How to Control Your Mouse Using a Keyboard on Windows 10 Use Mouse Keys to Move the Mouse PointerHow to Move the Mouse Cursor Wi 2020

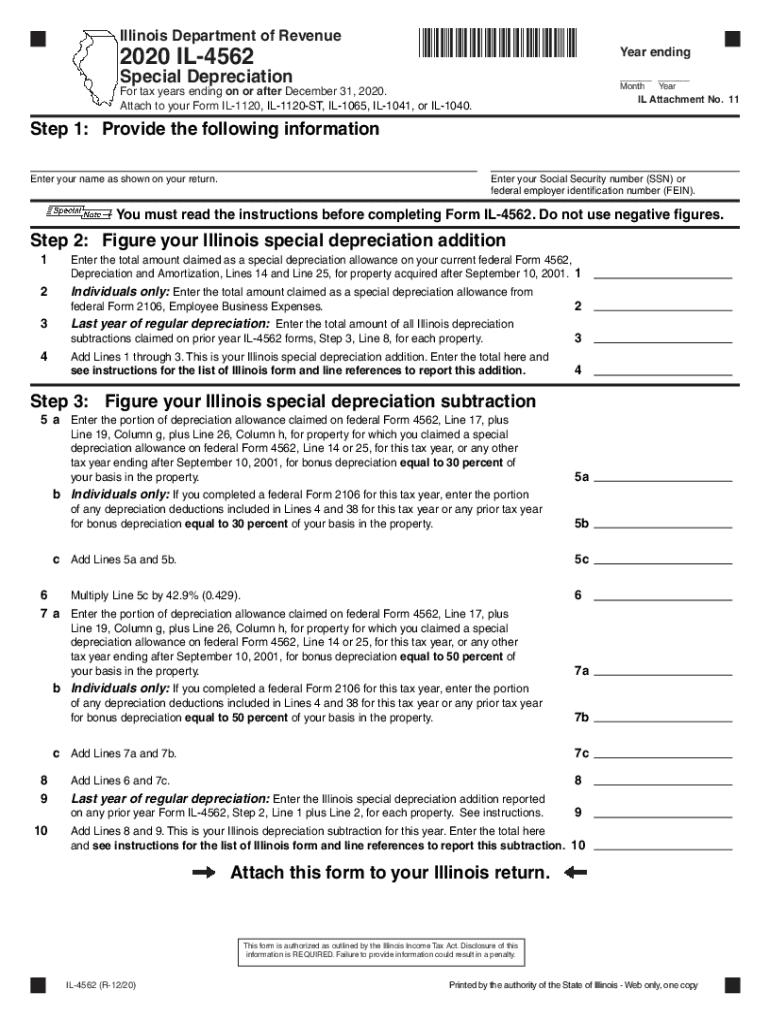

Understanding IL Depreciation

IL depreciation refers to the method of calculating the reduction in value of assets owned by businesses in Illinois. This process is essential for financial reporting and tax purposes. Businesses must adhere to specific guidelines set by the IRS and state regulations to ensure accurate reporting. Depreciation can apply to various asset types, including machinery, vehicles, and buildings. Understanding how to calculate and report IL depreciation can help businesses optimize their tax liabilities.

IRS Guidelines for Depreciation

The IRS provides comprehensive guidelines on how to calculate depreciation for tax purposes. Businesses typically use the Modified Accelerated Cost Recovery System (MACRS) for most assets. Under MACRS, assets are categorized into different classes, each with a specific recovery period. For example, five-year property includes vehicles and office equipment, while 15-year property encompasses improvements to nonresidential real property. Following IRS guidelines ensures compliance and helps in maximizing potential tax benefits.

Required Documents for Filing

When filing for IL depreciation, businesses must gather specific documents to support their claims. Key documents include:

- Purchase invoices for assets

- Asset depreciation schedules

- Prior year tax returns

- Any relevant financial statements

Having these documents ready helps streamline the filing process and ensures that all necessary information is accurately reported.

Filing Deadlines and Important Dates

Timely filing is crucial for compliance with tax regulations. For most businesses, the deadline for filing federal tax returns is April 15. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day. Businesses should also be aware of state-specific deadlines for IL depreciation filings to avoid penalties.

Penalties for Non-Compliance

Failing to comply with IL depreciation regulations can result in significant penalties. The IRS may impose fines for incorrect reporting or failure to file. Additionally, state authorities may levy their own penalties. It is essential for businesses to maintain accurate records and ensure compliance to avoid these financial repercussions.

