Illinois IL4562 form. Whether you're tech-savvy or new to digital signing, our intuitive interface guides you through the process smoothly.

Get more for Form IL 4562 Instructions For Tax Years Ending On Or After

- Visa check card or atm card application liberty savings federal credit union visa check card or atm card application liberty form

- Brtelco form

- Torrey pines reservation credit card authorization form ngem gsd

- Sba 7a loan application fillable form

- Dormant accounts form

- Loan application assistance agreement between the borrower and northwest business development company form

- Rings end inc form

- Equipment order form signa pay

Find out other Form IL 4562 Instructions For Tax Years Ending On Or After

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later