Digital vs. Paper Version of Forms

Businesses have the option to file IL depreciation forms digitally or via paper submissions. Digital submissions are often faster and can reduce the likelihood of errors. Furthermore, electronic filing may provide immediate confirmation of receipt, which is beneficial for record-keeping. However, some businesses may prefer paper forms for their tangible records. Understanding the pros and cons of each method can help businesses choose the best filing approach for their needs.

Quick guide on how to complete how to control your mouse using a keyboard on windows 10 use mouse keys to move the mouse pointerhow to move the mouse cursor

Prepare How To Control Your Mouse Using A Keyboard On Windows 10 Use Mouse Keys To Move The Mouse PointerHow To Move The Mouse Cursor Wi effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It serves as a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage How To Control Your Mouse Using A Keyboard On Windows 10 Use Mouse Keys To Move The Mouse PointerHow To Move The Mouse Cursor Wi on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest approach to modify and eSign How To Control Your Mouse Using A Keyboard On Windows 10 Use Mouse Keys To Move The Mouse PointerHow To Move The Mouse Cursor Wi with ease

- Find How To Control Your Mouse Using A Keyboard On Windows 10 Use Mouse Keys To Move The Mouse PointerHow To Move The Mouse Cursor Wi and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign How To Control Your Mouse Using A Keyboard On Windows 10 Use Mouse Keys To Move The Mouse PointerHow To Move The Mouse Cursor Wi and ensure great communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to control your mouse using a keyboard on windows 10 use mouse keys to move the mouse pointerhow to move the mouse cursor

Create this form in 5 minutes!

How to create an eSignature for the how to control your mouse using a keyboard on windows 10 use mouse keys to move the mouse pointerhow to move the mouse cursor

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is il depreciation and how does it affect businesses?

IL depreciation refers to the systematic reduction in the value of an asset over time due to wear and tear, obsolescence, or usage. Understanding il depreciation is crucial for businesses to accurately assess their financial statements and manage their tax liabilities. Properly calculating il depreciation can result in signNow tax savings, helping to improve your bottom line.

-

How can airSlate SignNow assist with managing documents related to il depreciation?

airSlate SignNow simplifies the process of sending and eSigning documents related to il depreciation, ensuring that important agreements and corporate documents are handled efficiently. With its user-friendly interface, businesses can quickly create, send, and manage essential documents without the hassle of physical paperwork. This streamlines compliance and record-keeping for il depreciation-related assets.

-

Does airSlate SignNow support integrations that enhance il depreciation management?

Yes, airSlate SignNow offers a variety of integrations with popular accounting and financial software, which can signNowly enhance your management of il depreciation. These integrations allow for seamless data transfer and accurate reporting, ensuring that il depreciation calculations are not only straightforward but also compliant with current financial regulations. This enhances your overall financial management strategy.

-

What features does airSlate SignNow provide to manage il depreciation documents effectively?

airSlate SignNow includes features like customizable templates, real-time tracking, and secure cloud storage, making it an ideal solution for managing documents related to il depreciation. These features automate document workflows, ensuring that all stakeholders can easily access and eSign documents any time, anywhere. This ensures a faster turnaround and improves collaboration among team members.

-

Is there a free trial available for airSlate SignNow to understand its benefits for il depreciation?

Yes, airSlate SignNow offers a free trial that allows businesses to explore its capabilities, including its suitability for managing il depreciation documents. This trial helps organizations experience firsthand how the platform can streamline their document processes and enhance compliance without any upfront financial commitment. Businesses can evaluate its impact on their il depreciation strategies.

-

How does airSlate SignNow ensure the security of my il depreciation documents?

airSlate SignNow uses advanced security measures, including encryption and secure cloud storage, to protect your il depreciation documents. These security protocols are designed to safeguard sensitive financial information from unauthorized access, ensuring that your compliance and legal obligations are met. This peace of mind is essential when managing important assets undergoing il depreciation.

-

What are the pricing options for airSlate SignNow, and are there any special offers for il depreciation management?

airSlate SignNow offers various pricing plans to cater to businesses of different sizes, making it a cost-effective solution for managing il depreciation documents. Each plan is tailored to fit specific needs, and potential customers can inquire about seasonal promotions that might provide additional savings or features. Staying within budget while managing il depreciation is easier with flexible pricing options.

Get more for How To Control Your Mouse Using A Keyboard On Windows 10 Use Mouse Keys To Move The Mouse PointerHow To Move The Mouse Cursor Wi

- Printable real id application california form

- The 626 ofm form

- Ejt 005 order on request to opt out of mandatory expedited jury trial procedures judicial council forms courts ca

- 661 info form

- California policy worn test form

- California extension retention form

- California reunification services form

- Ca form e bar

Find out other How To Control Your Mouse Using A Keyboard On Windows 10 Use Mouse Keys To Move The Mouse PointerHow To Move The Mouse Cursor Wi

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document